SunTrust 2013 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements, continued

142

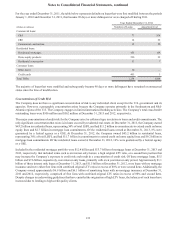

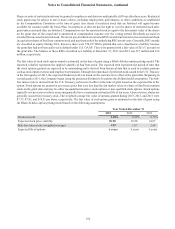

and carried at fair value. These VIEs had entered into TRS contracts with the Company with outstanding notional

amounts of $1.5 billion and $1.9 billion at December 31, 2013 and 2012, respectively, and the Company had entered

into mirror TRS contracts with third parties with the same outstanding notional amounts. At December 31, 2013, the

fair values of these TRS assets and liabilities were $35 million and $31 million, respectively, and at December 31,

2012, the fair values of these TRS assets and liabilities were $51 million and $46 million, respectively, reflecting the

pass-through nature of these structures. The notional amounts of the TRS contracts with the VIEs represent the

Company’s maximum exposure to loss, although such exposure to loss has been mitigated via the TRS contracts

with third parties. For additional information on the Company’s TRS with these VIEs, see Note 16, “Derivative

Financial Instruments.”

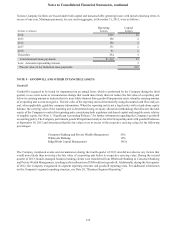

Community Development Investments

As part of its community reinvestment initiatives, the Company invests primarily within its footprint in multi-family

affordable housing developments and other community development entities as a limited and/or general partner and/

or a debt provider. The Company receives tax credits for various investments. The Company has determined that the

related partnerships are VIEs. For partnerships where the Company operates strictly as the general partner, the

Company consolidates these partnerships on its Consolidated Balance Sheets. As the general partner, the Company

typically guarantees the tax credits due to the limited partner and is responsible for funding construction and operating

deficits. At December 31, 2013 and 2012, total assets, which consist primarily of fixed assets and cash attributable

to the consolidated entities, were $3 million, and total liabilities, excluding intercompany liabilities, were $1 million.

Security deposits from the tenants are recorded as liabilities on the Company’s Consolidated Balance Sheets. The

Company maintains separate cash accounts to fund these liabilities and these assets are considered restricted. The

tenant liabilities and corresponding restricted cash assets were not material at December 31, 2013 and 2012. While

the obligations of the general partner are generally non-recourse to the Company, as the general partner, the Company

may from time to time step in when needed to fund deficits. During the years ended December 31, 2013 and 2012,

the Company did not provide any significant amount of funding as the general partner or to cover any deficits the

partnerships may have generated.

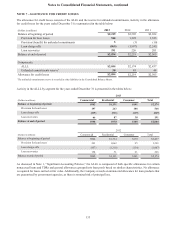

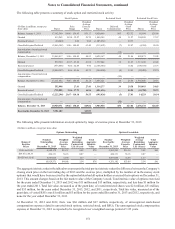

For other partnerships, the Company acts only in a limited partnership capacity. The Company has determined that

it is not the primary beneficiary of these partnerships and accounts for its interests in accordance with the accounting

guidance for investments in affordable housing projects. The general partner or an affiliate of the general partner

provides guarantees to the limited partner, which protects the Company from losses attributable to operating deficits,

construction deficits, and tax credit allocation deficits. Partnership assets of $1.5 billion and $1.2 billion in these

partnerships were not included in the Consolidated Balance Sheets at December 31, 2013 and 2012, respectively.

The limited partner interests had carrying values of $252 million and $186 million at December 31, 2013 and 2012,

respectively, and are recorded in other assets in the Company’s Consolidated Balance Sheets. The Company’s

maximum exposure to loss for these investments totaled $697 million and $505 million at December 31, 2013 and

2012, respectively. The Company’s maximum exposure to loss would be borne by the loss of the equity investments

along with $303 million and $236 million of loans, interest-rate swaps, or letters of credit issued by the Company to

the entities at December 31, 2013 and 2012, respectively. The difference between the maximum exposure to loss and

the investment and loan balances is primarily attributable to the unfunded equity commitments. Unfunded equity

commitments are amounts that the Company has committed to the entities upon the entities meeting certain conditions.

If these conditions are met, the Company will invest these additional amounts in the entities.

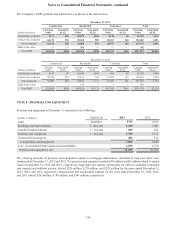

Additionally, the Company owns noncontrolling interests in funds whose purpose is to invest in community

developments. At December 31, 2013 and 2012, the Company's investment in these funds totaled $138 million and

$63 million, respectively, and the Company's maximum exposure to loss on its equity investments, which is comprised

of its investments in the funds plus any additional unfunded equity commitments, was $217 million and $110 million,

respectively.

When the Company owns both the limited partner and general partner interests or acts as the indemnifying party, the

Company consolidates the entities. At December 31, 2013 and 2012, total assets, which consist primarily of fixed

assets and cash, attributable to the consolidated non-VIE partnerships were $151 million and $239 million,

respectively, and total liabilities, excluding intercompany liabilities, primarily representing third party borrowings,

were $58 million and $100 million, respectively.