Sallie Mae 2009 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.trusts that settled before September 30, 2005 became 180 days delinquent, the Company previously exercised

its contingent call option to repurchase these loans at par value out of the trusts and recorded a loss for the

difference in the par value paid and the fair market value of the loans at the time of purchase. The Company

does not hold this contingent call option for any trusts that settled after September 30, 2005. In October 2008,

the Company decided to no longer exercise its contingent call option. The loss in 2008 also relates to the sale

of approximately $1.0 billion FFELP loans to the ED under ECASLA, which resulted in a $53 million loss.

For the year ended December 31, 2009, contingency fee, collections and guarantor servicing fee revenue

totaled $483 million, a $106 million decrease from $589 million in the prior year. This decrease was primarily

due to a decline in revenue due to a significantly smaller non-mortgage purchased paper portfolio

year-over-year as a result of winding down this collections business. Total impairment in the non-mortgage

purchased paper portfolio was $79 million in 2009 compared to $111 million in 2008. The impairment is a

result of the continued impact of the economy on the ability to collect on these assets (see “ASSET

PERFORMANCE GROUP BUSINESS SEGMENT”).

In response to the College Cost Reduction and Access Act of 2007 (“CCRAA”) and challenges in the

capital markets, the Company initiated a restructuring plan in the fourth quarter of 2007. The plan focused on

conforming our lending activities to the economic environment, exiting certain customer relationships and

product lines, winding down our debt purchased paper businesses, and significantly reducing our operating

expenses. The restructuring plan is essentially completed and our objectives have been met. As part of the

Company’s cost reduction efforts, restructuring expenses of $14 million and $83 million were recognized in

continuing operations in the years ended December 31, 2009 and 2008, respectively. Restructuring expenses

from the fourth quarter of 2007 through December 31, 2009 totaled $129 million, of which $120 million was

recorded in continuing operations and $9 million was recorded in discontinued operations. The majority of

these restructuring expenses were severance costs related to the completed and planned elimination of

approximately 2,900 positions, or approximately 25 percent of the workforce. We estimate approximately

$5 million of additional restructuring expenses associated with our current cost reduction efforts will be

incurred during 2010. On September 17, 2009, the House passed SAFRA which, if signed into law, would

eliminate the FFELP and require that, after July 1, 2010, all new federal loans be made through the Direct

Loan program. The Senate has yet to take up the legislation. If this legislation is signed into law, the Company

will undertake another significant restructuring to conform its infrastructure to the elimination of the FFELP

and achieve additional expense reduction. See “OVERVIEW — Legislative and Regulatory Developments” for

a further discussion of SAFRA.

Operating expenses were $1.26 billion in the year ended December 31, 2009 compared to $1.32 billion in

the prior year. The $61 million decrease in operating expenses was primarily due to the Company’s cost

reduction efforts discussed above as well as an $11 million reduction in amortization and impairment of

acquired intangible assets. The amortization and impairment of acquired intangibles for continuing operations

totaled $75 million and $86 million for the years ended December 31, 2009 and 2008, respectively.

Income tax expense from continuing operations was $238 million in the year ended December 31, 2009

compared to income tax (benefit) of $(76) million in the prior year, resulting in effective tax rates of 33 percent

and 54 percent. The movement in the effective tax rate in 2009 compared with the prior year was primarily

driven by the reduction of tax and interest on U.S. federal and state uncertain tax positions in both periods, as

well as the permanent tax impact of deducting Proposed Merger-related transaction costs in the year ended

December 31, 2008. Also contributing to the movement was the impact of significantly higher reported pre-tax

income in 2009 and the resulting changes in the proportion of income subject to federal and state taxes. For

additional information, see Note 19, “Income Taxes,” to the consolidated financial statements.

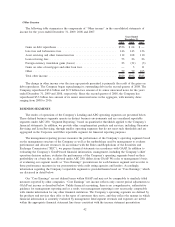

During 2009, the Company converted $339 million of its Series C Preferred Stock to common stock. As

part of this conversion, the Company delivered to the holders of the preferred stock: (1) approximately

17 million shares (the number of common shares they would most likely receive if the preferred stock they

held mandatorily converted to common shares in the fourth quarter of 2010) plus (2) a discounted amount of

the preferred stock dividends the holders of the preferred stock would have received if they held the preferred

39