SunTrust 2013 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82

Liquidity Risk Management

Liquidity risk is the risk of being unable, at a reasonable cost, to meet financial obligations as they come due. We mitigate

this risk by structuring our balance sheet prudently and by maintaining diverse borrowing resources to fund projected and

potential cash needs. For example, we structure our balance sheet so that we fund less liquid assets, such as loans, with stable

funding sources, such as retail and wholesale deposits, long-term debt, and capital. We primarily monitor and manage liquidity

risk at the Parent Company and Bank levels as the non-bank subsidiaries are relatively small and these subsidiaries ultimately

rely upon the Parent Company as a source of liquidity in adverse environments.

The Bank’s primary liquid assets consist of excess reserves and free and liquid securities (unencumbered, high-quality, liquid

assets) in its investment portfolio. The Bank manages its investment portfolio primarily as a store of liquidity, maintaining

the majority of its securities in liquid and high-grade asset classes such as agency MBS, agency debt, and U.S. Treasury

securities. At December 31, 2013, the Bank’s AFS investment portfolio contained $10.0 billion of unencumbered and liquid

securities at book value, of which approximately 94% consisted of agency MBS, agency debt, and U.S. Treasury securities.

We manage the Parent Company to maintain most of its liquid assets in cash and securities that it could quickly convert to

cash. Unlike the Bank, it is not typical for the Parent Company to maintain a material investment portfolio of publicly traded

securities. We manage the Parent Company cash balance to provide sufficient liquidity to fund all forecasted obligations

(primarily debt and capital service) for an extended period of months in accordance with our risk limits.

We assess liquidity needs that may occur in both the normal course of business and times of unusual adverse events, considering

both on and off-balance sheet arrangements and commitments that may impact liquidity in certain business environments.

We have contingency funding scenarios and plans that assess liquidity needs that may arise from certain stress events such

as credit rating downgrades, severe economic recessions, and financial market disruptions. Our contingency plans also provide

for continuous monitoring of net borrowed funds dependence and available sources of contingency liquidity. These sources

of contingency liquidity include available cash reserves; the ability to sell, pledge, or borrow against unencumbered securities

in the Bank’s investment portfolio; the capacity to borrow from the FHLB system; and the capacity to borrow at the Federal

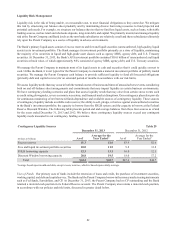

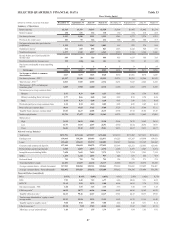

Reserve Discount Window. The following table presents period end and average balances from these four sources as of and

for the years ended December 31, 2013 and 2012. We believe these contingency liquidity sources exceed any contingent

liquidity needs measured in our contingency funding scenarios.

Contingency Liquidity Sources Table 29

December 31, 2013 December 31, 2012

(Dollars in billions) As of

Average for the

Year Ended ¹ As of

Average for the

Year Ended ¹

Excess reserves $1.3 $1.6 $3.4 $2.6

Free and liquid investment portfolio securities 10.0 11.5 9.8 12.8

FHLB borrowing capacity 12.3 13.1 16.0 12.1

Discount Window borrowing capacity 20.8 19.5 18.0 17.2

Total $44.4 $45.7 $47.2 $44.7

1Average based upon month-end data, except excess reserves, which is based upon a daily average.

Uses of Funds. Our primary uses of funds include the extension of loans and credit, the purchase of investment securities,

working capital, and debt and capital service. The Bank and the Parent Company borrow in the money markets using instruments

such as Fed funds, Eurodollars, and CP. At December 31, 2013, the Parent Company had no CP outstanding and the Bank

retained a material cash position in its Federal Reserve account. The Parent Company also retains a material cash position,

in accordance with our policies and risk limits, discussed in greater detail below.