SunTrust 2013 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

137

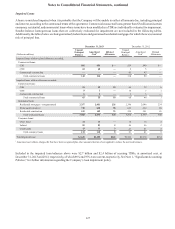

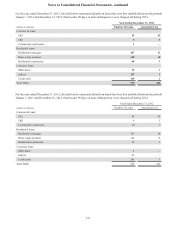

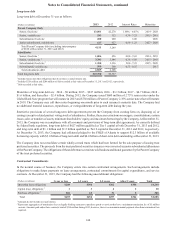

The estimated future amortization expense for intangible assets is as follows:

(Dollars in millions)

Core Deposit

Intangibles Other Total

2014 $4 $7 $11

2015 —55

2016 —22

2017 —22

2018 —22

Thereafter — 3 3

Total 1$4 $21 $25

1 Estimated future amortization expense is less than the intangible asset balance at December 31, 2013, due to the anticipated sale of RidgeWorth, including

its intangible assets, in 2014. See additional discussion of the planned sale in Note 20, “Business Segment Reporting.”

Mortgage Servicing Rights

The Company retains MSRs from certain of its sales or securitizations of residential mortgage loans. MSRs on residential

mortgage loans are the only servicing assets capitalized by the Company and are classified within intangible assets on the

Company's Consolidated Balance Sheets.

Income earned by the Company on its MSRs is derived primarily from contractually specified mortgage servicing fees and

late fees, net of curtailment costs. Such income earned for the years ended December 31, 2013, 2012, and 2011 was $317

million, $333 million, and $364 million, respectively. These amounts are reported in mortgage servicing related income in

the Consolidated Statements of Income.

At December 31, 2013 and 2012, the total UPB of mortgage loans serviced was $136.7 billion and $144.9 billion, respectively.

Included in these amounts were $106.8 billion and $113.2 billion at December 31, 2013 and 2012, respectively, of loans

serviced for third parties. During the years ended December 31, 2013 and 2012, the Company sold MSRs, at a price

approximating their fair value, on residential loans with a UPB of $2.8 billion and $2.1 billion, respectively.

At the end of each quarter, the Company determines the fair value of the MSRs using a valuation model that calculates the

present value of the estimated future net servicing income. The model incorporates a number of assumptions as MSRs do not

trade in an active and open market with readily observable prices. The Company determines fair value using market based

prepayment rates, discount rates, and other assumptions that are compared to various sources of market data including

independent third party valuations and industry surveys. Senior management and the STM valuation committee review all

significant assumptions quarterly since many factors can affect the fair value of MSRs. Changes to the valuation model inputs

and assumptions are reflected in the periods' results.

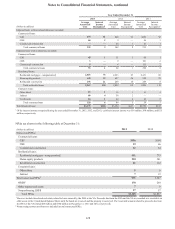

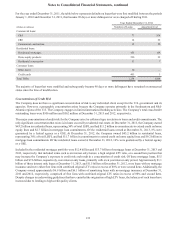

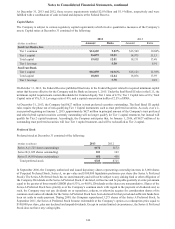

A summary of the key characteristics, inputs, and economic assumptions used to estimate the fair value of the Company’s

MSRs at December 31, 2013 and 2012, and the sensitivity of the fair values to immediate 10% and 20% adverse changes in

those assumptions are shown in the table below. The overall change in MSRs during the year ended December 31, 2013 was

primarily due to originations and an increase in prevailing interest rates during the period.

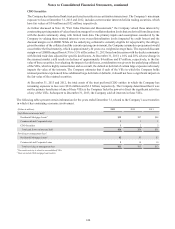

(Dollars in millions) December 31, 2013 December 31, 2012

Fair value of retained MSRs $1,300 $899

Prepayment rate assumption (annual) 8% 16%

Decline in fair value from 10% adverse change $38 $50

Decline in fair value from 20% adverse change 74 95

Discount rate (annual) 12% 11%

Decline in fair value from 10% adverse change $66 $37

Decline in fair value from 20% adverse change 126 70

Weighted-average life (in years) 7.7 4.9

Weighted-average coupon 4.4% 4.8%

The above sensitivities are hypothetical and should be used with caution. As the amounts indicate, changes in fair value based

on variations in assumptions generally cannot be extrapolated because the relationship of the change in assumption to the

change in fair value may not be linear. Also, in this table, the effect of a variation in a particular assumption on the fair value

of the retained interest is calculated without changing any other assumption. In reality, changes in one factor may result in