SunTrust 2013 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

compared to $144.9 billion at December 31, 2012. The decline was driven by the sales of servicing on certain loans in the

servicing portfolio.

Net securities gains decreased $2.0 billion during 2013 compared to 2012 due to the early termination during 2012 of agreements

regarding our previously owned shares of Coke common stock, resulting in a $1.9 billion gain on disposition of the stock in

2012. For further discussion regarding our investment portfolio activity and the Coke transaction, see the “Securities Available

for Sale” section in this MD&A.

Other noninterest income increased $56 million, or 58%, during 2013 compared to 2012. The increase was primarily due to

a $92 million loss recognized in 2012 upon the transfer to LHFS of guaranteed student and mortgage loans to be sold and the

sale during 2013 of held for sale affordable housing properties resulting in a gain on sale of $17 million. This was partially

offset by $50 million in lease financing asset impairments in 2013 as a result of updated market indicators of the residual

values of the assets. For additional information on the lease financing impairment, see Note 18, "Fair Value Election and

Measurement," to the Consolidated Financial Statements in this Form 10-K.

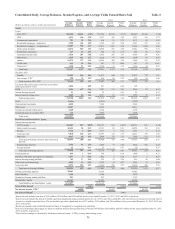

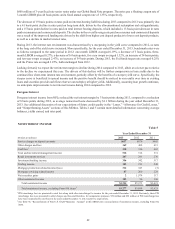

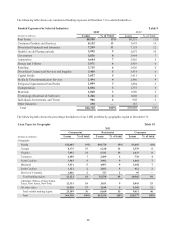

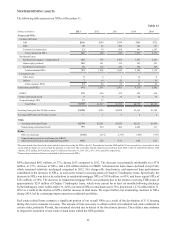

NONINTEREST EXPENSE

Table 6

Year Ended December 31

(Dollars in millions) 2013 2012 2011

Employee compensation $2,488 $2,603 $2,494

Employee benefits 413 474 382

Personnel expenses 2,901 3,077 2,876

Outside processing and software 746 710 653

Net occupancy expense 348 359 356

Operating losses 503 277 377

Credit and collection services 264 239 275

Regulatory assessments 181 233 300

Equipment expense 181 188 178

Marketing and customer development 135 184 184

Consulting and legal fees 73 165 120

Postage and delivery 69 76 81

Other staff expense 66 94 95

Communications 63 63 63

Operating supplies 28 34 45

Amortization/impairment of intangible assets/goodwill 23 46 43

Other real estate expense 4140 264

Impairment of affordable housing investments 396 10

Net loss/(gain) on debt extinguishment —16 (3)

Other expense 292 326 317

Total noninterest expense $5,880 $6,323 $6,234

Total noninterest expense, excluding Form 8-K items 1$5,461 $6,189 $6,234

1 See Table 36, "Reconcilement of Non-U.S. GAAP Measures - Annual," in this MD&A for a reconciliation of noninterest expense, excluding Form 8-K

items.

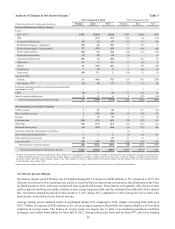

Noninterest expense decreased $443 million, or 7%, during 2013 compared to 2012, driven by declines across most expense

categories including personnel expenses, legal and consulting expenses, and certain cyclically high credit-related costs (driven

by other real estate expense), partially offset by higher operating losses. Excluding the impact of Form 8-K items in 2013 and

2012, noninterest expense decreased 12% due to improved expense management and the abatement of certain cyclically high

credit-related costs. See Table 36, "Reconcilement of Non-U.S. GAAP Measures - Annual," in this MD&A for a reconciliation

of noninterest expense, excluding Form 8-K items

Personnel expenses decreased $176 million, or 6%, compared to 2012. The decrease was largely attributable to lower salary

and other benefits costs during the year, partially driven by the decline in full time equivalent employees from 2012. Full time

equivalent employees declined by 2% compared to 2012, as a result of efficiency improvements, particularly in our branch

staffing model as we reduced our number of branches by 7% compared to December 31, 2012, to better align our distribution

channels with evolving client preferences. Additional branch reductions will occur in 2014, but the rate of decline will be less