SunTrust 2013 Annual Report Download - page 184

Download and view the complete annual report

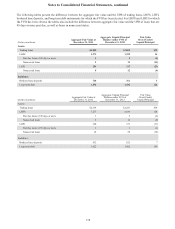

Please find page 184 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements, continued

168

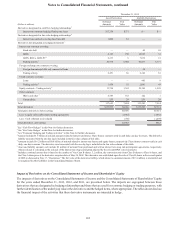

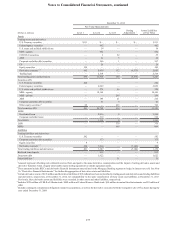

collected like amounts from the counterparties to the offsetting purchased CDS. At December 31, 2013 and 2012, the written

CDS had remaining terms of four years and ranging from less than one year to three years, respectively. The maximum guarantees

outstanding at December 31, 2013 and 2012, as measured by the gross notional amounts of written CDS, were $60 million and

$52 million, respectively. At December 31, 2013 and 2012, the gross notional amounts of purchased CDS contracts, which

represent benefits to, rather than obligations of, the Company, were $70 million and $175 million, respectively. The fair values

of written CDS were $3 million and $1 million at December 31, 2013 and 2012, respectively, and the fair values of purchased

CDS were $3 million and less than $1 million at December 31, 2013 and 2012, respectively.

The Company has also entered into TRS contracts on loans. The Company’s TRS business consists of matched trades, such that

when the Company pays depreciation on one TRS, it receives the same amount on the matched TRS. To mitigate its credit risk,

the Company typically receives initial cash collateral from the counterparty upon entering into the TRS and is entitled to additional

collateral if the fair value of the underlying reference assets deteriorates. At December 31, 2013 and 2012, there were $1.5 billion

and $1.9 billion of outstanding and offsetting TRS notional balances, respectively. The fair values of the TRS derivative assets

and liabilities at December 31, 2013, were $35 million and $31 million, respectively, and related collateral held at December 31,

2013, was $228 million. The fair values of the TRS derivative assets and liabilities at December 31, 2012, were $51 million and

$46 million, respectively, and related collateral held at December 31, 2012, was $282 million.

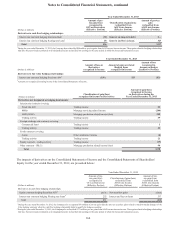

The Company writes risk participations, which are credit derivatives, whereby the Company has guaranteed payment to a dealer

counterparty in the event that the counterparty experiences a loss on a derivative, such as an interest rate swap, due to a failure

to pay by the counterparty’s customer (the “obligor”) on that derivative. The Company monitors its payment risk on its risk

participations by monitoring the creditworthiness of the obligors, which is based on the normal credit review process the Company

would have performed had it entered into the derivatives directly with the obligors. The obligors are all corporations or partnerships.

However, the Company continues to monitor the creditworthiness of its obligors and the likelihood of payment could change at

any time due to unforeseen circumstances. To date, no material losses have been incurred related to the Company’s written risk

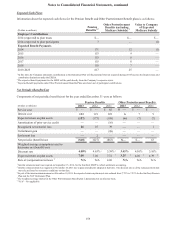

participations. At December 31, 2013 and 2012, the remaining terms on these risk participations generally ranged from less than

one year to twelve years and ten years, respectively, with a weighted average on the maximum estimated exposure of 6.9 years

and 4.4 years, respectively. The Company’s maximum estimated exposure to written risk participations, as measured by projecting

a maximum value of the guaranteed derivative instruments based on interest rate curve simulations and assuming 100% default

by all obligors on the maximum values, was approximately $33 million and $20 million at December 31, 2013 and 2012,

respectively. The fair values of the written risk participations were less than $1 million at December 31, 2013 and 2012. As part

of its trading activities, the Company may enter into purchased risk participations to mitigate credit exposure to a derivative

counterparty.

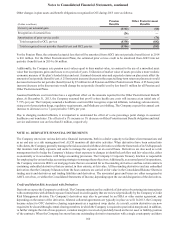

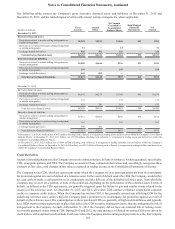

Cash Flow Hedges

The Company utilizes a comprehensive risk management strategy to monitor sensitivity of earnings to movements in interest rates.

Specific types of funding and principal amounts hedged are determined based on prevailing market conditions and the shape of

the yield curve. In conjunction with this strategy, the Company may employ various interest rate derivatives as risk management

tools to hedge interest rate risk from recognized assets and liabilities or from forecasted transactions. The terms and notional

amounts of derivatives are determined based on management’s assessment of future interest rates, as well as other factors.

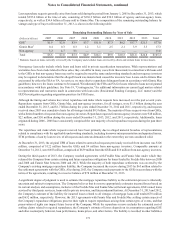

Interest rate swaps have been designated as hedging the exposure to the benchmark interest rate risk associated with floating

rate loans. At December 31, 2013 and 2012, the range of hedge maturities for hedges of floating rate loans was between less

than one year and five years, with the weighted average being 2.0 years and 2.4 years, respectively. Ineffectiveness on these

hedges was less than $1 million during the years ended December 31, 2013, 2012, and 2011. At December 31, 2013, $371

million of the deferred net gains on derivatives that are recognized in AOCI are expected to be reclassified to net interest income

over the next twelve months in connection with the recognition of interest income on these hedged items. The amount to be

reclassified into income includes both active and terminated or de-designated cash flow hedges. The Company may choose to

terminate or de-designate a hedging relationship in this program due to a change in the risk management objective for that

specific hedge item, which may arise in conjunction with an overall balance sheet management strategy.

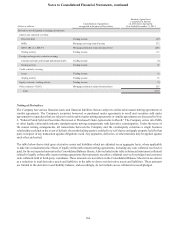

The Company also designated interest rate swaps to hedge exposure to changes in probable interest payments attributable to

changes in the benchmark interest rate associated with a forecasted issuance of fixed rate debt.

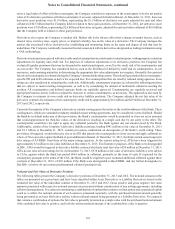

During 2008, the Company executed the Agreements on 60 million common shares of Coke. The Agreements were zero-cost

equity collars at inception, which caused the Agreements to be derivatives in their entirety. The Company designated the

Agreements as cash flow hedges of the Company's probable forecasted sales of its Coke common shares, and the risk management

objective was to hedge the cash flows on the forecasted sales of the Coke common shares at market values equal to or above

the call strike price and equal to or below the put strike price. The Company assessed hedge effectiveness on a quarterly basis

and measured hedge ineffectiveness with the effective portion of the changes in fair value of the Agreements recognized in

AOCI and any ineffective portions recognized in trading income. None of the components of the Agreements' fair values were