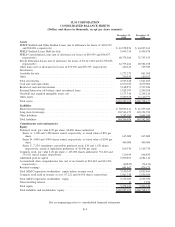

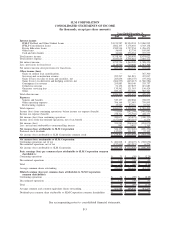

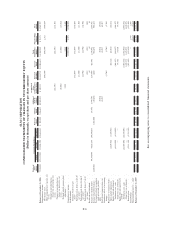

Sallie Mae 2009 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in thousands, except per share amounts, unless otherwise stated)

1. Organization and Business

SLM Corporation (the “Company”) is a holding company that operates through a number of subsidiaries.

The Company was formed 37 years ago as the Student Loan Marketing Association, a federally chartered

government-sponsored enterprise (the “GSE”), with the goal of furthering access to higher education by acting

as a secondary market for student loans. In 2004, the Company completed its transformation to a private

company through its wind-down of the GSE. The GSE’s outstanding obligations were placed into a Master

Defeasance Trust Agreement as of December 29, 2004, which was fully collateralized by direct, noncallable

obligations of the United States.

The Company’s primary business is to originate and hold student loans by providing funding, delivery

and servicing support for education loans in the United States through its participation in the Federal Family

Education Loan Program (“FFELP”) and through offering non-federally guaranteed Private Education Loans.

The Company primarily markets its FFELP Stafford and Private Education Loans through on-campus financial

aid offices.

The Company has expanded into a number of fee-based businesses, most notably its Asset Performance

Group (“APG”), which is presented as a distinct segment in accordance with the Financial Accounting

Standards Board’s (“FASB”) Accounting Standards Codification (“ASC”) 280, “Segment Reporting.” The

Company’s APG business segment provides a wide range of accounts receivable and collections services

including student loan default aversion services, defaulted student loan portfolio management services,

contingency collections services for student loans and other asset classes, and accounts receivable management

and collection for purchased portfolios of receivables that are delinquent or have been charged off by their

original creditors as well as sub-performing and non-performing mortgage loans. In 2008, the Company

concluded that its APG purchased paper business no longer produced a mutual strategic fit. The Company

sold its international Purchased Paper— Non-Mortgage business in the first quarter of 2009. The Company

sold all of its assets in the Purchased-Paper—Mortgage/Properties business in the fourth quarter of 2009. The

Company continues to wind down the domestic side of its Purchased Paper—Non-Mortgage business.

The Company also earns fees for a number of services, including student loan and guarantee servicing,

and for providing processing capabilities and information technology to educational institutions as well as

529 college savings plan program management, transfer and servicing agent services, and administration

services through Upromise Investments, Inc. (“UII”) and Upromise Investment Advisors, LLC (“UIA”). The

Company also operates a consumer savings network through Upromise, Inc. (“Upromise”). References in this

Annual Report to “Upromise” refer to Upromise and its subsidiaries, UII and UIA.

On April 16, 2007, the Company announced that a buyer group (“Buyer Group”) led by J.C. Flowers &

Co. (“J.C. Flowers”), Bank of America, N.A. and JPMorgan Chase, N.A. had signed a definitive agreement

(“Merger Agreement”) to acquire the Company (the “Proposed Merger”) for approximately $25.3 billion or

$60.00 per share of common stock. On January 25, 2008, the Company, Mustang Holding Company Inc.

(“Mustang Holding”), Mustang Merger Sub, Inc. (“Mustang Sub”), J.C. Flowers, Bank of America, N.A. and

JPMorgan Chase Bank, N.A. entered into a Settlement, Termination and Release Agreement (the “Agree-

ment”). Under the Agreement, the lawsuit filed by the Company on October 8, 2007, related to the Proposed

Merger, as well as all counterclaims, was dismissed and the Merger Agreement dated April 15, 2007, among

the Company, Mustang Holding and Mustang Sub was terminated on January 25, 2008.

On February 26, 2009, the Obama Administration (the “Administration”) issued their 2010 fiscal year

budget request to Congress which included provisions that called for the elimination of the FFELP program

and which would require all new federal loans to be made through the Direct Student Loan Program

(“DSLP”). On September 17, 2009 the House of Representatives passed H.R. 3221, the Student Aid and Fiscal

Responsibility act (“SAFRA”), which was consistent with the Administration’s 2010 budget request to

F-10