SunTrust 2013 Annual Report Download - page 180

Download and view the complete annual report

Please find page 180 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

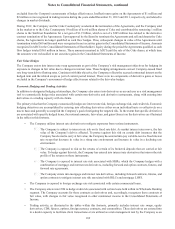

Notes to Consolidated Financial Statements, continued

164

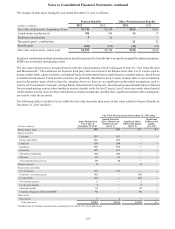

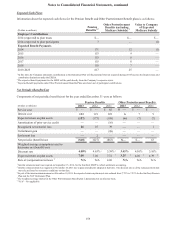

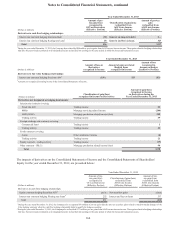

Year Ended December 31, 2013

(Dollars in millions)

Amount of pre-

tax gain/(loss)

recognized in

OCI on Derivatives

(Effective Portion)

Classification of gain/(loss)

reclassified from

AOCI into Income

(Effective Portion)

Amount of pre-tax

gain

reclassified from

AOCI into Income

(Effective Portion)

Derivatives in cash flow hedging relationships:

Interest rate contracts hedging forecasted debt ($2) Interest on long-term debt $—

Interest rate contracts hedging floating rate loans118 Interest and fees on loans 327

Total $16 $327

1 During the year ended December 31, 2013, the Company also reclassified $90 million pre-tax gains from AOCI into net interest income. These gains related to hedging relationships

that have been previously terminated or de-designated and are reclassified into earnings in the same period in which the forecasted transaction occurs.

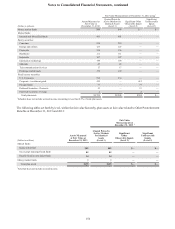

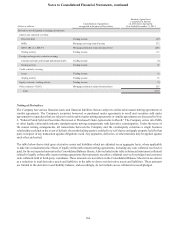

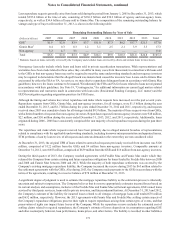

Year Ended December 31, 2013

(Dollars in millions)

Amount of loss on

Derivatives

recognized in Income

Amount of gain on related

Hedged Items

recognized in Income

Amount of loss

recognized in

Income on Hedges

(Ineffective Portion)

Derivatives in fair value hedging relationships:

Interest rate contracts hedging fixed rate debt1($36) $33 ($3)

1 Amounts are recognized in trading income in the Consolidated Statements of Income.

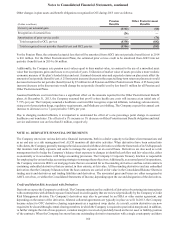

(Dollars in millions)

Classification of gain/(loss)

recognized in Income on Derivatives

Amount of gain/(loss)

recognized in Income

on Derivatives during the

Year Ended December 31, 2013

Derivatives not designated as hedging instruments:

Interest rate contracts covering:

Fixed rate debt Trading income $2

MSRs Mortgage servicing related income (284)

LHFS, IRLCs Mortgage production related income/(loss) 289

Trading activity Trading income 59

Foreign exchange rate contracts covering:

Commercial loans Trading income 1

Trading activity Trading income 23

Credit contracts covering:

Loans Other noninterest income (4)

Trading activity Trading income 21

Equity contracts - trading activity Trading income (15)

