SunTrust 2013 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.55

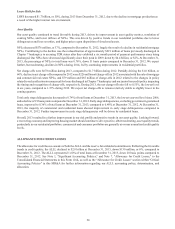

they have a higher likelihood of continuing to perform. To date, we have restructured loans in a variety of ways to help our

clients service their debt and to mitigate the potential for additional losses. The primary restructuring methods being offered

to our residential clients are reductions in interest rates and extensions of terms. For commercial loans, the primary restructuring

method is the extension of terms.

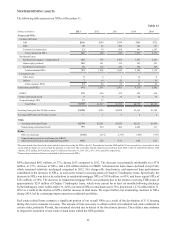

Loans with modifications deemed to be economic concessions resulting from borrower financial difficulties are reported as

TDRs. Accruing loans may retain accruing status at the time of restructure and the status is determined by, among other things,

the nature of the restructure, the borrower's repayment history, and the borrower's repayment capacity. Nonaccruing loans

that are modified and demonstrate a sustainable history of repayment performance, typically six months, in accordance with

their modified terms are generally reclassified to accruing TDR status. Generally, once a residential loan becomes a TDR, we

expect that the loan will continue to be reported as a TDR for its remaining life even after returning to accruing status unless

the modified rates and terms at the time of modification were available in the market at the time of the modification. We note

that some restructurings may not ultimately result in the complete collection of principal and interest (as modified by the

terms of the restructuring), culminating in default, which could result in additional incremental losses. These potential

incremental losses have been factored into our overall ALLL estimate through the use of loss forecasting methodologies. The

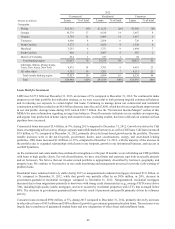

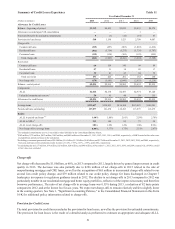

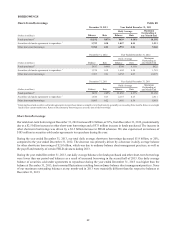

level of re-defaults will likely be affected by future economic conditions. At December 31, 2013 and 2012, specific reserves

included in the ALLL for residential TDRs were $345 million and $348 million, respectively. See Note 6, "Loans," to the

Consolidated Financial Statements in this Form 10-K for more information.

Representatives of the United States Attorney's Office for the Western District of Virginia (USAO) and the Office of the

Special Inspector General for the Troubled Asset Relief Program (collectively the “Western District”) have advised STM of

the status of their ongoing investigation of STM's administration of HAMP. The Western District's investigation focuses on

whether, during 2009 and 2010, STM harmed borrowers and violated civil or criminal laws by making misrepresentations

and failing to properly process applications for modifications of certain mortgages owned by the GSEs pursuant to the HAMP

guidelines. While no determinations have been made, the Western District has indicated that they intend to pursue some form

of action and may impose substantial penalties on STM. STM continues to cooperate with the investigation and believes that

it has substantial defenses to the asserted allegations.

Separately, we have committed to providing $500 million in consumer relief pursuant to the National Mortgage Servicing

Settlement agreement in principle with certain parties. At December 31, 2013, our financial statements reflect our estimated

costs of fulfilling our commitments under this program. A final agreement in the Mortgage Servicing Settlement matter has

not been reached and the methods by which we will meet these obligations are still being developed. An expansion in the

number and type of restructuring methods for consumer clients, including principal forgiveness, is expected as a result of

these consumer relief commitments. Additionally, certain modification methods under consideration could be deemed to be

economic concessions and result in additional modified loans being reported as TDRs.

See additional discussion related to HAMP, Consent Order, and the Mortgage Servicing Settlement in Note 19,

“Contingencies,” to the Consolidated Financial Statements in this Form 10-K.