SunTrust 2013 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements, continued

161

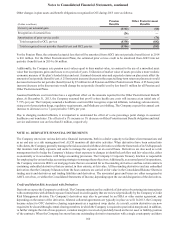

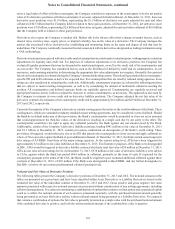

exists a legal right of offset with that counterparty, the Company considers its exposure to the counterparty to be the net market

value of its derivative positions with that counterparty if an asset, adjusted for held collateral. At December 31, 2013, these net

derivative asset positions were $1.0 billion, representing the $1.5 billion of derivative net gains adjusted for cash and other

collateral of $0.5 billion that the Company held in relation to these gain positions. At December 31, 2012, net derivative asset

positions were $1.8 billion, representing $2.6 billion of derivative net gains, adjusted for cash and other collateral of $0.8 billion

that the Company held in relation to these gain positions.

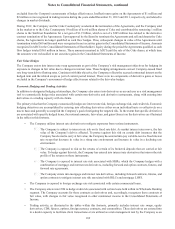

Derivatives also expose the Company to market risk. Market risk is the adverse effect that a change in market factors, such as

interest rates, currency rates, equity prices, or implied volatility, has on the value of a derivative. The Company manages the

market risk associated with its derivatives by establishing and monitoring limits on the types and degree of risk that may be

undertaken. The Company continually measures this risk associated with its derivatives designated as trading instruments using

a VAR methodology.

Derivative instruments are priced with observable market assumptions at a mid-market valuation point, with appropriate valuation

adjustments for liquidity and credit risk. For purposes of valuation adjustments to its derivative positions, the Company has

evaluated liquidity premiums that may be demanded by market participants, as well as the credit risk of its counterparties and

its own credit. The Company has considered factors such as the likelihood of default by itself and its counterparties, its net

exposures, and remaining maturities in determining the appropriate fair value adjustments to recognize. Generally, the expected

loss of each counterparty is estimated using the Company’s internal risk rating system. The risk rating system utilizes counterparty-

specific PD and LGD estimates to derive the expected loss. For counterparties that are rated by national rating agencies, those

ratings are also considered in estimating the credit risk. Additionally, counterparty exposure is evaluated by offsetting positions

that are subject to master netting arrangements, as well as by considering the amount of marketable collateral securing the

position. All counterparties and defined exposure limits are explicitly approved. Counterparties are regularly reviewed and

appropriate business action is taken to adjust the exposure to certain counterparties, as necessary. This approach is also used by

the Company to estimate its own credit risk on derivative liability positions. The Company adjusted the net fair value of its

derivative contracts for estimates of net counterparty credit risk by approximately $16 million and $29 million at December 31,

2013 and 2012, respectively.

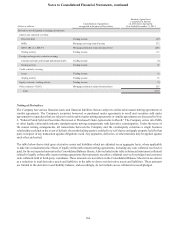

Currently the majority of the Company’s derivatives contain contingencies that relate to the creditworthiness of the Bank. These

contingencies, which are contained in industry standard master netting agreements, may be considered events of default. Should

the Bank be in default under any of these provisions, the Bank’s counterparties would be permitted to close-out net at amounts

that would approximate the then-fair values of the derivatives resulting in a single sum due by one party to the other. The

counterparties would have the right to apply any collateral posted by the Bank against any net amount owed by the Bank.

Additionally, certain of the Company’s derivative liability positions, totaling $941 million in fair value at December 31, 2013

and $1.3 billion at December 31, 2012, contain provisions conditioned on downgrades of the Bank’s credit rating. These

provisions, if triggered, would either give rise to an ATE that permits the counterparties to close-out net and apply collateral or,

where a CSA is present, require the Bank to post additional collateral. At December 31, 2013, the Bank carried senior long-term

debt ratings of A3/BBB+ from three of the major ratings agencies. At the current rating level, ATEs have been triggered for

approximately $3 million in fair value liabilities at December 31, 2013. For illustrative purposes, if the Bank were downgraded

to BB+, ATEs would be triggered in derivative liability contracts that had a total fair value of $9 million at December 31, 2013;

ATEs do not exist at lower ratings levels. At December 31, 2013, $938 million in fair value of derivative liabilities were subject

to CSAs, against which the Bank has posted $864 million in collateral, primarily in the form of cash. If requested by the

counterparty pursuant to the terms of the CSA, the Bank would be required to post estimated additional collateral against these

contracts at December 31, 2013, of $10 million if the Bank were downgraded to Baa3/BBB-, and any further downgrades to

Ba1/BB+ or below do not contain predetermined collateral posting levels.

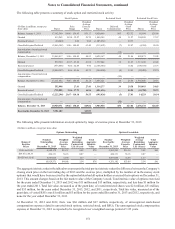

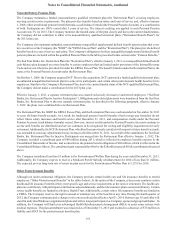

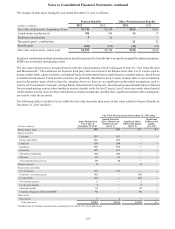

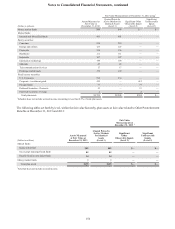

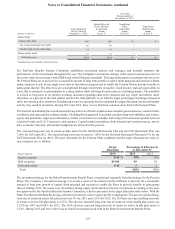

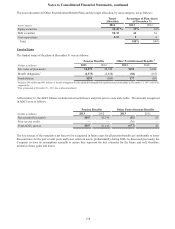

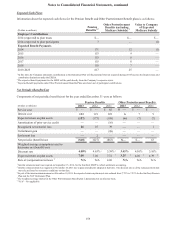

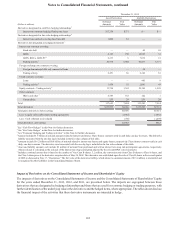

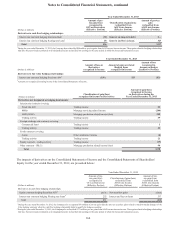

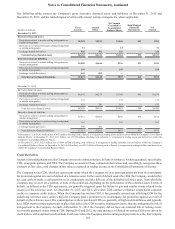

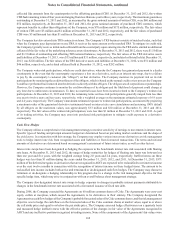

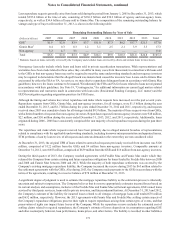

Notional and Fair Value of Derivative Positions

The following tables present the Company’s derivative positions at December 31, 2013 and 2012. The notional amounts in the

tables are presented on a gross basis and have been classified within Asset Derivatives or Liability Derivatives based on the

estimated fair value of the individual contract at December 31, 2013 and 2012. Gross positive and gross negative fair value

amounts associated with respective notional amounts are presented without consideration of any netting agreements, including

collateral arrangements. For contracts constituting a combination of options that contain a written option and a purchased option

(such as a collar), the notional amount of each option is presented separately, with the purchased notional amount generally

being presented as an Asset Derivative and the written notional amount being presented as a Liability Derivative. For contracts

that contain a combination of options, the fair value is generally presented as a single value with the purchased notional amount

if the combined fair value is positive, and with the written notional amount, if the combined fair value is negative.