SunTrust 2013 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

140

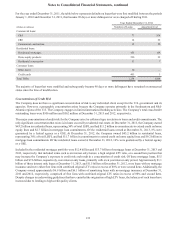

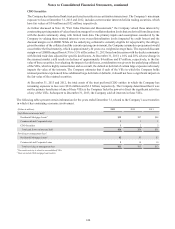

CDO Securities

The Company has transferred bank trust preferred securities in securitization transactions. The Company's maximum

exposure to loss at December 31, 2013 and 2012, includes current senior interests held in trading securities, which

have fair values of $54 million and $52 million, respectively.

As further discussed in Note 18, "Fair Value Election and Measurement," the Company valued these interests by

constructing a pricing matrix of values based on a range of overcollateralization levels that are derived from discussions

with the dealer community along with limited trade data. The primary inputs and assumptions considered by the

Company in valuing these retained interests were overcollateralization levels (impacted by credit losses) and the

discount margin over LIBOR. While all the underlying collateral is currently eligible for repayment by the obligor,

given the nature of the collateral and the current repricing environment, the Company assumed no prepayment would

occur before the final maturity, which is approximately 20 years on a weighted average basis. The expected discount

margin over LIBOR ranged from 4.3% to 5.5% at December 31, 2013 based on discussion with the dealer community

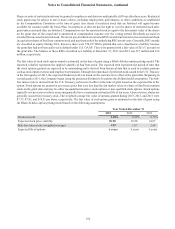

with limited trade data adjusted for specific deal factors. At December 31, 2013, a 10% and 20% adverse change in

the assumed market yield results in declines of approximately $4 million and $7 million, respectively, in the fair

value of these securities. In evaluating the impact of credit losses, consideration was given to the underlying collateral

of the VIEs, which is highly concentrated, and as a result, the default or deferral of certain large exposures adversely

impacts the value of the interests. The Company estimates that if each of the VIEs in which the Company holds

retained positions experienced three additional large deferrals or defaults, it should not have a significant impact on

the fair value of the retained securities.

At December 31, 2013 and 2012, the total assets of the trust preferred CDO entities in which the Company has

remaining exposure to loss were $816 million and $1.2 billion, respectively. The Company determined that it was

not the primary beneficiary of any of these VIEs as the Company lacks the power to direct the significant activities

of any of the VIEs. Subsequent to December 31, 2013, the Company sold all interests in these VIEs.

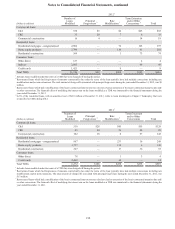

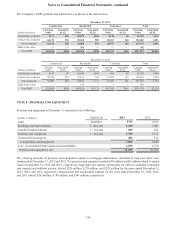

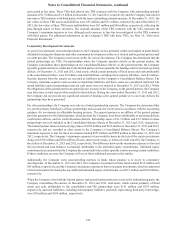

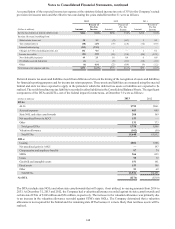

The following tables present certain information for the years ended December 31, related to the Company’s asset transfers

in which it has continuing economic involvement.

(Dollars in millions) 2013 2012 2011

Cash flows on interests held1:

Residential Mortgage Loans2$32 $27 $48

Commercial and Corporate Loans 111

CDO Securities 322

Total cash flows on interests held $36 $30 $51

Servicing or management fees1:

Residential Mortgage Loans2$2 $3 $3

Commercial and Corporate Loans 910 10

Total servicing or management fees $11 $13 $13

1 The transfer activity is related to unconsolidated VIEs.

2 Does not include GSE mortgage loan transfers