SunTrust 2013 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

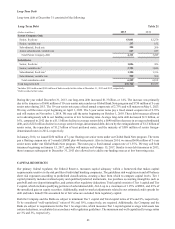

62

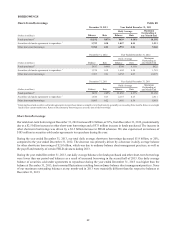

BORROWINGS

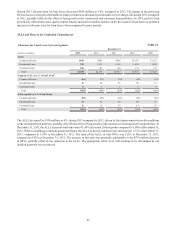

Short-Term Borrowings Table 20

December 31, 2013 Year Ended December 31, 2013

Balance Rate

Daily Average Maximum

Outstanding at

any Month-End

(Dollars in millions) Balance Rate

Funds purchased 1$1,192 0.07% $639 0.10% $1,192

Securities sold under agreements to repurchase 11,759 0.10 1,857 0.14 1,911

Other short-term borrowings 5,788 0.22 4,953 0.26 5,868

December 31, 2012 Year Ended December 31, 2012

Balance Rate

Daily Average Maximum

Outstanding at

any Month-End

(Dollars in millions) Balance Rate

Funds purchased 1$617 0.09% $798 0.11% $925

Securities sold under agreements to repurchase 11,574 0.18 1,602 0.18 1,781

Other short-term borrowings 3,303 0.31 6,952 0.27 10,697

December 31, 2011 Year Ended December 31, 2011

Balance Rate

Daily Average Maximum

Outstanding at

any Month-End

(Dollars in millions) Balance Rate

Funds purchased 1$839 0.09% $1,038 0.13% $1,169

Securities sold under agreements to repurchase 11,644 0.13 2,157 0.15 2,411

Other short-term borrowings 8,983 0.22 3,465 0.36 8,983

1 Funds purchased and securities sold under agreements to repurchase mature overnight or at a fixed maturity generally not exceeding three months. Rates on overnight

funds reflect current market rates. Rates on fixed maturity borrowings are set at the time of the borrowings.

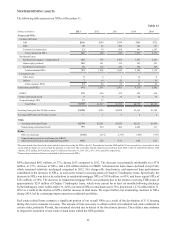

Short-Term Borrowings

Our total short-term borrowings at December 31, 2013 increased $3.2 billion, or 59%, from December 31, 2012, predominantly

due to a $2.5 billion increase in other short-term borrowings and a $575 million increase in funds purchased. The increase in

other short-term borrowings was driven by a $2.5 billion increase in FHLB advances. We also experienced an increase of

$185 million in securities sold under agreements to repurchase during the year.

During the year ended December 31, 2013, our total daily average short-term borrowings decreased $1.9 billion, or 20%,

compared to the year ended December 31, 2012. The decrease was primarily driven by a decrease in daily average balance

for other short-term borrowings of $2.0 billion, which was due to ordinary balance sheet management practices, as well as

the payoff and maturity of certain FHLB advances during 2013.

During the year ended December 31, 2013, our daily average balances for funds purchased and other short-term borrowings

were lower than our period-end balances as a result of increased borrowing in the second half of 2013. Our daily average

balance of securities sold under agreements to repurchase during the year ended December 31, 2013 was higher than the

balance at December 31, 2013, due to normal fluctuations resulting from ordinary balance sheet management practices. None

of our maximum outstanding balances at any month-end in 2013 were materially different than the respective balances at

December 31, 2013.