SunTrust 2013 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

117

it retrospectively as permitted. As this ASU only impacts financial statement presentation and related footnote disclosures,

there is no impact on the Company's financial position, results of operations, or EPS.

In January 2014, the FASB issued ASU 2014-01, "Investments - Equity Method and Joint Ventures (Topic 323): Accounting

for Investments in Qualified Affordable Housing Projects (a consensus of the FASB Emerging Issues Task Force)." The ASU

allows for use of the proportional amortization method for qualified affordable housing projects if certain conditions are met.

Under the proportional amortization method, the initial cost of the investment is amortized in proportion to the tax credits and

other tax benefits received and the net investment performance is recognized in the income statement as a component of

income tax expense. The ASU provides for a practical expedient, which allows for amortization of only expected tax credits

over the period tax credits are expected to be received. This method is permitted if it produces a measurement that is substantially

similar to the measurement that would result from using both tax credits and other tax benefits. The ASU is effective for fiscal

years and interim periods beginning after December 15, 2014. As early adoption is permitted, the Company adopted this ASU

upon issuance and expects to use the practical expedient method. The standard is required to be applied retrospectively,

therefore prior period amounts included in noninterest expense prior to adoption will be reclassified in prior period presentations

during 2014. During the year ended December 31, 2013, prior to adoption, $49 million of initial investment costs were included

in other noninterest expense in the Consolidated Statements of Income. No other impact is expected on the Company's financial

position, results of operations, or EPS.

In January 2014, the FASB issued ASU 2014-04, "Receivables—Troubled Debt Restructurings by Creditors (Subtopic 310-40):

Reclassification of Residential Real Estate Collateralized Consumer Mortgage Loans upon Foreclosure (a consensus of the

FASB Emerging Issues Task Force)." The update clarifies that an in substance repossession or foreclosure occurs, and a

creditor is considered to have received physical possession of residential real estate property collateralizing a consumer

mortgage loan, upon either (1) the creditor obtaining legal title to the residential real estate property upon completion of a

foreclosure or (2) the borrower conveying all interest in the residential real estate property to the creditor to satisfy that loan

through completion of a deed in lieu of foreclosure or through a similar legal agreement. The ASU is effective for fiscal years

and interim periods beginning after December 15, 2014. The adoption of this ASU is not expected to have a significant impact

on the Company's financial position, results of operations, or EPS.

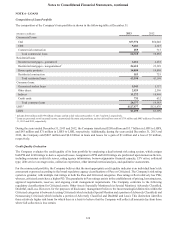

NOTE 2 - ACQUISITIONS/DISPOSITIONS

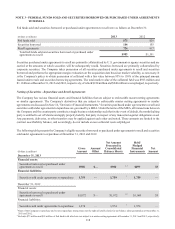

During the three years ended December 31, 2013, the Company consummated the following acquisitions:

(Dollars in millions) Date Cash paid Goodwill

Other

Intangibles Gain Comments

2012

Acquisition of assets of

FirstAgain, LLC 6/22/2012 ($12) $32 $— $— Goodwill recorded is tax-

deductible.

2011

Acquisition of certain additional

assets of CSI Capital

Management

5/9/2011 (19) 20 7 — Goodwill and intangibles

recorded are tax-deductible.

There were no material acquisitions or dispositions during the year ended December 31, 2013; however, the Company reached

a definitive agreement in 2013 to sell RidgeWorth, and the sale is expected to close in the second quarter of 2014. See Note

20, "Business Segment Reporting," for additional detail.