Other contracts - IRLCs Mortgage production related income/(loss) 98

Total $190

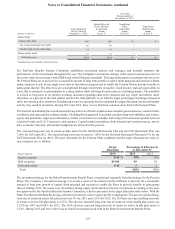

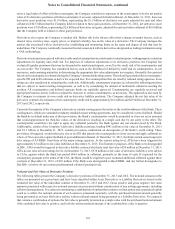

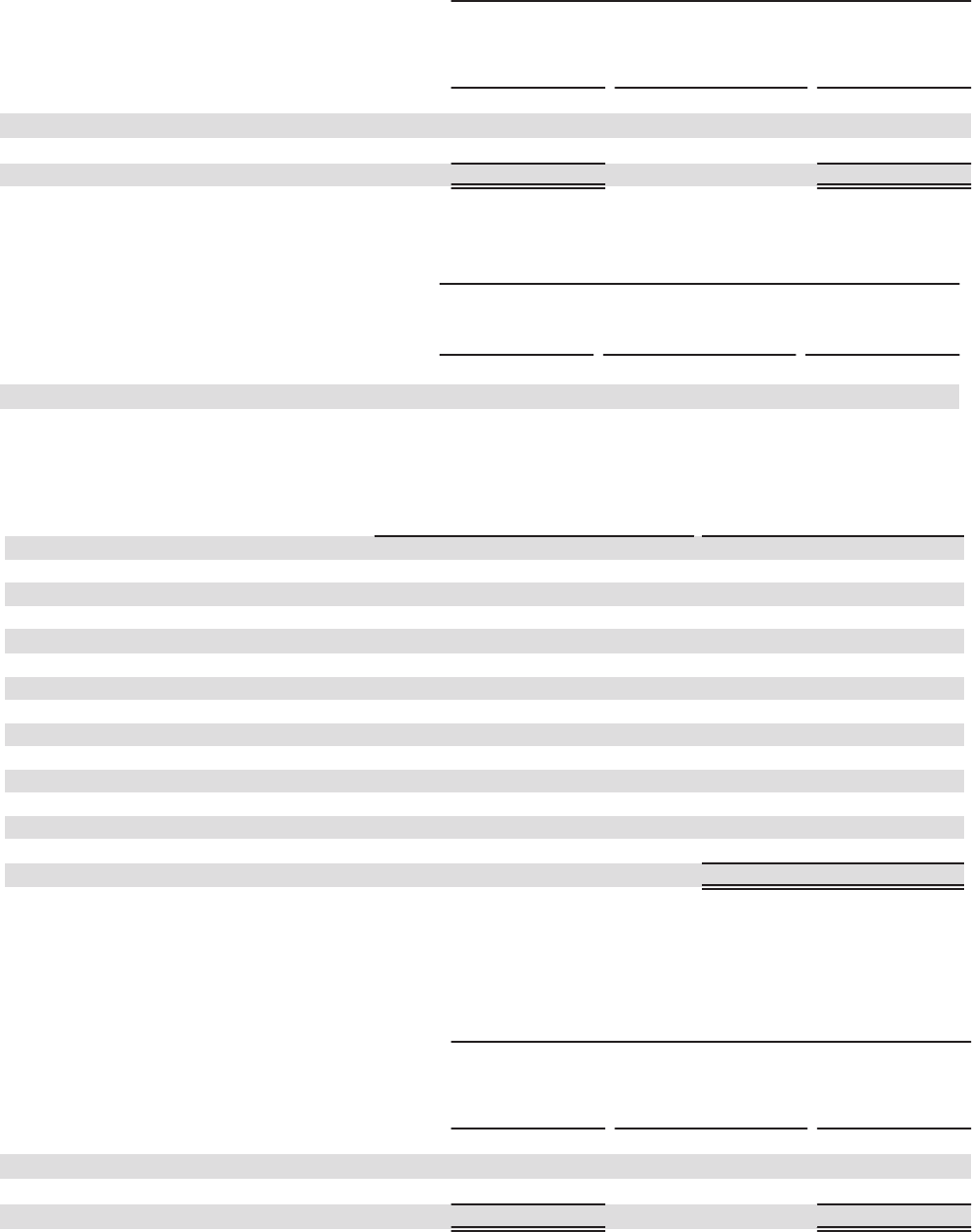

The impacts of derivatives on the Consolidated Statements of Income and the Consolidated Statements of Shareholders'

Equity for the year ended December 31, 2012, are presented below:

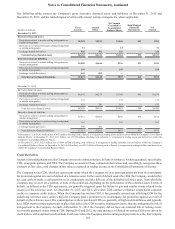

Year Ended December 31, 2012

(Dollars in millions)

Amount of pre-

tax gain/(loss)

recognized in

OCI on Derivatives

(Effective Portion)

Classification of gain/(loss)

reclassified from

AOCI into Income

(Effective Portion)

Amount of pre-

tax gain/(loss)

reclassified from

AOCI into Income

(Effective Portion)

Derivatives in cash flow hedging relationships:

Equity contracts hedging Securities AFS 1($171) Net securities gains ($365)

Interest rate contracts hedging Floating rate loans 2 252 Interest and fees on loans 337

Total $81 ($28)

1 During the year ended December 31, 2012, the Company also recognized $60 million of pre-tax gains directly into net securities gains related to mark-to-market changes of the

Coke hedging contracts when the cash flow hedging relationship failed to qualify for hedge accounting.

2 During the year ended December 31, 2012, the Company also reclassified $171 million pre-tax gains from AOCI into net interest income. These gains related to hedging relationships

that have been previously terminated or de-designated and are reclassified into earnings in the same period in which the forecasted transaction occurs.