SunTrust 2013 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements, continued

116

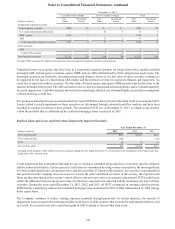

• Level 3 – Assets or liabilities for which significant valuation assumptions are not readily observable in the market;

instruments valued based on the best available data, some of which may be internally developed, and considers risk

premiums that a market participant would require.

To determine the fair value measurement for assets and liabilities required or permitted to be recorded at fair value, the

Company considers the principal or most advantageous market in which it would transact and considers assumptions that

market participants would use when pricing the asset or liability. If available, the Company looks to active and observable

markets to price identical assets or liabilities. If identical assets and liabilities are not traded in active markets, the Company

looks to market observable data for similar assets and liabilities. Nevertheless, the Company uses alternative valuation

techniques to derive a fair value measurement for those assets and liabilities that are either not actively traded in observable

markets or for which market observable inputs are not available. For additional information on the Company’s valuation of

its assets and liabilities held at fair value, see Note 18, “Fair Value Election and Measurement.”

Accounting Policies Recently Adopted and Pending Accounting Pronouncements

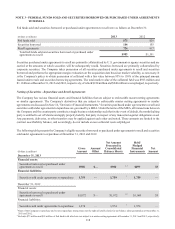

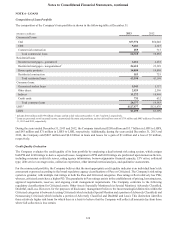

In December 2011, the FASB issued ASU 2011-11, "Balance Sheet (Topic 210): Disclosures about Offsetting Assets and

Liabilities." The ASU requires additional disclosures about financial instruments and derivative instruments that are offset or

subject to an enforceable master netting arrangement or similar agreement. In January 2013, the FASB issued ASU 2013-01,

“Balance Sheet (Topic 210): Clarifying the Scope of Disclosures about Offsetting Assets and Liabilities”, which more narrowly

defined the scope of financial instruments to only include derivatives, repurchase and reverse repurchase agreements, and

securities borrowing and lending transactions. The Company adopted these ASUs at January 1, 2013, and the adoption did

not have an impact on the Company's financial position, results of operations, or EPS. See Note 3, "Federal Funds Sold and

Securities Borrowed or Purchased under Agreements to Resell" and Note 16, "Derivative Financial Instruments."

In February 2013, the FASB issued ASU 2013-02, "Comprehensive Income (Topic 220): Reporting of Amounts Reclassified

Out of Accumulated Other Comprehensive Income" which provides disclosure guidance on amounts reclassified out of AOCI

by component. The Company adopted the ASU at January 1, 2013, and the adoption did not have an impact on the Company's

financial position, results of operations, or EPS. See Note 21, "Accumulated Other Comprehensive Income."

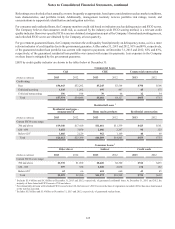

In March 2013, the FASB issued ASU 2013-04, "Liabilities (Topic 405): Obligations Resulting from Joint and Several Liability

Arrangements for Which the Total Amount of the Obligation Is Fixed at the Reporting Date (a consensus of the FASB Emerging

Issues Task Force)." The ASU requires additional disclosures about joint and several liability arrangements and requires the

Company to measure obligations resulting from joint and several liability arrangements as the sum of the amount the Company

agreed to pay on the basis of its arrangement among its co-obligors and any additional amount the Company expects to pay

on behalf of its co-obligors. The ASU is effective for the fiscal years and interim periods beginning after December 15, 2013.

The Company adopted the ASU at January 1, 2014 and the adoption did not have an impact on the Company's financial

position, results of operations, or EPS.

In June 2013, the FASB issued ASU 2013-08, "Financial Services—Investment Companies (Topic 946): Amendments to the

Scope, Measurement, and Disclosure Requirements." The ASU clarifies the characteristics of an investment company and

requires an investment company to measure noncontrolling ownership interests in other investment companies at fair value

rather than using the equity method of accounting. The ASU is effective for the fiscal years and interim periods beginning

after December 15, 2013. The Company adopted the ASU at January 1, 2014 and the adoption did not have a significant

impact on the Company's financial position, results of operations, or EPS.

In July 2013, the FASB issued ASU 2013-10, “Derivatives and Hedging (Topic 815): Inclusion of the Fed Funds Effective

Swap Rate (or Overnight Index Swap Rate) as a Benchmark Interest Rate for Hedge Accounting Purposes (a consensus of

the Emerging Issues Task Force).” The ASU permits the Fed Funds Effective Swap Rate (OIS) to be used as a benchmark

interest rate for hedge accounting purposes, in addition to U.S. Treasury rates, and LIBOR. The amendments also remove the

restriction on using different benchmark rates for similar hedges. The ASU was effective prospectively for qualifying new or

redesignated hedging relationships entered into on or after July 17, 2013. The adoption of the ASU had no impact on the

Company's current hedging relationships and, thus, no impact on the Company's financial position, results of operations, or

EPS.

In July 2013, the FASB issued ASU 2013-11, “Income Taxes (Topic 740): Presentation of an Unrecognized Tax Benefit When

a Net Operating Loss Carryforward, a Similar Tax Loss, or a Tax Credit Carryforward Exists (a consensus of the Emerging

Issues Task Force).” Prior to this ASU, U.S. GAAP did not include explicit guidance on the financial statement presentation

of a UTB when a NOL carryforward, a similar tax loss, or a tax credit carryforward exists. The ASU requires, with limited

exceptions, that a UTB, or a portion of a UTB, should be presented in the financial statements as a reduction to a DTA for a

NOL carryforward, a similar tax loss, or a tax credit carryforward. The ASU is effective for fiscal years and interim periods

beginning after December 15, 2013. As early adoption is permitted, the Company adopted this ASU upon issuance and applied