Sallie Mae 2009 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.to properly determine the fair value of the Residual Interests, as well as a shock analysis to fair value

related to all significant assumptions.

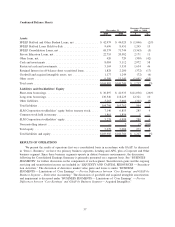

4. Student Loans — Our FFELP loans and Private Education Loans are accounted for at cost or at the

lower of cost or market if the loan is held-for-sale. The fair value is disclosed in compliance with

ASC 825. For both FFELP loans and Private Education Loans accounted for at cost, fair value is

determined by modeling loan level cash flows using stated terms of the assets and internally-

developed assumptions to determine aggregate portfolio yield, net present value and average life. The

significant assumptions used to project cash flows are prepayment speeds, default rates, cost of funds,

and required return on equity. In addition, the Floor Income component of our FFELP loan portfolio

is valued through discounted cash flow and option models using both observable market inputs and

internally developed inputs. Significant inputs into the models are not generally market observable.

They are either derived internally through a combination of historical experience and management’s

qualitative expectation of future performance (in the case of prepayment speeds, default rates, and

capital assumptions) or are obtained through external broker quotes (as in the case of cost of funds).

When possible, market transactions are used to validate the model. In most cases, these are either

infrequent or not observable. For FFELP loans classified as held-for-sale and accounted for at the

lower of cost or market, the fair value is based on the committed sales price of the various loan

purchase programs established by ED.

For further information regarding the impact of Level 3 fair values to the results of operations, see

Note 16, “Fair Value Measurements,” to the consolidated financial statements.

Securitization Accounting and Retained Interests

We regularly engage in securitization transactions as part of our Lending segment financing strategy (see

also “LIQUIDITY AND CAPITAL RESOURCES — Securitization Activities”). In a securitization, we sell

student loans to a trust that issues bonds backed by the student loans as part of the transaction. When our

securitizations meet the sale criteria of ASC 860, “Transfers and Servicing,” we record a gain on the sale of

the student loans, which is the difference between the allocated cost basis of the assets sold and the relative

fair value of the assets received including the Residual Interest component of the Retained Interest in the

securitization transaction. The Residual Interest is the right to receive cash flows from the student loans and

reserve accounts in excess of the amounts needed to pay servicing, derivative costs (if any), other fees, and the

principal and interest on the bonds backed by the student loans. We have not structured any securitization

transaction to meet the sale criteria since March 2007 and all securitizations settled since that date have been

accounted for on-balance sheet as secured financings as a result.

Under ASC 825, we elected to carry all existing Residual Interests at fair value with subsequent changes

in fair value recorded in servicing and securitization revenue. Since there are no quoted market prices for our

Residual Interests, we estimate their fair value both initially and each subsequent quarter using the key

assumptions listed below:

• The CPR (see “Premium and Discount Amortization” above for discussion of this assumption).

• The expected credit losses from the underlying securitized loan portfolio. Although loss estimates

related to the allowance for loan loss are based on a loss confirmation period of generally two years,

expected credit losses related to the Residual Interests use a life of loan default rate. The life of loan

default rate is used to determine the percentage of the loan’s original balance that will default. The life

of loan default rate is then applied using a curve to determine the percentage of the overall default rate

that should be recognized annually throughout the life of the loan (see also “Allowance for Loan

Losses” above for the determination of default rates and the factors that may impact them).

• The discount rate used (see “Fair Value Measurement” discussed above).

We also receive income for servicing the loans in our securitization trusts. We assess the amounts

received as compensation for these activities at inception and on an ongoing basis to determine if the amounts

31