SunTrust 2013 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236

|

|

Notes to Consolidated Financial Statements, continued

127

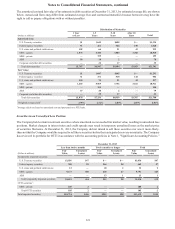

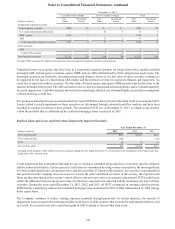

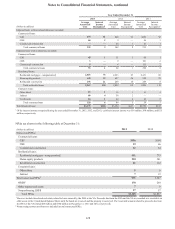

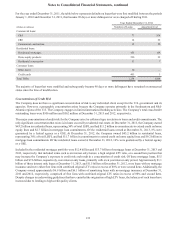

Impaired Loans

A loan is considered impaired when it is probable that the Company will be unable to collect all amounts due, including principal

and interest, according to the contractual terms of the agreement. Commercial nonaccrual loans greater than $3 million and certain

consumer, residential, and commercial loans whose terms have been modified in a TDR are individually evaluated for impairment.

Smaller-balance homogeneous loans that are collectively evaluated for impairment are not included in the following tables.

Additionally, the tables below exclude guaranteed student loans and guaranteed residential mortgages for which there was nominal

risk of principal loss.

December 31, 2013 December 31, 2012

(Dollars in millions)

Unpaid

Principal

Balance

Amortized

Cost1Related

Allowance

Unpaid

Principal

Balance

Amortized

Cost1Related

Allowance

Impaired loans with no related allowance recorded:

Commercial loans:

C&I $81 $56 $— $59 $40 $—

CRE 61 60 — 65—

Commercial construction ———45 45 —

Total commercial loans 142 116 — 110 90 —

Impaired loans with an allowance recorded:

Commercial loans:

C&I 51 49 10 46 38 6

CRE 83—

1571

Commercial construction 63—53—

Total commercial loans 65 55 10 66 48 7

Residential loans:

Residential mortgages - nonguaranteed 2,357 2,051 226 2,346 2,046 234

Home equity products 710 638 96 661 612 88

Residential construction 241 189 23 259 201 26

Total residential loans 3,308 2,878 345 3,266 2,859 348

Consumer loans:

Other direct 14 14 — 14 14 2

Indirect 83 83 5 46 46 2

Credit cards 13 13 3 21 21 5

Total consumer loans 110 110 8 81 81 9

Total impaired loans $3,625 $3,159 $363 $3,523 $3,078 $364

1 Amortized cost reflects charge-offs that have been recognized plus other amounts that have been applied to reduce the net book balance.

Included in the impaired loan balances above were $2.7 billion and $2.4 billion of accruing TDRs, at amortized cost, at

December 31, 2013 and 2012, respectively, of which 96% and 95% were current, respectively. See Note 1, “Significant Accounting

Policies,” for further information regarding the Company’s loan impairment policy.