SunTrust 2013 Annual Report Download - page 185

Download and view the complete annual report

Please find page 185 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

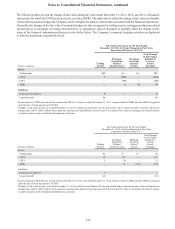

Notes to Consolidated Financial Statements, continued

169

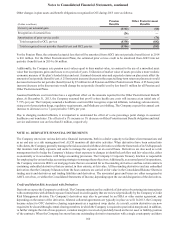

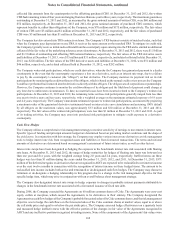

excluded from the Company's assessments of hedge effectiveness. Ineffectiveness gains on the Agreements of $1 million and

$2 million were recognized in trading income during the years ended December 31, 2012 and 2011, respectively, and related to

changes in market dividends.

During 2012, the Company and the Coke Counterparty accelerated the termination of the Agreements, and the Company sold

in the market or to the Coke Counterparty 59 million of its 60 million shares of Coke and contributed the remaining 1 million

shares to the SunTrust Foundation for a net gain of $1.9 billion, which is net of a $305 million loss related to the derivative

contract termination of the Agreements. Upon approval by the Board to terminate the Agreements and sell and donate the Coke

shares, the Agreements no longer qualified as cash flow hedges. Thus, subsequent changes in value of the Agreements until

termination totaled $60 million and were recognized in net securities gains in the Consolidated Statements of Income. Amounts

recognized in AOCI in the Consolidated Statements of Shareholders' Equity during the period the Agreements qualified as cash

flow hedges totaled $365 million in losses. These amounts remained in AOCI until the sale of the Coke shares, at which time

the amounts were reclassified to net securities gains in the Consolidated Statements of Income.

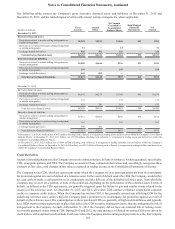

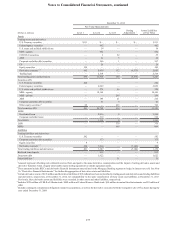

Fair Value Hedges

The Company enters into interest rate swap agreements as part of the Company’s risk management objectives for hedging its

exposure to changes in fair value due to changes in interest rates. These hedging arrangements convert Company-issued fixed

rate long-term debt to floating rates. Consistent with this objective, the Company reflects the accrued contractual interest on the

hedged item and the related swaps as part of current period interest. There were no components of derivative gains or losses

excluded in the Company’s assessment of hedge effectiveness related to the fair value hedges.

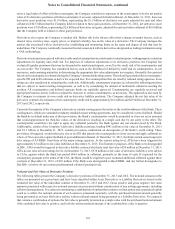

Economic Hedging and Trading Activities

In addition to designated hedging relationships, the Company also enters into derivatives as an end user as a risk management

tool to economically hedge risks associated with certain non-derivative and derivative instruments, along with entering into

derivatives in a trading capacity with its clients.

The primary risks that the Company economically hedges are interest rate risk, foreign exchange risk, and credit risk. Economic

hedging objectives are accomplished by entering into offsetting derivatives either on an individual basis or collectively on a

macro basis and generally accomplish the Company’s goal of mitigating the targeted risk. To the extent that specific derivatives

are associated with specific hedged items, the notional amounts, fair values, and gains/(losses) on the derivatives are illustrated

in the tables in this footnote.

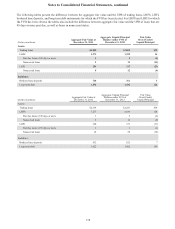

• The Company utilizes interest rate derivatives to mitigate exposures from various instruments.

The Company is subject to interest rate risk on its fixed rate debt. As market interest rates move, the fair

value of the Company’s debt is affected. To protect against this risk on certain debt issuances that the

Company has elected to carry at fair value, the Company has entered into pay variable-receive fixed interest

rate swaps that decrease in value in a rising rate environment and increase in value in a declining rate

environment.

The Company is exposed to risk on the returns of certain of its brokered deposits that are carried at fair

value. To hedge against this risk, the Company has entered into interest rate derivatives that mirror the risk

profile of the returns on these instruments.

The Company is exposed to interest rate risk associated with MSRs, which the Company hedges with a

combination of mortgage and interest rate derivatives, including forward and option contracts, futures, and

forward rate agreements.

The Company enters into mortgage and interest rate derivatives, including forward contracts, futures, and

option contracts to mitigate interest rate risk associated with IRLCs and mortgage LHFS.

• The Company is exposed to foreign exchange rate risk associated with certain commercial loans.

• The Company enters into CDS to hedge credit risk associated with certain loans held within its Wholesale Banking

segment. The Company accounts for these contracts as derivatives and, accordingly, recognizes these contracts at

fair value, with changes in fair value recognized in other noninterest income in the Consolidated Statements of

Income.

• Trading activity, as illustrated in the tables within this footnote, primarily includes interest rate swaps, equity

derivatives, CDS, futures, options, foreign currency contracts, and commodities. These derivatives are entered into

in a dealer capacity to facilitate client transactions or are utilized as a risk management tool by the Company as an