SunTrust 2013 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236

|

|

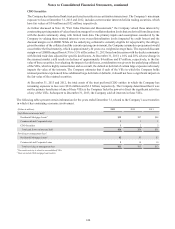

Notes to Consolidated Financial Statements, continued

134

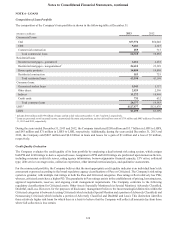

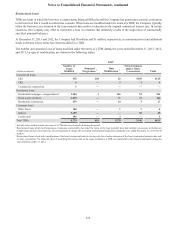

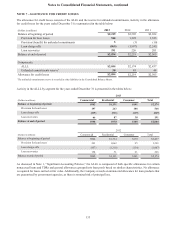

The Company’s LHFI portfolio and related ALLL is shown in the tables below:

December 31, 2013

Commercial Residential Consumer Total

(Dollars in millions)

Carrying

Val u e

Associated

ALLL

Carrying

Val u e

Associated

ALLL

Carrying

Val u e

Associated

ALLL

Carrying

Val u e

Associated

ALLL

Individually evaluated $171 $10 $2,878 $345 $110 $8 $3,159 $363

Collectively evaluated 64,139 936 40,010 585 20,267 160 124,416 1,681

Total evaluated 64,310 946 42,888 930 20,377 168 127,575 2,044

LHFI at fair value — — 302 — — — 302 —

Total LHFI $64,310 $946 $43,190 $930 $20,377 $168 $127,877 $2,044

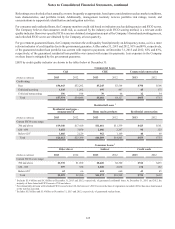

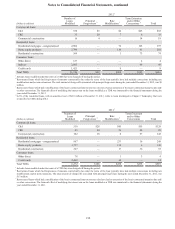

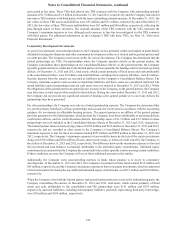

December 31, 2012

Commercial Residential Consumer Total

(Dollars in millions)

Carrying

Value

Associated

ALLL

Carrying

Value

Associated

ALLL

Carrying

Value

Associated

ALLL

Carrying

Value

Associated

ALLL

Individually evaluated $138 $7 $2,859 $348 $81 $9 $3,078 $364

Collectively evaluated 58,750 895 39,961 783 19,302 132 118,013 1,810

Total evaluated 58,888 902 42,820 1,131 19,383 141 121,091 2,174

LHFI at fair value — — 379 — — — 379 —

Total LHFI $58,888 $902 $43,199 $1,131 $19,383 $141 $121,470 $2,174

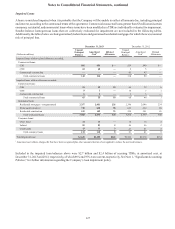

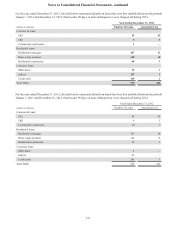

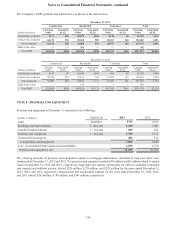

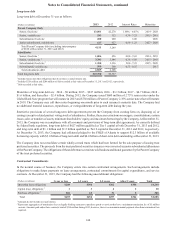

NOTE 8 - PREMISES AND EQUIPMENT

Premises and equipment at December 31 consisted of the following:

(Dollars in millions) Useful Life 2013 2012

Land Indefinite $345 $349

Buildings and improvements 2 - 40 years 1,045 1,041

Leasehold improvements 1 - 30 years 609 622

Furniture and equipment 1 - 20 years 1,399 1,357

Construction in progress 206 111

Total premises and equipment 3,604 3,480

Less: Accumulated depreciation and amortization 2,039 1,916

Premises and equipment, net $1,565 $1,564

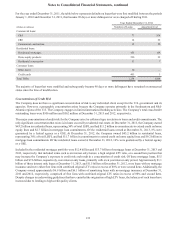

The carrying amounts of premises and equipment subject to mortgage indebtedness (included in long-term debt) were

immaterial at December 31, 2013 and 2012. Net premises and equipment included $5 million and $6 million related to capital

leases at December 31, 2013 and 2012, respectively. Aggregate rent expense (principally for offices), including contingent

rent expense and sublease income, totaled $220 million, $228 million, and $225 million for the years ended December 31,

2013, 2012, and 2011, respectively. Depreciation and amortization expense for the years ended December 31, 2013, 2012,

and 2011 totaled $185 million, $188 million, and $181 million, respectively.