SunTrust 2013 Annual Report Download - page 188

Download and view the complete annual report

Please find page 188 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

172

in the Consolidated Balance Sheets, and the related repurchase provision is recognized in mortgage production related income/

(loss) in the Consolidated Statements of Income. See Part I., "Item 1A. Risk Factors," in this Form 10-K for further information

regarding potential additional liability.

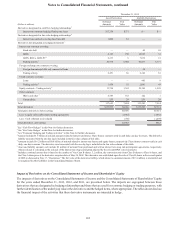

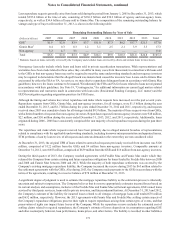

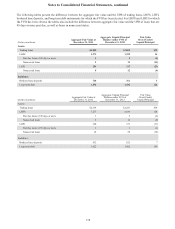

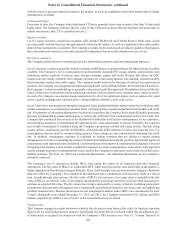

The following table summarizes the changes in the Company’s reserve for mortgage loan repurchases:

Year Ended December 31

(Dollars in millions) 2013 2012 2011

Balance at beginning of period $632 $320 $265

Repurchase provision 114 713 502

Charge-offs (668)(401)(447)

Balance at end of period $78 $632 $320

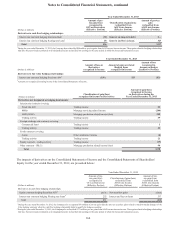

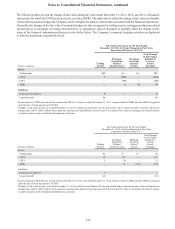

During the years ended December 31, 2013 and 2012, the Company repurchased or otherwise settled mortgages with original

loan balances of $1.1 billion and $769 million, respectively, related to investor demands. At December 31, 2013, the carrying

value of outstanding repurchased mortgage loans, net of any allowance for loan losses, was $339 million, comprised of $325

million LHFI and $14 million LHFS, respectively, of which $54 million LHFI and $14 million LHFS, were nonperforming.

At December 31, 2012, the carrying value of outstanding repurchased mortgage loans, net of any allowance for loan losses,

was $240 million, comprised of $209 million LHFI and $31 million LHFS, respectively, of which $70 million LHFI and $31

million LHFS, were nonperforming.

The Company normally retains servicing rights when loans are transferred. As servicer, the Company makes representations

and warranties that it will service the loans in accordance with investor servicing guidelines and standards which may include

(i) collection and remittance of principal and interest, (ii) administration of escrow for taxes and insurance, (iii) advancing

principal, interest, taxes, insurance, and collection expenses on delinquent accounts, (iv) loss mitigation strategies including

loan modifications, and (v) foreclosures. The Company recognizes a liability for contingent losses when MSRs are sold, which

totaled $21 million and $12 million at December 31, 2013 and 2012.

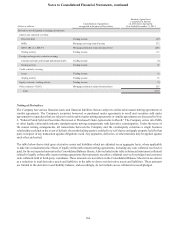

Contingent Consideration

The Company has contingent payment obligations related to certain business combination transactions. Payments are calculated

using certain post-acquisition performance criteria. The potential obligation and amount recorded as a liability representing

the fair value of the contingent payments was $26 million and $30 million at December 31, 2013 and 2012, respectively. If

required, these contingent payments will be payable within the next three years.

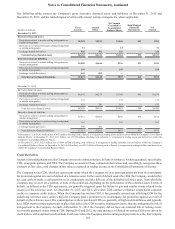

Visa

The Company issues credit and debit transactions through Visa and MasterCard International. The Company is a defendant,

along with Visa and MasterCard International (the “Card Associations”), as well as several other banks, in one of several

antitrust lawsuits challenging the practices of the Card Associations (the “Litigation”). The Company entered into judgment

and loss sharing agreements with Visa and certain other banks in order to apportion financial responsibilities arising from any

potential adverse judgment or negotiated settlements related to the Litigation. Additionally, in connection with Visa's

restructuring in 2007, a provision of the original Visa By-Laws, Section 2.05j, was restated in Visa's certificate of incorporation.

Section 2.05j contains a general indemnification provision between a Visa member and Visa, and explicitly provides that after

the closing of the restructuring, each member's indemnification obligation is limited to losses arising from its own conduct

and the specifically defined Litigation.

Agreements associated with Visa's IPO have provisions that Visa will fund a litigation escrow account, established for the

purpose of funding judgments in, or settlements of, the Litigation. Since inception of the escrow account, Visa has funded over

$8.5 billion into the escrow account, approximately $4.1 billion of which has been paid out in Litigation settlements and another

$4.4 billion which was paid into a settlement fund during 2012. If the escrow account is insufficient to cover the Litigation

losses, then Visa will issue additional Class A shares (“loss shares”). The proceeds from the sale of the loss shares would then

be deposited in the escrow account. The issuance of the loss shares will cause a dilution of Visa's Class B shares as a result of

an adjustment to lower the conversion factor of the Class B shares to Class A shares. Visa U.S.A.'s members are responsible

for any portion of the settlement or loss on the Litigation after the escrow account is depleted and the value of the Class B

shares is fully-diluted. In May 2009, the Company sold its 3.2 million Class B shares to the Visa Counterparty and entered

into a derivative with the Visa Counterparty. The Company received $112 million and recognized a gain of $112 million in