Sallie Mae 2009 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

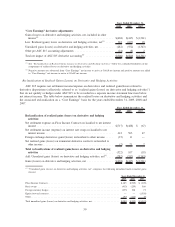

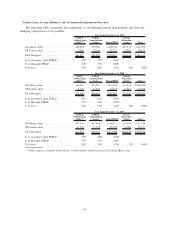

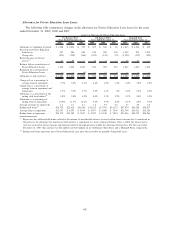

The following table reflects the “Core Earnings” net interest margin, before provisions for loan losses.

(Certain percentages do not add or subtract down as they are based on average balances.)

2009 2008 2007

Years Ended December 31,

“Core Earnings” basis student loan spread

(1)

:

FFELP loan spread ........................................... .63% .83% .96%

Private Education Loan spread

(2)

................................. 4.54 5.09 5.12

Total “Core Earnings” basis student loan spread

(3)

.................... 1.39 1.63 1.67

“Core Earnings” basis other asset spread

(1)(4)

........................ (.93) (.51) (.11)

“Core Earnings” net interest margin, before 2008 Asset-Backed Financing

Facilities fees

(1)

........................................... 1.25 1.49 1.49

Less: 2008 Asset-Backed Financing Facilities fees.................... (.11) (.19) —

“Core Earnings” net interest margin

(5)

............................. 1.14% 1.30% 1.49%

(1)

Before commitment and liquidity fees associated with the 2008 Asset-Backed Financing Facilities, which are referred to as

the “2008 Asset-Backed Financing Facilities fees” (see “LIQUIDITY AND CAPITAL RESOURCES — Additional Funding

Sources for General Corporate Purposes” for a further discussion).

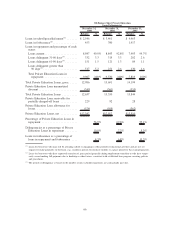

(2)

“Core Earnings” basis Private Education Loan Spread, before 2008 Asset-Backed

Financing Facilities fees and after provision for loan losses . ............... .66% 2.41% .41%

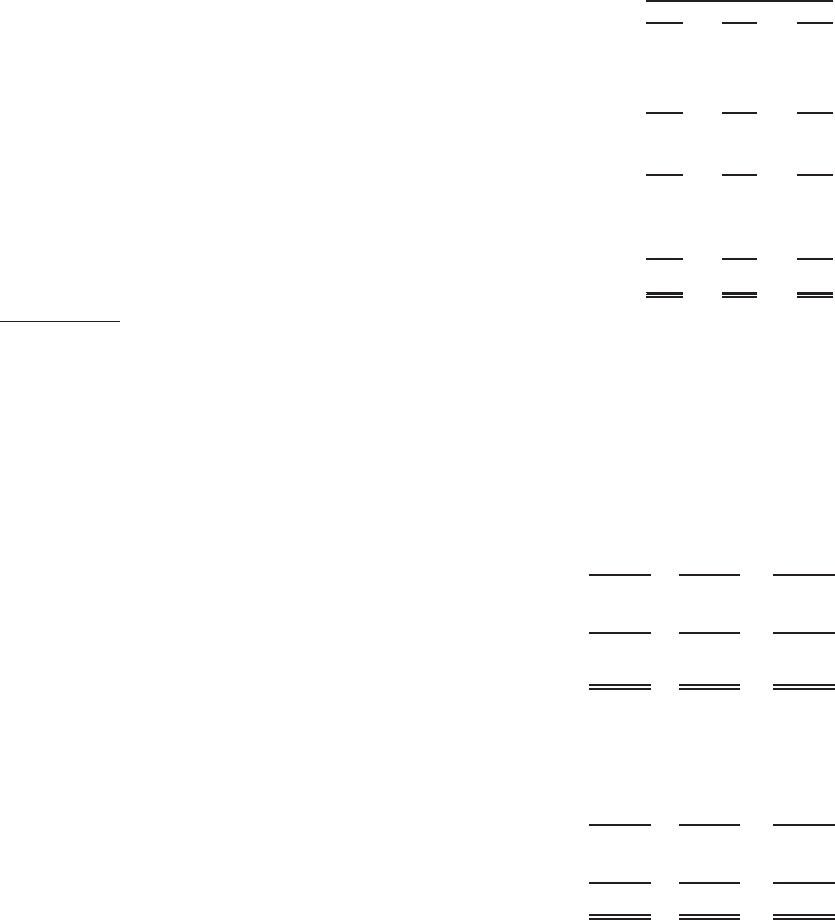

(3)

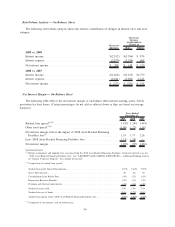

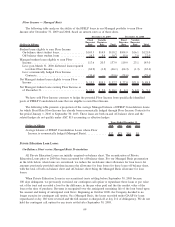

Composition of “Core Earnings” basis student loan spread:

“Core Earnings” basis student loan yield . . . ......................... 3.43% 5.77% 8.12%

Consolidation Loan Rebate Fees . . . .............................. (.47) (.52) (.57)

Repayment Borrower Benefits ................................... (.09) (.11) (.11)

Premium and discount amortization . .............................. (.09) (.14) (.17)

“Core Earnings” basis student loan net yield ......................... 2.78 5.00 7.27

“Core Earnings” basis student loan cost of funds . . . .................... (1.39) (3.37) (5.60)

“Core Earnings” basis student loan spread, before 2008 Asset-Backed Financing

Facilities fees . ............................................. 1.39% 1.63% 1.67%

(4)

Comprised of investments, cash and other loans

(5)

The average balances of our Managed interest-earning assets for the respective

periods are:

FFELP loans . ............................................. $150,059 $141,647 $127,940

Private Education Loans ....................................... 36,046 32,597 26,190

Total student loans . . ........................................ 186,105 174,244 154,130

Other interest-earning assets . ................................... 12,897 12,403 17,455

Total Managed interest-earning assets .............................. $199,002 $186,647 $171,585

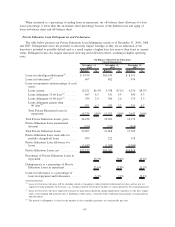

“Core Earnings” Basis Student Loan Spread

The “Core Earnings” basis student loan spread, before the 2008 Asset-Backed Financing Facilities fees,

for 2009 decreased 24 basis points from 2008. The “Core Earnings” basis student loan spread was negatively

impacted primarily by a 18 basis point widening of the CP/LIBOR spread, higher credit spreads on the

Company’s ABS debt issued in 2008 and 2009 due to the current credit environment and lower spreads earned

on FFELP loans funded through the ED Participation Program. Partially offsetting these decreases to the

student loan spread are lower cost of funds related to the ED Conduit Program (See “LIQUIDITY AND

CAPITAL RESOURCES — ED Funding Programs”) and higher asset spreads earned on Private Education

Loans originated during 2009 compared to prior years.

59