SunTrust 2013 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

152

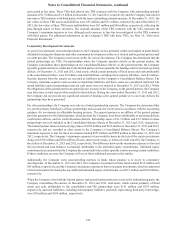

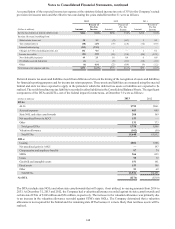

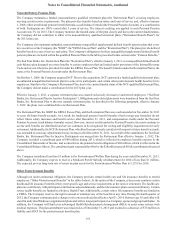

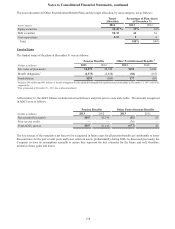

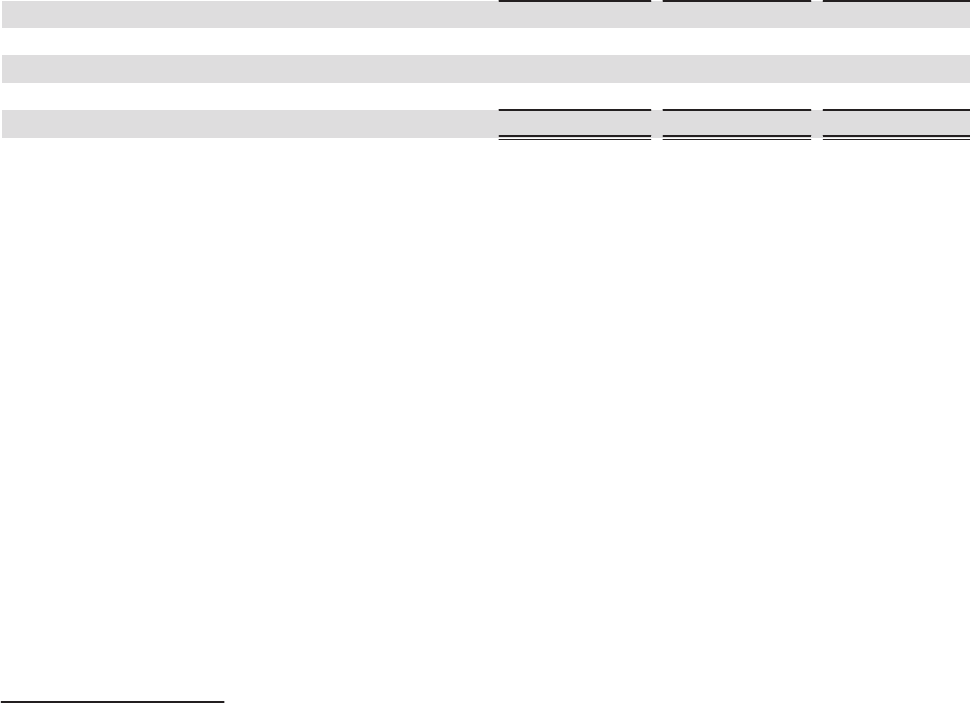

Stock-based compensation expense recognized in noninterest expense for the years ended December 31 was as follows:

(Dollars in millions) 2013 2012 2011

Stock-based compensation expense:

Stock options $6 $11 $15

Restricted stock 32 30 32

RSUs 18 27 10

Total stock-based compensation expense $56 $68 $57

The recognized stock-based compensation tax benefit was $21 million, $26 million, and $22 million for the years ended

December 31, 2013, 2012, and 2011, respectively.

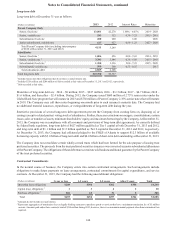

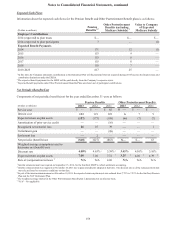

In addition to the SunTrust stock-based compensation awards, the Company has two subsidiaries which sponsor separate

equity plans where subsidiary restricted stock or restricted membership interests are granted to key employees of the

subsidiaries. These awards may be subject to one or more vesting criteria, including employment, performance, or other

conditions as established by the board of directors or executive of the subsidiary at the time of grant. Compensation cost for

these restricted awards is equal to the fair market value of the shares on the grant date of the award and is amortized to

compensation expense over the vesting period considering an estimation of forfeitures. As the equity of these subsidiaries is

not traded in public markets, fair market value of the shares on the grant date is determined based on an external valuation.

