SunTrust 2013 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

118

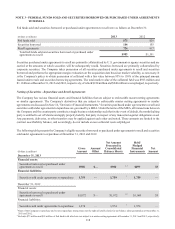

NOTE 3 - FEDERAL FUNDS SOLD AND SECURITIES BORROWED OR PURCHASED UNDER AGREEMENTS

TO RESELL

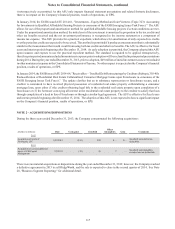

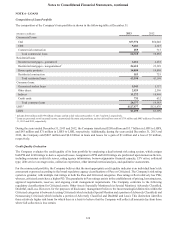

Fed funds sold and securities borrowed or purchased under agreements to resell were as follows at December 31:

(Dollars in millions) 2013 2012

Fed funds sold $75 $29

Securities borrowed 184 155

Resell agreements 724 917

Total fed funds sold and securities borrowed or purchased under

agreements to resell $983 $1,101

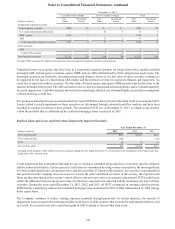

Securities purchased under agreements to resell are primarily collateralized by U.S. government or agency securities and are

carried at the amounts at which securities will be subsequently resold. Securities borrowed are primarily collateralized by

corporate securities. The Company takes possession of all securities purchased under agreements to resell and securities

borrowed and performs the appropriate margin evaluation on the acquisition date based on market volatility, as necessary. It

is the Company's policy to obtain possession of collateral with a fair value between 95% to 110% of the principal amount

loaned under resale and securities borrowing agreements. The total market value of the collateral held was $913 million and

$1.1 billion at December 31, 2013 and 2012, respectively, of which $234 million and $246 million was repledged, respectively.

Netting of Securities - Repurchase and Resell Agreements

The Company has various financial assets and financial liabilities that are subject to enforceable master netting agreements

or similar agreements. The Company's derivatives that are subject to enforceable master netting agreements or similar

agreements are discussed in Note 16, "Derivative Financial Instruments." Securities purchased under agreements to resell and

securities sold under agreements to repurchase are governed by a MRA. Under the terms of the MRA, all transactions between

the Company and the counterparty constitute a single business relationship such that in the event of default, the nondefaulting

party is entitled to set off claims and apply property held by that party in respect of any transaction against obligations owed.

Any payments, deliveries, or other transfers may be applied against each other and netted. These amounts are limited to the

contract asset/liability balance, and accordingly, do not include excess collateral received/pledged.

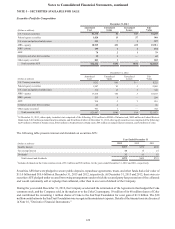

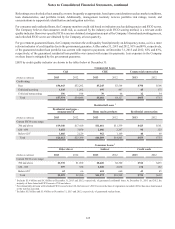

The following table presents the Company's eligible securities borrowed or purchased under agreements to resell and securities

sold under agreements to repurchase at December 31, 2013 and 2012:

Net Amount

Presented in

Consolidated

Balance Sheets

(Dollars in millions)

Gross

Amount

Amount

Offset

Held/

Pledged

Financial

Instruments

Net

Amount

December 31, 2013

Financial assets:

Securities borrowed or purchased under

agreements to resell $908 $— $908 1, 2 $899 $9

Financial liabilities:

Securities sold under agreements to repurchase 1,759 — 1,759 11,759 —

December 31, 2012

Financial assets:

Securities borrowed or purchased under

agreements to resell $1,072 $— $1,072 1,2 $1,069 $3

Financial liabilities:

Securities sold under agreements to repurchase 1,574 — 1,574 11,574 —

1 None of the Company's repurchase and reverse repurchase transactions met the right of setoff criteria for net balance sheet presentation at December 31,

2013 and 2012.

2 Excludes $75 million and $29 million of Fed funds sold which are not subject to a master netting agreement at December 31, 2013 and 2012, respectively.