SunTrust 2013 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

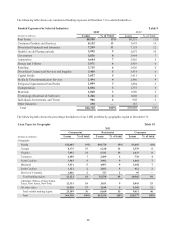

Consumer

The loan types comprising our consumer loan segment include government-guaranteed student loans, other direct (consisting

primarily of direct auto loans, loans secured by negotiable collateral, and private student loans), indirect (consisting of loans

secured by automobiles, boats, or recreational vehicles), and consumer credit cards.

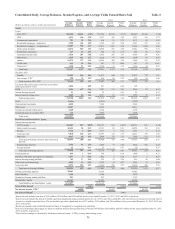

The composition of our loan portfolio at December 31 is shown in the following table:

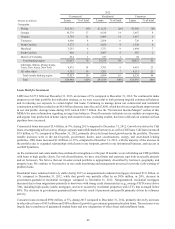

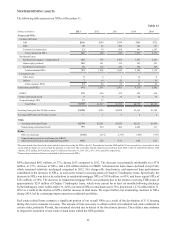

Loan Portfolio by Types of Loans Table 7

(Dollars in millions) 2013 2012 2011 2010 2009

Commercial loans:

C&I $57,974 $54,048 $49,538 $44,753 $44,008

CRE 5,481 4,127 5,094 6,167 6,694

Commercial construction 855 713 1,240 2,568 4,984

Total commercial loans 64,310 58,888 55,872 53,488 55,686

Residential loans:

Residential mortgages - guaranteed 3,416 4,252 6,672 4,520 949

Residential mortgages - nonguaranteed124,412 23,389 23,243 23,959 25,847

Home equity products 14,809 14,805 15,765 16,751 17,783

Residential construction 553 753 980 1,291 1,909

Total residential loans 43,190 43,199 46,660 46,521 46,488

Consumer loans:

Guaranteed student loans 5,545 5,357 7,199 4,260 2,786

Other direct 2,829 2,396 2,059 1,722 1,484

Indirect 11,272 10,998 10,165 9,499 6,665

Credit cards 731 632 540 485 566

Total consumer loans 20,377 19,383 19,963 15,966 11,501

LHFI $127,877 $121,470 $122,495 $115,975 $113,675

LHFS $1,699 $3,399 $2,353 $3,501 $4,670

1 Includes $302 million, $379 million, $431 million, $488 million, and $437 million of loans carried at fair value at December 31, 2013, 2012, 2011,

2010, and 2009, respectively.

We believe that our loan portfolio is well diversified by product, client, and geography throughout our footprint. However,

our loan portfolio may be exposed to certain concentrations of credit risk which exist in relation to individual borrowers or

groups of borrowers, certain types of collateral, certain industries, certain loan products, or certain regions of the country. As

seen below in Table 10, we have experienced a shift in our loans by geography since December 31, 2012. Specifically, the

percentage of our loans to clients outside of our banking footprint compared to our total loan portfolio increased, primarily

as a result of an increase in loans in our CIB business which serves clients nationwide. See Note 6, “Loans,” to the Consolidated

Financial Statements in this Form 10-K for more information.

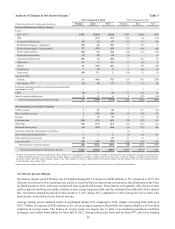

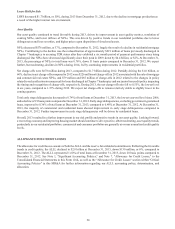

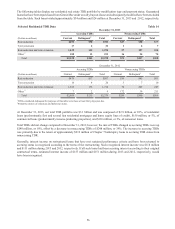

Selected Loan Maturity Data Table 8

(Dollars in millions)

At December 31, 2013

Total 1 year or less 1-5 years After 5 years

Loan Maturity

Commercial and commercial real estate 1$57,880 $21,953 $32,414 $3,513

Real estate - construction 855 155 634 66

Total $58,735 $22,108 $33,048 $3,579

Interest Rate Sensitivity

Selected loans with:

Predetermined interest rates $5,124 $1,989

Floating or adjustable interest rates 27,924 1,590

Total $33,048 $3,579

1 Excludes $4.9 billion in lease financing and $705 million in installment loans.