SunTrust 2013 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

89

The income tax provision during the fourth quarter of 2013 was $122 million compared with an income tax provision of $62

million during the fourth quarter of 2012. The increase in the income tax provision was primarily the result of higher pre-tax

income in the fourth quarter of 2013 compared to the same period in 2012. The fourth quarter 2013 and 2012 effective tax

rates were favorably impacted by audit settlements, statute expirations, and/or changes in tax rates.

BUSINESS SEGMENTS

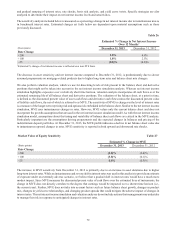

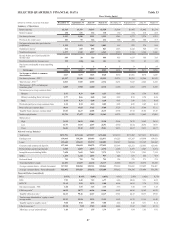

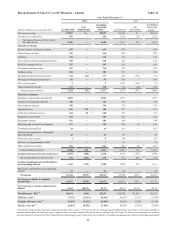

The following table presents net income/(loss) for our reportable business segments during the years ended December 31:

Net Income/(Loss) by Segment Table 34

(Dollars in millions) 2013 2012 2011

Consumer Banking and Private Wealth Management $583 $310 $350

Wholesale Banking 900 698 270

Mortgage Banking (568) (696) (717)

Corporate Other 485 1,517 432

Reconciling Items 1(56) 129 312

Total Corporate Other 429 1,646 744

Consolidated net income 1,344 1,958 647

1 Includes differences between net income/(loss) reported for each business segment using management accounting practices and U.S. GAAP. Prior period information has been

restated to reflect changes in internal reporting methodology and inter-segment transfers. See additional information in Note 20, "Business Segment Reporting," to the Consolidated

Financial Statements in this Form 10-K.

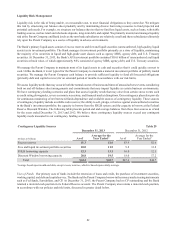

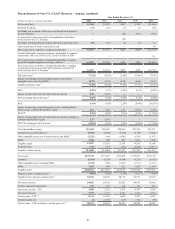

The following table presents average loans and average deposits for our reportable business segments during the years ended

December 31:

Average Loans and Deposits by Segment Table 35

Average Loans Average Consumer and Commercial Deposits

(Dollars in millions) 2013 2012 2011 2013 2012 2011

Consumer Banking and Private Wealth

Management $40,457 $41,823 $40,209 $84,107 $83,917 $84,477

Wholesale Banking 54,195 50,741 46,975 39,827 38,697 35,060

Mortgage Banking 27,974 30,288 29,128 3,206 3,638 3,084

Corporate Other 31 41 (4) (64) (3) 105

See Note 20, “Business Segment Reporting,” to the Consolidated Financial Statements in this Form 10-K for discussion of

our segment structure, basis of presentation, and internal management reporting methodologies.

BUSINESS SEGMENT RESULTS

Years Ended December 31, 2013 vs. 2012

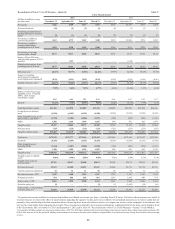

Consumer Banking and Private Wealth Management

Consumer Banking and Private Wealth Management reported net income of $583 million during the year ended December

31, 2013, an increase of $273 million, or 88%, compared to 2012. The increase in net income was driven by continued

improvement in credit quality resulting in a lower provision for credit losses and a decline in noninterest expense, which in

aggregate, more than offset a decline in revenue.

Net interest income was $2.6 billion during 2013, a decrease of $121 million, or 4%, compared to 2012. The decrease was

driven by lower deposit spreads and lower average loan balances. Net interest income related to loans decreased $42 million,

or 4%. Of this decrease, $34 million is attributable to a $1.4 billion, or 3%, decline in average loan balances, while the remaining

decline is associated with a two basis point decrease in loan spreads. The decline in average loans was driven by the $2.0

billion student loan sale executed in the fourth quarter of 2012 and home equity line paydowns during 2013. These declines

were partially offset by increases in other consumer loan categories as a result of higher consumer loan production. Net interest

income related to deposits decreased $104 million, or 6%, compared to the same period during 2012, as deposit spreads