SunTrust 2013 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

124

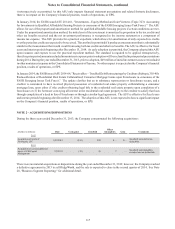

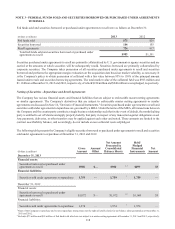

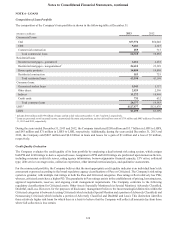

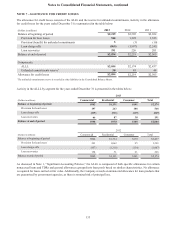

NOTE 6 - LOANS

Composition of Loan Portfolio

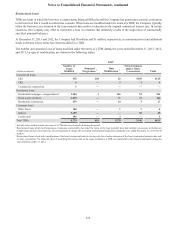

The composition of the Company's loan portfolio is shown in the following table at December 31:

(Dollars in millions) 2013 2012

Commercial loans:

C&I $57,974 $54,048

CRE 5,481 4,127

Commercial construction 855 713

Total commercial loans 64,310 58,888

Residential loans:

Residential mortgages - guaranteed 3,416 4,252

Residential mortgages - nonguaranteed 124,412 23,389

Home equity products 14,809 14,805

Residential construction 553 753

Total residential loans 43,190 43,199

Consumer loans:

Guaranteed student loans 5,545 5,357

Other direct 2,829 2,396

Indirect 11,272 10,998

Credit cards 731 632

Total consumer loans 20,377 19,383

LHFI 2$127,877 $121,470

LHFS $1,699 $3,399

1 Includes $302 million and $379 million of loans carried at fair value at December 31, 2013 and 2012, respectively.

2 Loans are presented net of unearned income, unamortized discounts and premiums, and net deferred loan costs of $739 million and $805 million at December

31, 2013 and 2012, respectively.

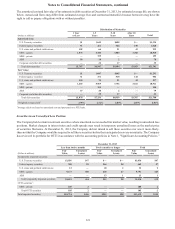

During the years ended December 31, 2013 and 2012, the Company transferred $280 million and $3.7 billion in LHFI to LHFS,

and $43 million and $71 million in LHFS to LHFI, respectively. Additionally, during the years ended December 31, 2013 and

2012, the Company sold $807 million and $4.8 billion in loans and leases for a gain of $1 million and a loss of $3 million,

respectively.

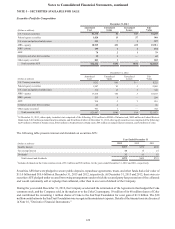

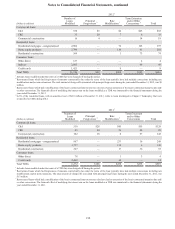

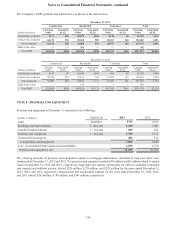

Credit Quality Evaluation

The Company evaluates the credit quality of its loan portfolio by employing a dual internal risk rating system, which assigns

both PD and LGD ratings to derive expected losses. Assignment of PD and LGD ratings are predicated upon numerous factors,

including consumer credit risk scores, rating agency information, borrower/guarantor financial capacity, LTV ratios, collateral

type, debt service coverage ratios, collection experience, other internal metrics/analysis, and qualitative assessments.

For the commercial portfolio, the Company believes that the most appropriate credit quality indicator is an individual loan’s risk

assessment expressed according to the broad regulatory agency classifications of Pass or Criticized. The Company's risk rating

system is granular, with multiple risk ratings in both the Pass and Criticized categories. Pass ratings reflect relatively low PDs;

whereas, criticized assets have a higher PD. The granularity in Pass ratings assists in the establishment of pricing, loan structures,

approval requirements, reserves, and ongoing credit management requirements. The Company conforms to the following

regulatory classifications for Criticized assets: Other Assets Especially Mentioned (or Special Mention), Adversely Classified,

Doubtful, and Loss. However, for the purposes of disclosure, management believes the most meaningful distinction within the

Criticized categories is between Accruing Criticized (which includes Special Mention and a portion of Adversely Classified) and

Nonaccruing Criticized (which includes a portion of Adversely Classified and Doubtful and Loss). This distinction identifies

those relatively higher risk loans for which there is a basis to believe that the Company will collect all amounts due from those

where full collection is less certain.