SunTrust 2013 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

98

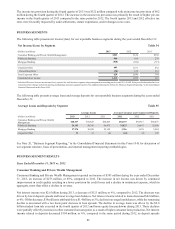

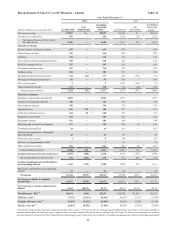

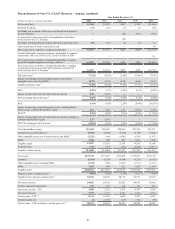

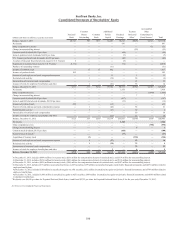

(Dollars in billions) December 31, 2013

Reconciliation of Common Equity Tier 1 Ratio

Tier 1 Common Equity - Basel I $14.6

Adjustments from Basel I to Basel III 11 —

CET 1 Capital - Basel III 12 14.6

RWA - Basel I $148.7

Adjustments from Basel I to Basel III 13 3.9

RWA - Basel III 12 152.6

Resulting regulatory capital ratios:

Basel I - Tier 1 common equity ratio 9.8%

Basel III - Common Equity Tier 1 ratio 12 9.6

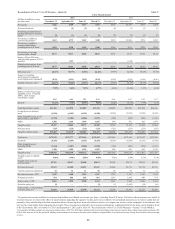

1 We present net income/(loss) available to common shareholders that excludes the portion of the impairment charges on goodwill and intangible assets allocated to the common

shareholders and net income/(loss) to common shareholders that excludes the accelerated accretion associated with the repurchase of preferred stock issued to the U.S. Treasury.

We believe these measures are useful to investors, because removing the non-cash impairment charge and non-cash accelerated accretion provides a more representative view

of normalized operations and the measure also allows better comparability with peers in the industry who also provide a similar presentation when applicable. In addition, we

use this measure internally to analyze performance.

2 Computed by dividing noninterest expense by total revenue - FTE. The FTE basis adjusts for the tax-favored status of net interest income from certain loans and investments.

We believe this measure to be the preferred industry measurement of net interest income and it enhances comparability of net interest income arising from taxable and tax-exempt

sources.

3 We present a tangible efficiency ratio which excludes the impairment/amortization of goodwill/intangible assets other than MSRs. We believe this measure is useful to investors

because, by removing the effect of these intangible asset costs and goodwill impairment (the level of which may vary from company to company), it allows investors to more

easily compare our efficiency to other companies in the industry. This measure is utilized by us to assess our efficiency and that of our lines of business.

4 We present return on average total assets excluding the impact of the Form 8-K items because removing the impact of these items is more indicative of normalized

operations.

5 We present ROTCE to exclude intangible assets and Form 8-K items, except for MSRs, from average common shareholders' equity. We believe this measure is useful to investors

because, by removing the effect of intangible assets and Form 8-K items, except for MSRs, (the level of which may vary from company to company), it allows investors to more

easily compare our ROE to other companies in the industry who present a similar measure. We also believe that removing intangible assets, except for MSRs, is a more relevant

measure of the return on our common shareholders' equity.

6 Goodwill is deducted net of deferred taxes to determine Tier 1 capital. Deferred taxes of $186 million, $163 million, $154 million, $134 million, and $115 million are excluded

from 2013, 2012, 2011, 2010, and 2009, respectively.

7 Other intangible assets are deducted net of deferred taxes to determine Tier 1 capital. Deferred taxes of $2 million, $7 million, $16 million, $26 million, and $40 million are

excluded from 2013, 2012, 2011, 2010, and 2009, respectively.

8 We present a tangible equity to tangible assets ratio that excludes the after-tax impact of purchase accounting intangible assets. We believe this measure is useful to investors

because, by removing the effect of intangible assets that result from merger and acquisition activity (the level of which may vary from company to company), it allows investors

to more easily compare our capital adequacy to other companies in the industry. This measure is used by us to analyze capital adequacy.

9 We present a tangible book value per common share that excludes the after-tax impact of purchase accounting intangible assets and also excludes preferred stock from tangible

equity. We believe this measure is useful to investors because, by removing the effect of intangible assets that result from merger and acquisition activity as well as preferred

stock (the level of which may vary from company to company), it allows investors to more easily compare our common stock book value to other companies in the industry.

10 We present total revenue - FTE excluding net securities gains. Total Revenue is calculated as net interest income - FTE plus noninterest income. Net interest income is presented

on an FTE basis, which adjusts for the tax-favored status of net interest income from certain loans and investments. We believe this measure to be the preferred industry measurement

of net interest income and it enhances comparability of net interest income arising from taxable and tax-exempt sources. We also believe that revenue without net securities gains

is more indicative of our performance because it isolates income that is primarily client relationship and client transaction driven and is more indicative of normalized operations.

11 Primarily relates to the improved treatment of mortgage servicing assets essentially offset by certain disallowed DTAs.

12 The Basel III calculations of CET 1, RWA, and the common equity Tier 1 ratio are based upon our current interpretation of the final Basel III rules published by the Federal

Reserve during October 2013, on a fully phased in basis.

13 The largest differences between our RWA as calculated under Basel I compared to Basel III relate to the risk-weightings for certain commercial loans, unfunded commitments,

and mortgage servicing assets.