SunTrust 2013 Annual Report Download - page 214

Download and view the complete annual report

Please find page 214 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

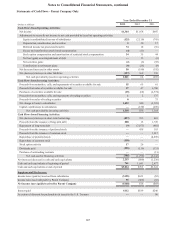

Notes to Consolidated Financial Statements, continued

198

2013. The case has returned to the District Court for further proceedings regarding STM's defense to UGRIC's claims for

additional premiums.

SunTrust Mortgage Reinsurance Class Actions

STM and Twin Rivers Insurance Company ("Twin Rivers") have been named as defendants in two putative class actions

alleging that the companies entered into illegal “captive reinsurance” arrangements with private mortgage insurers. More

specifically, plaintiffs allege that SunTrust’s selection of private mortgage insurers who agree to reinsure loans referred to

them by SunTrust with Twin Rivers results in illegal “kickbacks” in the form of the insurance premiums paid to Twin Rivers.

Plaintiffs contend that this arrangement violates the Real Estate Settlement Procedures Act (“RESPA”) and results in unjust

enrichment to the detriment of borrowers. The first of these cases, Thurmond, Christopher, et al. v. SunTrust Banks, Inc. et

al., was filed in February 2011 in the U.S. District Court for the Eastern District of Pennsylvania. This case was stayed by the

Court pending the outcome of Edwards v. First American Financial Corporation, a captive reinsurance case that was pending

before the U.S. Supreme Court at the time. The second of these cases, Acosta, Lemuel & Maria Ventrella et al. v. SunTrust

Bank, SunTrust Mortgage, Inc., et al., was filed in the U.S. District Court for the Central District of California in December

2011. This case was stayed pending a decision in the Edwards case also. In June 2012, the U.S. Supreme Court withdrew its

grant of certiorari in Edwards and, as a result, the stays in these cases were lifted. The plaintiffs in Acosta voluntarily dismissed

this case. A motion to dismiss is pending in the Thurmond case.

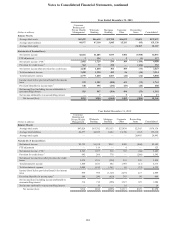

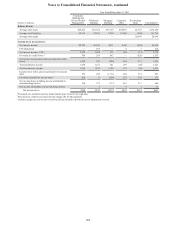

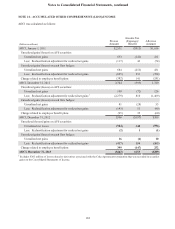

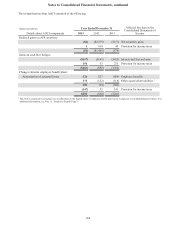

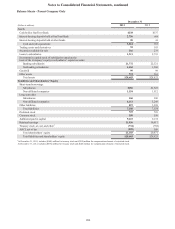

NOTE 20 - BUSINESS SEGMENT REPORTING

The Company has three segments used to measure business activity: Consumer Banking and Private Wealth Management,

Wholesale Banking, and Mortgage Banking, with the remainder in Corporate Other. The business segments are determined

based on the products and services provided or the type of customer served, and they reflect the manner in which financial

information is evaluated by management. During the second quarter of 2013, branch-managed business banking clients were

transferred from Wholesale Banking to Consumer Banking and Private Wealth Management, and all periods presented in the

tables below reflect this transfer. The following is a description of the segments and their composition, which reflects the

transfer of branch-managed business banking clients.

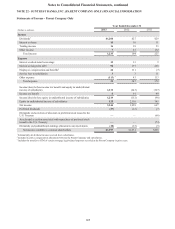

The Consumer Banking and Private Wealth Management segment is made up of two primary businesses: Consumer Banking

and Private Wealth Management.

• Consumer Banking provides services to consumers and branch-managed small business clients through an extensive

network of traditional and in-store branches, ATMs, the internet (www.suntrust.com), mobile banking, and telephone

(1-800-SUNTRUST). Financial products and services offered to consumers and small business clients include

deposits, home equity lines and loans, credit lines, indirect auto, student lending, bank card, other lending products,

and various fee-based services. Consumer Banking also serves as an entry point for clients and provides services for

other lines of business.

• Private Wealth Management provides a full array of wealth management products and professional services to both

individual and institutional clients including loans, deposits, brokerage, professional investment management, and

trust services to clients seeking active management of their financial resources. Institutional clients are served by the

IIS business. Discount/online and full service brokerage products are offered to individual clients through STIS.

Private Wealth Management also includes GenSpring, which provides family office solutions to ultra high net worth

individuals and their families. Utilizing teams of multi-disciplinary specialists with expertise in investments, tax,

accounting, estate planning, and other wealth management disciplines, GenSpring helps families manage and sustain

wealth across multiple generations.