SunTrust 2013 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

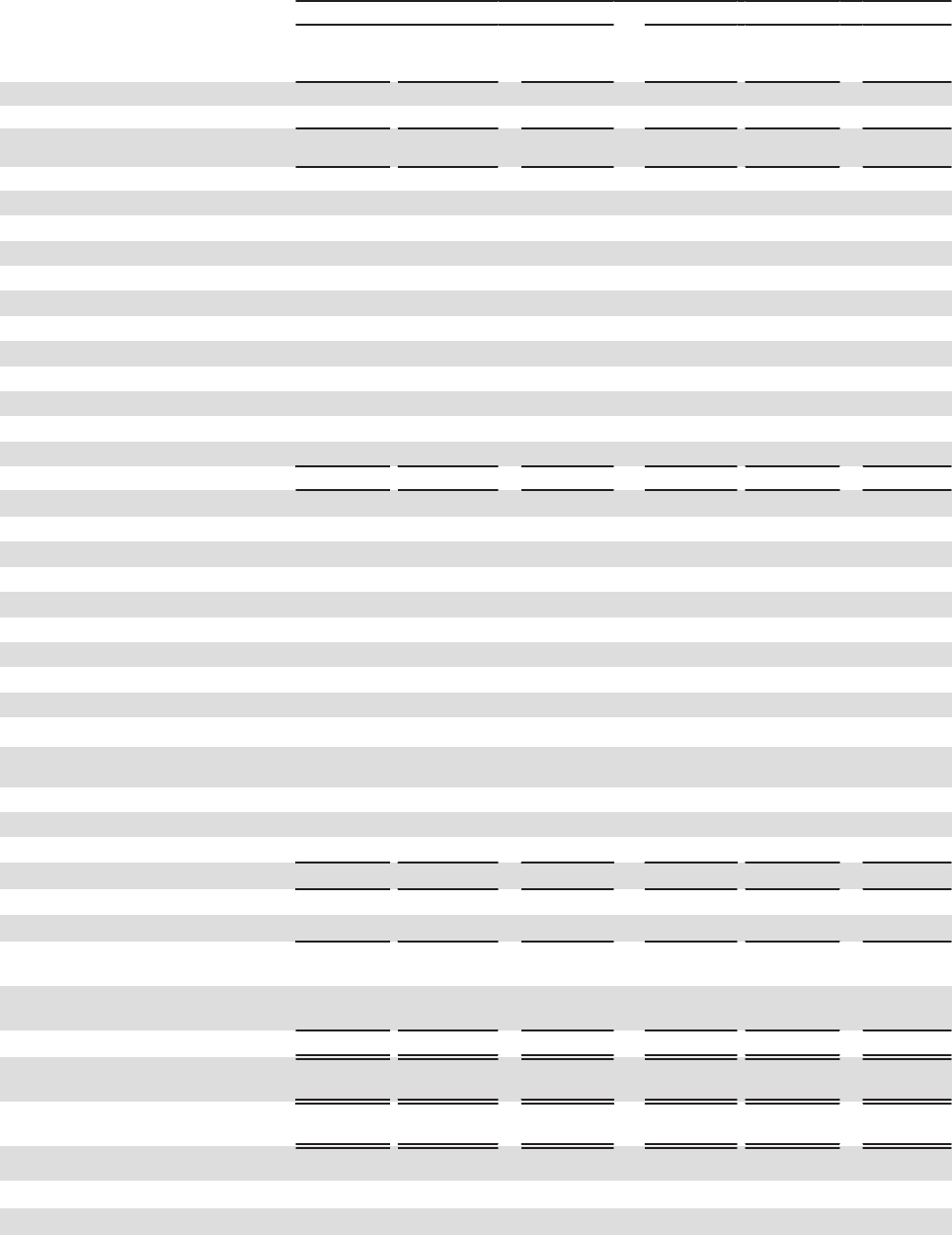

95

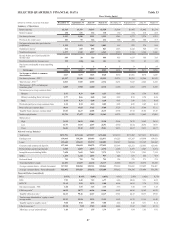

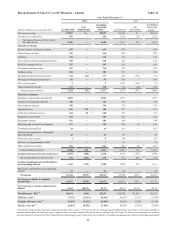

Reconcilement of Non-U.S. GAAP Measures - Annual Table 36

Year Ended December 31

(Dollars in millions, except per share data)

2013 2012

As Reported

8-K

Adjustments

Excluding

Form 8-K

items 1As Reported

8-K

Adjustments

Excluding

Form 8-K

items 1

Net interest income $4,853 $— $4,853 $5,102 $— $5,102

Provision for credit losses 553 — 553 1,395 172 21,223

Net interest income after provision

for credit losses 4,300 — 4,300 3,707 172 3,879

Noninterest Income

Service charges on deposit accounts 657 — 657 676 — 676

Other charges and fees 369 — 369 402 — 402

Card fees 310 — 310 316 — 316

Trust and investment management income 518 — 518 512 — 512

Retail investment services 267 — 267 241 — 241

Investment banking income 356 — 356 342 — 342

Trading income 182 — 182 211 — 211

Mortgage production related income 314 (63) 3377 343 (371) 4714

Mortgage servicing related income 87 — 87 260 — 260

Net securities gains 2— 2 1,974 1,938 536

Other noninterest income 152 — 152 96 (92) 6188

Total noninterest income 3,214 (63) 3,277 5,373 1,475 3,898

Noninterest Expense

Employee compensation and benefits 2,901 — 2,901 3,077 — 3,077

Outside processing and software 746 — 746 710 — 710

Net occupancy expense 348 — 348 359 — 359

Operating losses 503 323 7180 277 — 277

Credit and collection services 264 96 8168 239 — 239

Regulatory assessments 181 — 181 233 — 233

Equipment expense 181 — 181 188 — 188

Marketing and customer development 135 — 135 184 38 9146

Consulting and legal fees 73 —73 165 —165

Amortization/impairment of intangible

assets/goodwill 23 — 23 46 — 46

Other real estate expense 4— 4 140 — 140

Net loss on extinguishment of debt —— — 16 — 16

Other noninterest expense 521 — 521 689 96 10 593

Total noninterest expense 5,880 419 5,461 6,323 134 6,189

Income before provision for income taxes 1,634 (482) 2,116 2,757 1,169 1,588

Provision/(benefit) for income taxes 273 (303) 11 576 773 416 11 357

Income including income attributable to

noncontrolling interest 1,361 (179) 1,540 1,984 753 1,231

Net income attributable to noncontrolling

interest 17 — 17 26 — 26

Net income $1,344 ($179) $1,523 $1,958 $753 $1,205

Net income available to common

shareholders $1,297 ($179) $1,476 $1,931 $753 $1,178

Net income per average common share -

diluted $2.41 ($0.33) $2.74 $3.59 $1.40 $2.19

Total Revenue - FTE 12 $8,194 ($63) $8,257 $10,598 $1,475 $9,123

Efficiency ratio 13 71.75% (5.61)% 66.14% 59.67% 8.17% 67.84%

Tangible efficiency ratio 14 71.48% (5.62)% 65.86% 59.24% 8.10% 67.34%

Effective tax rate 15 16.89% 10.55% 27.44% 28.29% (5.43)% 22.86%

1 We present certain income statement categories and also total revenue - FTE, net income per average common diluted share, net income, net income available to

common shareholders, an efficiency ratio, a tangible efficiency ratio, and the effective tax rate, excluding Form 8-K items. We believe these measures are useful to

investors because it removes the effect of material items impacting the years' results and is more reflective of normalized operations as it reflects results that are primarily