SunTrust 2013 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.50

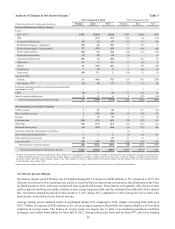

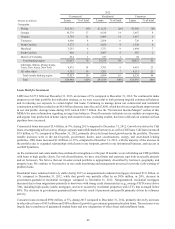

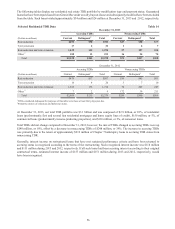

Loans Held for Sale

LHFS decreased $1.7 billion, or 50%, during 2013 from December 31, 2012, due to the decline in mortgage production as

a result of the higher interest rate environment.

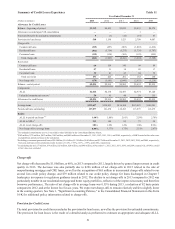

Asset Quality

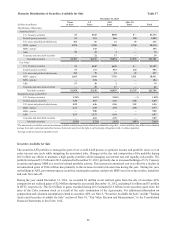

Our asset quality continued to trend favorably during 2013, driven by improvement in asset quality metrics, resolution of

existing NPAs, and lower inflows of NPLs. This was driven by positive trends in our residential portfolios due to lower

delinquencies and loss severities, and higher prices upon disposition of foreclosed assets.

NPLs decreased $576 million, or 37%, compared to December 31, 2012, largely the result of a decline in residential mortgage

NPLs. Contributing to the decline was the reclassification of approximately $219 million of loans previously discharged in

Chapter 7 bankruptcy to accruing TDR status after they exhibited a six month period of payment performance since being

discharged. Our NPLs have decreased significantly since their peak in 2009, down by $4.4 billion, or 82%. At December 31,

2013, the percentage of NPLs to total loans was 0.76%, down 51 basis points compared to December 31, 2012. We expect

further, but moderating, declines in NPLs during 2014, led by continuing improvements in residential portfolios.

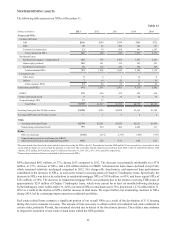

Net charge-offs were $678 million during 2013, compared to $1.7 billion during 2012. Partially driving the $1.0 billion, or

60%, decline in net charge-offs compared to 2012 were $226 million of charge-offs in 2012 associated with the sale of mortgage

and commercial real estate NPLs, and $79 million and $65 million of charge-offs in 2012 related to the changes in policy

related to reclassification to nonaccrual for loans discharged in Chapter 7 bankruptcy and our junior lien credit policy impacting

the timing and recognition of charge-offs, respectively. During 2013, the net charge-off ratio fell to 0.55%, the lowest level

in six years, compared to 1.37% during 2012. We expect net charge-offs to remain relatively stable to slightly lower in the

coming quarters.

Total early stage delinquencies decreased to 0.74% of total loans at December 31, 2013, the lowest year-end level since 2006,

and a decline of 19 basis points compared to December 31, 2012. Early stage delinquencies, excluding government-guaranteed

loans, improved to 0.36% of total loans at December 31, 2013, compared to 0.48% at December 31, 2012. At December 31,

2013, the majority of commercial and residential loans showed improvement in early stage delinquencies compared to

December 31, 2012. Further improvement in early stage delinquencies will be driven by residential loans.

Overall, 2013 resulted in a further improvement in our risk profile and positive trends in our asset quality. Looking forward,

a recovering economy and improving housing market should continue to drive positive, albeit moderating, asset quality trends,

particularly in our residential portfolios; commercial and consumer portfolios are generally at or near normalized credit quality

levels.

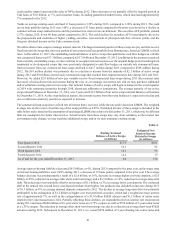

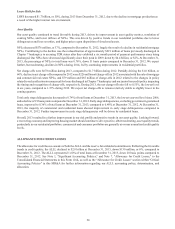

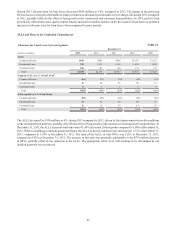

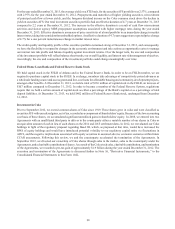

ALLOWANCE FOR CREDIT LOSSES

The allowance for credit losses consists of both the ALLL and the reserve for unfunded commitments. Reflecting the favorable

trends in credit quality, the ALLL declined to $2.0 billion at December 31, 2013, down $130 million, or 6%, compared to

December 31, 2012. The ALLL represented 1.60% of total loans at December 31, 2013, down 20 basis points compared to

December 31, 2012. See Note 1, "Significant Accounting Policies," and Note 7, "Allowance for Credit Losses," to the

Consolidated Financial Statements in this Form 10-K, as well as the "Allowance for Credit Losses" section within "Critical

Accounting Policies" in this MD&A for further information regarding our ALLL accounting policy, determination, and

allocation.