SunTrust 2013 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

81

using the Monte Carlo simulation yielded results that were similar to the historical simulation results. The methodology change

was primarily to ensure our internal modeling approach for VAR was on the same basis as that for Stressed VAR, which is a

requirement under the Market Risk Rule.

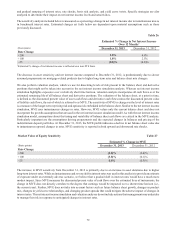

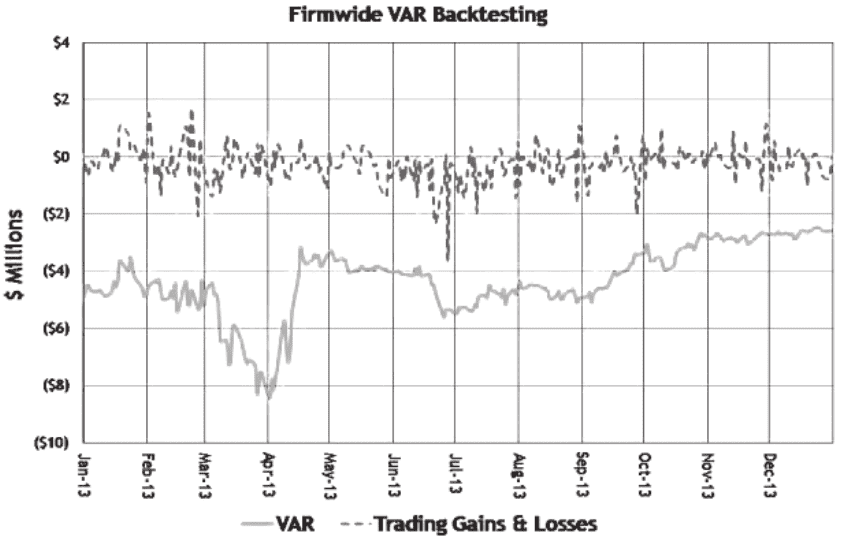

In accordance with the Market Risk Rule, we evaluate the accuracy of our VAR model through daily backtesting by comparing

daily trading gains and losses (excluding fees, commissions, reserves, net interest income, and intraday trading) with the

corresponding daily VAR-based measures. As illustrated below for the year ended December 31, 2013, there were no instances

where trading losses exceeded firmwide VAR.

We have valuation policies, procedures, and methodologies for all covered positions. Additionally, reporting of trading

positions is in accordance with U.S. GAAP and is subject to independent price verification. See Note 16, "Derivative Financial

Instruments" and Note 18, "Fair Value Election and Measurement" to the Consolidated Financial Statements in this Form 10-

K and the "Critical Accounting Policies" section of this MD&A.

Model risk management: Our model risk management approach for validating and evaluating the accuracy of internal and

vended models and associated processes includes developmental and implementation testing and on-going monitoring and

maintenance performed by the various model owners. Our MRMG regularly performs independent model validations for the

VAR and stressed VAR models. The validations include evaluation of all model-owner authored documentation and model-

owner developed monitoring and maintenance plans and reports. In addition, the MRMG performs its own testing. Due to

ongoing developments in financial markets, evolution in modeling approaches, and for purposes of model enhancement, we

assess all VAR models regularly through the monitoring and maintenance process.

Stress testing: We use a comprehensive range of stress testing techniques to help monitor risks across trading desks and to

augment standard daily VAR reporting. The stress testing framework is designed to quantify the impact of rare and extreme

historical but plausible stress scenarios that could lead to large unexpected losses. In addition to performing firmwide stress

testing of our aggregate trading portfolio, additional types of secondary stress tests including historical repeats and simulations

using hypothetical risk factor shocks are also performed. Across our comprehensive stress testing framework, all trading

positions across each applicable market risk category (interest rate risk, equity risk, foreign exchange risk, spread risk, and

commodity risk) are included. We review stress testing scenarios on an ongoing basis and make updates as necessary to ensure

that both current and potential emerging risks are appropriately captured.

Trading portfolio capital adequacy: We assess capital adequacy on a regular basis, based on estimates of our risk profile and

capital positions under baseline and stressed scenarios. Scenarios consider material risks, including credit risk, market risk,

and operational risk. Our assessment of capital adequacy arising from market risk also includes a review of risk arising from

material portfolios of covered positions. See “Capital Resources” in this MD&A for additional discussion of capital adequacy.