SunTrust 2013 Annual Report Download - page 130

Download and view the complete annual report

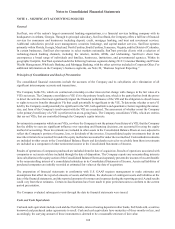

Please find page 130 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements, continued

114

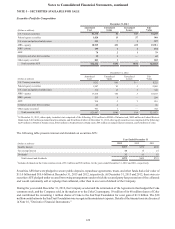

by the weighted average number of common shares outstanding during each period, plus common share equivalents calculated

for stock options, warrants, and restricted stock outstanding using the treasury stock method.

The Company has issued certain restricted stock awards, which are unvested share-based payment awards that contain

nonforfeitable rights to dividends or dividend equivalents. These restricted shares are considered participating securities.

Accordingly, the Company calculated net income available to common shareholders pursuant to the two-class method, whereby

net income is allocated between common shareholders and participating securities.

Net income available to common shareholders represents net income after preferred stock dividends, accretion of the discount

on preferred stock issuances, gains or losses from any repurchases of preferred stock, and dividends and allocation of

undistributed earnings to the participating securities. For additional information on the Company’s EPS, see Note 12, “Net

Income Per Common Share.”

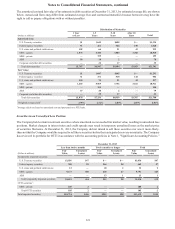

Securities Sold Under Agreements to Repurchase and Securities Purchased Under Agreements to Resell

Securities sold under agreements to repurchase and securities purchased under agreements to resell are accounted for as

collateralized financing transactions and are recorded at the amounts at which the securities were sold or acquired, plus accrued

interest. The fair value of collateral pledged or received is continually monitored and additional collateral is obtained or

requested to be returned to the Company as deemed appropriate. For additional information on the collateral pledged to secure

repurchase agreements, see Note 3, "Federal Funds Sold and Securities Borrowed or Purchased Under Agreements to Resell,"

Note 4, "Trading Assets and Liabilities and Derivatives," and Note 5, "Securities Available for Sale."

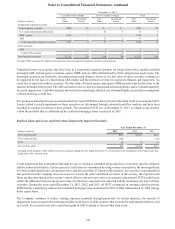

Guarantees

The Company recognizes a liability at the inception of a guarantee, at an amount equal to the estimated fair value of the

obligation. A guarantee is defined as a contract that contingently requires a company to make payment to a guaranteed party

based upon changes in an underlying asset, liability, or equity security of the guaranteed party, or upon failure of a third party

to perform under a specified agreement. The Company considers the following arrangements to be guarantees: certain asset

purchase/sale agreements, standby letters of credit and financial guarantees, certain indemnification agreements included

within third party contractual arrangements, and certain derivative contracts. For additional information on the Company’s

guarantor obligations, see Note 17, “Guarantees.”

Derivative Financial Instruments and Hedging Activities

The Company records all contracts that satisfy the definition of a derivative at fair value in the Consolidated Balance Sheets.

Accounting for changes in the fair value of a derivative is dependent upon whether or not it has been designated in a formal,

qualifying hedging relationship. The Company offsets all outstanding derivative transactions with a single counterparty as

well as any cash collateral paid to and received from that counterparty for derivative contracts that are subject to ISDA or

other legally enforceable master netting arrangements and meet accounting guidance for offsetting treatment.

Changes in the fair value of derivatives not designated in a hedging relationship are recorded in noninterest income. This

includes derivatives that the Company enters into in a dealer capacity to facilitate client transactions and as a risk management

tool to economically hedge certain identified market risks, along with certain IRLCs on residential mortgage loans that are a

normal part of the Company’s operations. The Company also evaluates contracts, such as brokered deposits and short-term

debt, to determine whether any embedded derivatives are required to be bifurcated and separately accounted for as freestanding

derivatives. For certain contracts containing embedded derivatives, the Company has elected not to bifurcate the embedded

derivative and instead carry the entire contract at fair value.

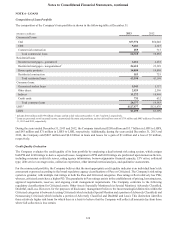

Certain derivatives used as risk management tools are also designated as accounting hedges of the Company’s exposure to

changes in interest rates or other identified market risks. The Company prepares written hedge documentation for all derivatives

which are designated as hedges of (1) changes in the fair value of a recognized asset or liability (fair value hedge) attributable

to a specified risk or (2) a forecasted transaction, such as the variability of cash flows to be received or paid related to a

recognized asset or liability (cash flow hedge). The written hedge documentation includes identification of, among other items,

the risk management objective, hedging instrument, hedged item and methodologies for assessing and measuring hedge

effectiveness and ineffectiveness, along with support for management’s assertion that the hedge will be highly effective.

Methodologies related to hedge effectiveness and ineffectiveness are consistent between similar types of hedge transactions

and have included (i) statistical regression analysis of changes in the cash flows of the actual derivative and a perfectly effective

hypothetical derivative, and (ii) statistical regression analysis of changes in the fair values of the actual derivative and the

hedged item.