Depending on the specific terms of the awards, unvested awards may or may not be entitled to receive dividends or distributions

during the vesting period. The restricted stock awards and restricted membership interest awards are subject to certain fair

value put and call provisions subsequent to vesting. Stock-based compensation expense recognized in noninterest expense

for the subsidiary equity plans totaled $6 million for the year ended December 31, 2013 and totaled $8 million for both years

ended December 31, 2012 and 2011. During 2011, one of the subsidiaries converted all unvested membership interest awards

into LTI cash awards for a fixed dollar amount equal to the fair value of the membership interest at the date of modification.

The modified awards will continue to vest based on their original vesting schedule, and compensation expense will be

recognized based on the higher of the original grant date value or the modified value.

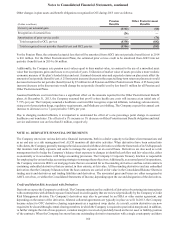

Retirement Plans

Defined Contribution Plan

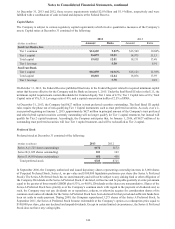

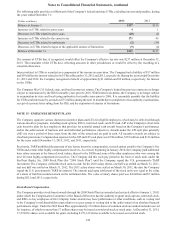

SunTrust's employee benefit program includes a qualified defined contribution plan. For 2013 and 2012, the plan provided a

dollar for dollar match on the first 6% of eligible pay that a participant, including executive participants, elected to defer to

the 401(k) plan. Compensation expense related to this plan for each year ended December 31, 2013 and 2012 was $96 million.

SunTrust also maintains the SunTrust Banks, Inc. Deferred Compensation Plan in which key executives of the Company are

eligible. In accordance with the terms of the plan, the matching contribution to the Deferred Compensation Plan is the same

percentage of match as provided in the 401(k) Plan subject to such limitations as may be imposed by the plans' provisions

and applicable laws and regulations. Effective January 1, 2012, the Company's 401(k) plan and the Deferred Compensation

Plan were amended to permit an additional discretionary Company contribution equal to a fixed percentage of eligible pay,

as defined in the respective plan. For the 2012 performance year, the Company made a discretionary contribution on March

15, 2013, in the amount of 2% of 2012 eligible pay to the 401(k) Plan and the Deferred Compensation Plan, which was $38

million. For the 2013 performance year, the Company anticipates making a discretionary contribution on March 15, 2014, in

the amount of 1% of 2013 eligible pay to the 401(k) Plan and the Deferred Compensation Plan of $19 million.

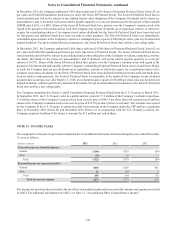

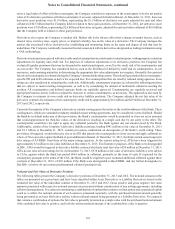

During 2011 the Company's 401(k) plan and the Deferred Compensation Plan provided a dollar for dollar match on the first

5% of eligible pay that a participant elected to defer to the 401(k) plan. Compensation expense related to the 401(k) plan for

the year ended December 31, 2011 totaled $81 million, excluding the special contribution during 2011 described below.

Effective January 1, 2011, employees hired on or after January 1, 2011 will vest in all Company 401(k) matching contributions

and matching contributions under the Deferred Compensation Plan upon completion of two years of vesting service. During

2011, the Company's 401(k) plan and the Deferred Compensation Plan were amended to provide for a special one-time

contribution equal to 5% of eligible 2011 earnings, which was $28 million, for employees who have: (1) at least 20 years of

service at December 31, 2011, or (2) 10 years of service and the sum of age and service equaled or exceeded 60 at December 31,

2011. This contribution was made subsequent to the retirement pension benefit curtailment described below.