SunTrust 2013 Annual Report Download - page 198

Download and view the complete annual report

Please find page 198 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements, continued

182

with the issuer at par and cannot be traded in the market; as such, no significant observable market data for these

instruments is available.

Commercial Paper

From time to time, the Company trades third party CP that is generally short-term in nature (less than 30 days) and

highly rated. The Company estimates the fair value of this CP based on observable pricing from executed trades of

similar instruments; thus, CP is classified as level 2.

Equity securities

Level 3 equity securities classified as securities AFS include FHLB stock and Federal Reserve Bank stock, which

are redeemable with the issuer at cost and cannot be traded in the market. As such, no significant observable market

data for these instruments is available. The Company accounts for the stock based on industry guidance that requires

these investments be carried at cost and evaluated for impairment based on the ultimate recovery of cost.

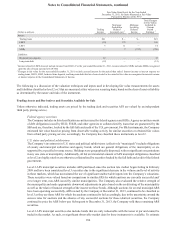

Derivative contracts

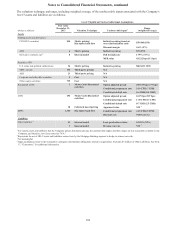

The Company holds derivative instruments used for both trading purposes and risk management purposes.

Level 1 derivative contracts generally include exchange-traded futures or option contracts for which pricing is readily

available. The Company’s level 2 instruments are predominantly standard OTC swaps, options, and forwards, with

underlying market variables of interest rates, foreign exchange, equity, and credit. Because fair values for OTC

contracts are not readily available, the Company estimates fair values using internal, but standard, valuation models

that incorporate market-observable inputs. The valuation model is driven by the type of contract: for option-based

products, the Company uses an appropriate option pricing model, such as Black-Scholes; for forward-based products,

the Company’s valuation methodology is generally a discounted cash flow approach. The primary drivers of the fair

values of derivative instruments are the underlying variables, such as interest rates, exchange rates, equity, or credit.

As such, the Company uses market-based assumptions for all of its significant inputs, such as interest rate yield

curves, quoted exchange rates and spot prices, market implied volatilities, and credit curves.

Level 2 derivative instruments are primarily transacted in the institutional dealer market and priced with observable

market assumptions at a mid-market valuation point, with appropriate valuation adjustments for liquidity and credit

risk. For purposes of valuation adjustments to its derivative positions, the Company has evaluated liquidity premiums

that may be demanded by market participants, as well as the credit risk of its counterparties and its own credit. The

Company has considered factors such as the likelihood of default by itself and its counterparties, its net exposures,

and remaining maturities in determining the appropriate fair value adjustments to record. Generally, the expected

loss of each counterparty is estimated using the Company's proprietary internal risk rating system. The risk rating

system utilizes counterparty-specific probabilities of default and LGD estimates to derive the expected loss. For

counterparties that are rated by national rating agencies, those ratings are also considered in estimating the credit

risk. In addition, counterparty exposure is evaluated by netting positions that are subject to master netting

arrangements, as well as considering the amount of marketable collateral securing the position. Specifically approved

counterparties and exposure limits are defined. Creditworthiness of the approved counterparties is regularly reviewed

and appropriate business action is taken to adjust the exposure to certain counterparties, as necessary. This approach

used to estimate exposures to counterparties is also used by the Company to estimate its own credit risk on derivative

liability positions. See Note 16, “Derivative Financial Instruments,” for additional information on the Company's

derivative contracts.

The Company's level 3 derivatives include IRLCs that satisfy the criteria to be treated as derivative financial

instruments. The fair value of IRLCs on residential LHFS, while based on interest rates observable in the market, is

highly dependent on the ultimate closing of the loans. These “pull-through” rates are based on the Company’s historical

data and reflect the Company’s best estimate of the likelihood that a commitment will ultimately result in a closed

loan. As pull-through rates increase, the fair value of IRLCs also increases. Servicing value is included in the fair

value of IRLCs, and the fair value of servicing is determined by projecting cash flows which are then discounted to

estimate an expected fair value. The fair value of servicing is impacted by a variety of factors, including prepayment

assumptions, discount rates, delinquency rates, contractually specified servicing fees, servicing costs, and underlying

portfolio characteristics. Because these inputs are not transparent in market trades, IRLCs are considered to be level

3 assets. During the years ended December 31, 2013 and 2012, the Company transferred $222 million and $882

million, respectively, of IRLCs out of level 3 as the associated loans were closed.

Trading loans

The Company engages in certain businesses whereby the election to carry loans at fair value for financial reporting

aligns with the underlying business purpose. Specifically, the loans that are included within this classification are:

(i) loans made or acquired in connection with the Company’s TRS business (see Note 10, "Certain Transfers of