Sallie Mae 2009 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Federally Guaranteed Student Lending Programs

There are currently two loan delivery programs that provide federal government guaranteed student loans:

the FFELP and the DSLP. FFELP loans are provided by the private sector. DSLP loans are provided to

borrowers directly by ED on terms similar to student loans provided under the FFELP. We participate in and

are the largest lender under the FFELP. The Company is participating in ED’s Participation and Put program,

which were established under the authority provided in ECASLA. This program is scheduled to terminate on

June 30, 2010. Under this program, ED provides funding to lenders for up to one year at a cost of commercial

paper (“CP”) plus 50 basis points. The lender has the option to sell the loans to ED within 90 days of the end

of the AY for a fee of $75 per loan plus the principal amount of and accrued interest on the loan plus the one

percent origination fee for which we are reimbursed. We are also a contractor to service loans sold to ED and

DSLP loans.

For the federal fiscal year (“FFY”) ended September 30, 2009 (“FFY 2009”), ED estimated that the

market share of FFELP loans was 69 percent, down from 76 percent in FFY 2008. (See “LENDING

BUSINESS SEGMENT — Competition.”) Total FFELP and DSLP volume for FFY 2009 grew by 28 percent,

with the FFELP portion growing 17 percent and the DSLP portion growing 63 percent.

The Higher Education Act (the “HEA”) regulates every aspect of the federally guaranteed student loan

program, including communications with borrowers, loan originations and default aversion requirements.

Failure to service a student loan properly could jeopardize the guarantee on federal student loans. This

guarantee generally covers 98 and 97 percent of the student loan’s principal and accrued interest for loans

disbursed before and after July 1, 2006, respectively. In the case of death, disability or bankruptcy of the

borrower, the guarantee covers 100 percent of the loan’s principal and accrued interest. The guarantee on our

existing loan portfolio would not be impacted by pending legislation.

FFELP loans are guaranteed by state agencies or non-profit companies designated as Guarantors, with ED

providing reinsurance to the Guarantor. Guarantors are responsible for performing certain functions necessary

to ensure the program’s soundness and accountability. These functions include reviewing loan application data

to detect and prevent fraud and abuse and to assist lenders in preventing default by providing counseling to

borrowers. Generally, the Guarantor is responsible for ensuring that loans are serviced in compliance with the

requirements of the HEA. When a borrower defaults on a FFELP loan, we submit a claim to the Guarantor

who provides reimbursements of principal and accrued interest subject to the Risk Sharing (See APPENDIX A,

“FEDERAL FAMILY EDUCATION LOAN PROGRAM,” to this document for a description of the role of

Guarantors.)

Private Education Loan Products

In addition to federal loan programs, which have statutory limits on annual and total borrowing, we offer

Private Education Loan programs to bridge the gap between the cost of education and a student’s resources.

Historically, the majority of our Private Education Loans were made in conjunction with a FFELP Stafford

Loan and are marketed to schools through the same marketing channels and by the same sales force as FFELP

loans. However, we also originate Private Education Loans at DSLP schools. We expect no interruption in our

presence in the school channel if SAFRA were to pass. As a result of the credit market dislocation discussed

above, a large number of lenders have exited the Private Education Loan business and only a few of the

country’s largest banks continue to offer the product.

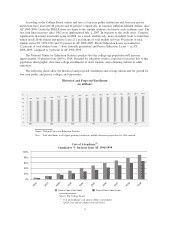

Drivers of Growth in the Student Loan Industry

Growth in our Managed student loan portfolio and our servicing and collection businesses is driven by

the growth in the overall market for student loans, as well as by our own market share gains. Rising

enrollment and college costs and increases in borrowing limits have resulted in the size of the federally insured

student loan market more than tripling over the last 10 years. Federally insured student loan originations grew

from $30 billion in FFY 1999 to $96 billion in FFY 2009.

4