SunTrust 2013 Annual Report Download - page 215

Download and view the complete annual report

Please find page 215 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

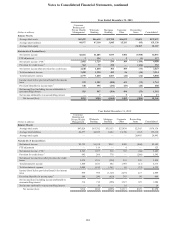

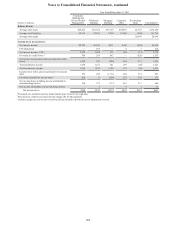

Notes to Consolidated Financial Statements, continued

199

The Wholesale Banking segment includes the following five businesses:

• CIB delivers comprehensive capital markets, corporate and investment banking solutions, including advisory, capital

raising, and financial risk management, to clients in the Wholesale Banking segment and Private Wealth Management

business. Investment Banking and Corporate Banking teams within CIB serve clients across the nation, offering a

full suite of traditional banking and investment banking products and services to companies with annual revenues

typically greater than $100 million. Investment Banking serves select industry segments including consumer and

retail, energy, financial services, healthcare, industrials, media and communications, real estate, and technology.

Corporate Banking serves clients across diversified industry sectors based on size, complexity, and frequency of

capital markets issuance. Also managed within CIB are the Equipment Finance Group, which provides lease financing

solutions (through SunTrust Equipment Finance & Leasing), and Premium Assignment Corporation, which create

corporate insurance premium financing solutions.

• Commercial & Business Banking offers an array of traditional banking products and investment banking services as

needed by Commercial clients with annual revenues generally from $1 to $150 million as well as the dealer services

(financing dealer floor plan inventories) and not-for-profit and government sectors.

• Commercial Real Estate provides a full range of financial solutions for commercial real estate developers, owners

and investors including construction, mini-perm, and permanent real estate financing as well as tailored financing

and equity investment solutions via STRH primarily through the REIT group focused on Real Estate Investment

Trusts. The Institutional Real Estate team targets relationships with institutional advisors, private funds, sovereign

wealth funds, and insurance companies and the Regional team focuses on real estate owners and developers through

a regional delivery structure. Commercial Real Estate also offers tailored financing and equity investment solutions

for community development and affordable housing owners/developers projects through SunTrust Community

Capital with special expertise in Low Income Housing Tax Credits and New Market Tax Credits.

• RidgeWorth, an SEC registered investment advisor, serves as investment manager for the RidgeWorth Funds as well

as individual clients. RidgeWorth is also a holding company with ownership in other institutional asset management

boutiques offering a wide array of equity and fixed income capabilities. These boutiques include Ceredex Value

Advisors, Certium Asset Management, Seix Investment Advisors, Silvant Capital Management, StableRiver Capital

Management, and Zevenbergen Capital Investments. On December 11, 2013, the Company announced that it had

reached a definitive agreement to sell RidgeWorth to an investor group led by a private equity fund managed by

Lightyear Capital LLC. The sale is expected to close during the second quarter of 2014. It is subject to various

customary closing conditions including consents of certain RidgeWorth investment advisory clients. RidgeWorth

results are included in the Wholesale Banking Segment and will continue to be reported as part of Wholesale Banking

until the sale closes.

• Treasury & Payment Solutions provides all SunTrust business clients with services required to manage their payments

and receipts combined with the ability to manage and optimize their deposits across all aspects of their business.

Treasury & Payment Solutions operates all electronic and paper payment types, including card, wire transfer, ACH,

check, and cash, plus provides clients the means to manage their accounts electronically online both domestically

and internationally.

Mortgage Banking offers residential mortgage products nationally through its retail and correspondent channels, as well as

via the internet (www.suntrust.com) and by telephone (1-800-SUNTRUST). These products are either sold in the secondary

market, primarily with servicing rights retained, or held in the Company’s loan portfolio. Mortgage Banking services loans

for itself and for other investors and includes ValuTree Real Estate Services, LLC, a tax service subsidiary.

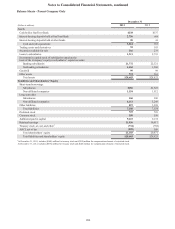

Corporate Other includes management of the Company’s investment securities portfolio, long-term debt, end user derivative

instruments, short-term liquidity and funding activities, balance sheet risk management, and most real estate assets.

Additionally, it includes Enterprise Information Services, which is the primary information technology and operations group;

Corporate Real Estate, Marketing, SunTrust Online, Human Resources, Finance, Corporate Risk Management, Legal and

Compliance, Branch Operations, Communications, Procurement, and Executive Management.

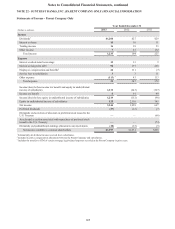

Because the business segment results are presented based on management accounting practices, the transition to the

consolidated results, which are prepared under U.S. GAAP, creates certain differences which are reflected in Reconciling

Items.