SunTrust 2013 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236

|

|

Notes to Consolidated Financial Statements, continued

135

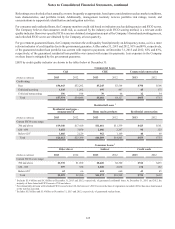

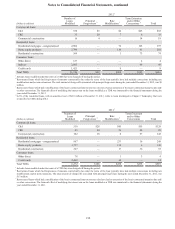

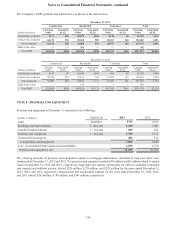

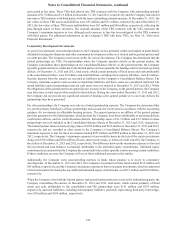

Various Company facilities are leased under both capital and noncancelable operating leases with initial remaining terms in

excess of one year. Minimum payments, by year and in aggregate, at December 31, 2013, were as follows:

(Dollars in millions)

Operating

Leases

Capital

Leases

2014 $208 $2

2015 196 2

2016 190 2

2017 171 2

2018 91 2

Thereafter 354 3

Total minimum lease payments $1,210 13

Less: Amounts representing interest 3

Present value of net minimum lease payments $10

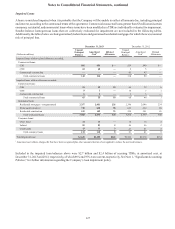

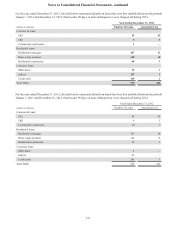

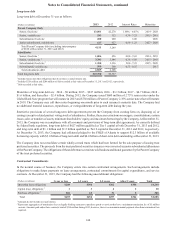

NOTE 9 – GOODWILL AND OTHER INTANGIBLE ASSETS

Goodwill

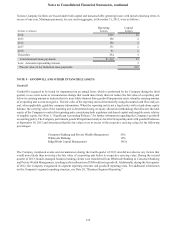

Goodwill is required to be tested for impairment on an annual basis, which is performed by the Company during the third

quarter, or as events occur or circumstances change that would more likely than not reduce the fair value of a reporting unit

below its carrying amount or indicate that it is more likely than not that a goodwill impairment exists when the carrying amount

of a reporting unit is zero or negative. The fair value of the reporting unit is determined by using discounted cash flow analyses

and, when applicable, guideline company information. When the reporting unit is not a legal entity with a stand-alone equity

balance, the carrying value of the reporting unit is determined using an equity allocation methodology that allocates the total

equity of the Company to each of its reporting units considering both regulatory risk-based capital and tangible assets relative

to tangible equity. See Note 1, "Significant Accounting Policies," for further information regarding the Company's goodwill

accounting policy. The Company performed a goodwill impairment analysis for all of its reporting units with goodwill balances

at September 30, 2013 and determined that the fair values were in excess of the respective carrying values by the following

percentages:

Consumer Banking and Private Wealth Management 56%

Wholesale Banking 14%

RidgeWorth Capital Management 141%

The Company monitored events and circumstances during the fourth quarter of 2013 and did not observe any factors that

would more likely than not reduce the fair value of a reporting unit below its respective carrying value. During the second

quarter of 2013, branch-managed business banking clients were transferred from Wholesale Banking to Consumer Banking

and Private Wealth Management, resulting in the reallocation of $300 million in goodwill. Additionally, during the first quarter

of 2012, the Company reorganized its segment reporting structure and goodwill reporting units. For additional information

on the Company's segment reporting structure, see Note 20, "Business Segment Reporting."