SunTrust 2013 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

145

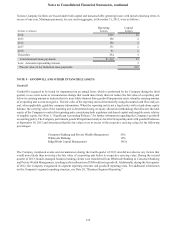

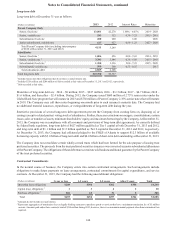

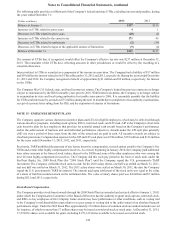

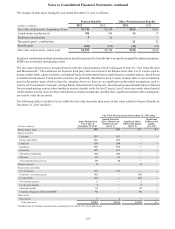

NOTE 12 – NET INCOME PER COMMON SHARE

Equivalent shares of 18 million, 23 million, and 26 million related to common stock options and common stock warrants

outstanding at December 31, 2013, 2012, and 2011, respectively, were excluded from the computations of diluted net income

per average common share because they would have been anti-dilutive.

Reconciliations of net income to net income available to common shareholders and the difference between average basic

common shares outstanding and average diluted common shares outstanding are included below.

Year Ended December 31

(In millions, except per share data) 2013 2012 2011

Net income $1,344 $1,958 $647

Preferred dividends (37)(12)(7)

Dividends and accretion of discount on preferred stock

issued to the U.S. Treasury ——(66)

Accelerated accretion associated with repurchase of preferred stock

issued to the U.S. Treasury ——(74)

Dividends and undistributed earnings allocated to unvested shares (10)(15)(5)

Net income available to common shareholders $1,297 $1,931 $495

Average basic common shares 534 534 524

Effect of dilutive securities:

Stock options 112

Restricted stock and warrants 432

Average diluted common shares 539 538 528

Net income per average common share - diluted $2.41 $3.59 $0.94

Net income per average common share - basic $2.43 $3.62 $0.94

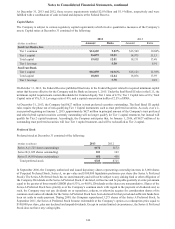

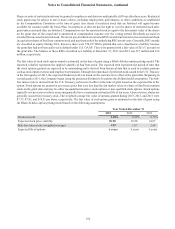

NOTE 13 – CAPITAL

During 2013, the Company submitted its CCAR capital plans for review by the Federal Reserve. Upon completion of the

Federal Reserve's review, they did not object to the Company's capital actions. Accordingly, during 2013, the Company

maintained dividend payments on its preferred stock, increased its quarterly common stock dividend from $0.05 to $0.10 per

share beginning in the second quarter, and repurchased a total of $150 million, or approximately 4.6 million shares, of its

outstanding common stock. Also pursuant to its capital plan, the Company repurchased an additional $50 million of its

outstanding common stock in early 2014. The Company has submitted its 2014 capital plan for review by the Federal Reserve

in conjunction with the 2014 CCAR process and awaits the completion of their review.

The Company remains subject to certain restrictions on its ability to increase the dividend on common shares as a result of

participating in the U.S. Treasury’s CPP. If the Company increases its dividend above $0.54 per share per quarter prior to the

tenth anniversary of its participation in the CPP, then the anti-dilution provision within the warrants issued in connection with

the Company’s participation in the CPP will require the exercise price and number of shares to be issued upon exercise to be

proportionately adjusted. The amount of such adjustment is determined by a formula and depends in part on the extent to

which the Company raises its dividend. The formulas are contained in the warrant agreements which were filed as exhibits

to Form 8-K filed on September 23, 2011.

During the years ended December 31, 2013, 2012, and 2011, the Company declared and paid common dividends totaling

$188 million, or $0.35 per common share, $107 million, or $0.20 per common share, and $64 million, or $0.12 per common

share, respectively. The Company also paid cash dividends on perpetual preferred stock totaling $37 million, $12 million, and

$67 million during the years ended December 31, 2013, 2012, and 2011, respectively. During 2013, the dividend per share

for Series A and Series B Perpetual Preferred Stock was $4,056, and $5,793 for the Series E Perpetual Preferred Stock.

Substantially all of the Company’s retained earnings are undistributed earnings of the Bank, which are restricted by various

regulations administered by federal and state bank regulatory authorities. At December 31, 2013 and 2012, retained earnings

of the Bank available for payment of cash dividends to the Parent Company under these regulations totaled approximately

$2.6 billion and $1.8 billion, respectively. Additionally, the Federal Reserve requires the Company to maintain cash reserves.