SunTrust 2013 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

143

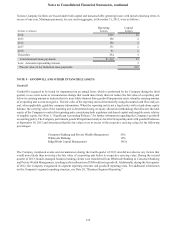

During 2012, the Company decided to sell certain consolidated affordable housing properties, and accordingly,

recorded an impairment charge to adjust the carrying values to their estimated net realizable values. Upon moving

to held for sale, most of these affordable housing properties were sold during 2013 resulting in an aggregate gain

recognized upon sale of $17 million. At December 31, 2013, market indicators remain consistent with the carrying

values of the remaining properties to be sold and marketing efforts continue with an expected disposition in the first

quarter of 2014.

Registered and Unregistered Funds Advised by RidgeWorth

RidgeWorth, a registered investment advisor and majority owned subsidiary of the Company, serves as the investment

advisor for various private placement, common and collective funds, and registered mutual funds (collectively the

“Funds”). The Company evaluates these Funds to determine if the Funds are VIEs. In February 2010, the FASB

issued guidance that defers the application of the existing VIE consolidation guidance for investment funds meeting

certain criteria. All of the registered and unregistered Funds advised by RidgeWorth meet the scope exception criteria,

thus, are not evaluated for consolidation under the guidance. Accordingly, the Company continues to apply the

consolidation guidance in effect prior to the issuance of the existing guidance to interests in funds that qualify for

the deferral.

The Company has concluded that some of the Funds are VIEs. However, the Company has determined that it is not

the primary beneficiary of these funds as the Company does not absorb a majority of the expected losses nor expected

returns of the funds. The Company’s exposure to loss is limited to the investment advisor and other administrative

fees it earns and if applicable, any equity investments. The total unconsolidated assets of these funds at December

31, 2013 and 2012, were $247 million and $372 million, respectively.

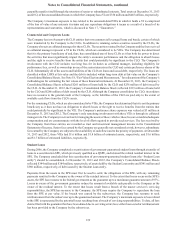

On December 11, 2013, it was publicly announced that the Company had reached a definitive agreement to sell

RidgeWorth to an investor group led by a private equity fund managed by Lightyear Capital LLC. The sale is expected

to close during the second quarter of 2014. See additional discussion of the planned sale in Note 20 , "Business

Segment Reporting."

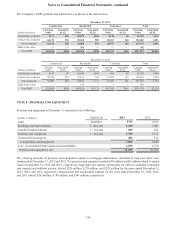

NOTE 11 - BORROWINGS AND CONTRACTUAL COMMITMENTS

Short-term borrowings

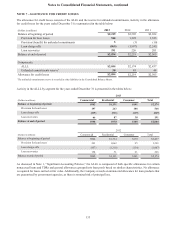

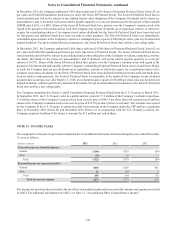

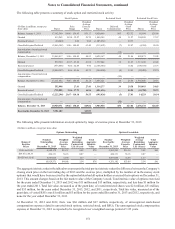

Other short-term borrowings at December 31 was as follows:

2013 2012

(Dollars in millions) Balance Interest Rate Balance Interest Rate

FHLB advances $4,000 0.21% $1,500 0.34%

Master notes 1,554 0.28 1,512 0.30

Dealer collateral 232 0.10 282 0.17

Other 2 2.70 9 2.70

Total other short-term borrowings $5,788 $3,303

At December 31, 2013 and 2012, the Company had $27.1 billion and $23.8 billion of collateral pledged to the Federal Reserve

discount window to support $20.8 billion and $18.0 billion of available, unused borrowing capacity, respectively.