SunTrust 2013 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

165

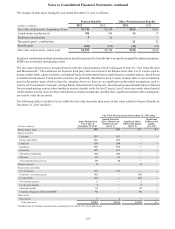

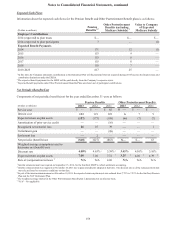

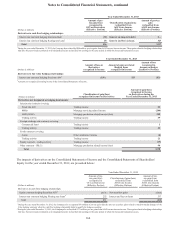

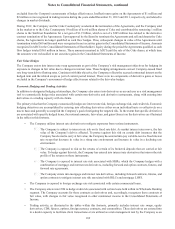

Year Ended December 31, 2012

(Dollars in millions)

Amount of gain on

Derivatives recognized

in Income

Amount of loss on related

Hedged Items

recognized in Income

Amount of gain/(loss)

recognized in Income

on Hedges (Ineffective

Portion)

Derivatives in fair value hedging relationships1:

Interest rate contracts hedging Fixed rate debt $5 ($5) $—

Interest rate contracts hedging Securities AFS 1 (1) —

Total $6 ($6) $—

1 Amounts are recognized in trading income in the Consolidated Statements of Income.

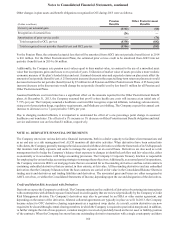

(Dollars in millions)

Classification of gain/(loss)

recognized in Income on Derivatives

Amount of gain/(loss)

recognized in Income

on Derivatives during the

Year Ended December 31, 2012

Derivatives not designated as hedging instruments:

Interest rate contracts covering:

Fixed rate debt Trading income ($2)

MSRs Mortgage servicing related income 284

LHFS, IRLCs, LHFI-FV Mortgage production related income/(loss) (331)

Trading activity Trading income 86

Foreign exchange rate contracts covering:

Commercial loans and foreign-denominated debt Trading income 129

Trading activity Trading income 14

Credit contracts covering:

Loans 1Other noninterest income (8)

Trading activity Trading income 24

Equity contracts - trading activity Trading income 8

Other contracts - IRLCs Mortgage production related income/(loss) 930

Total $1,134

1 For the six months ended June 30, 2012, losses of $3 million were recorded in trading income.

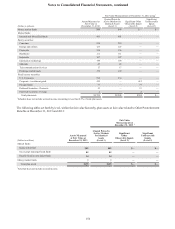

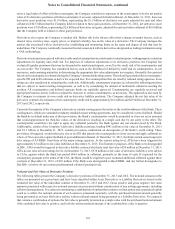

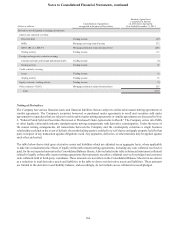

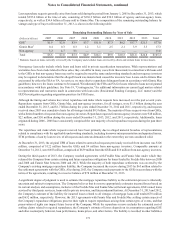

The impacts of derivatives on the Consolidated Statements of Income and the Consolidated Statements of Shareholders'

Equity for the year ended December 31, 2011, are presented below:

Year Ended December 31, 2011

(Dollars in millions)

Amount of pre-

tax gain/(loss)

recognized in

OCI on Derivatives

(Effective Portion)

Classification of gain

reclassified from

AOCI into Income

(Effective Portion)

Amount of pre-

tax gain

reclassified from

AOCI into Income

(Effective Portion)

Derivatives in cash flow hedging relationships:

Equity contracts hedging Securities AFS ($46) Net securities gains $—

Interest rate contracts hedging Floating rate loans 1 730 Interest and fees on loans 423

Total $684 $423

1 During the year ended December 31, 2011, the Company also reclassified $202 million pre-tax gains from AOCI into net interest income. These gains related to hedging

relationships that have been previously terminated or de-designated and are reclassified into earnings in the same period in which the forecasted transaction occurs.

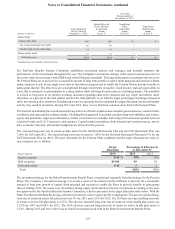

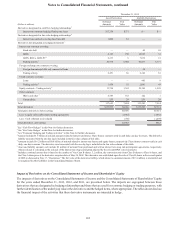

Year Ended December 31, 2011

(Dollars in millions)

Amount of loss on

Derivatives

recognized in Income

Amount of gain on related

Hedged Items

recognized in Income

Amount of loss

recognized in

Income on Hedges

(Ineffective Portion)

Derivatives in fair value hedging relationships:

Interest rate contracts hedging fixed rate debt1$51 ($52) ($1)

1 Amounts are recognized in trading income in the Consolidated Statements of Income.