SunTrust 2013 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

144

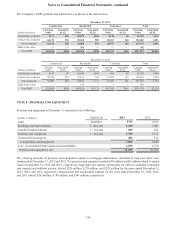

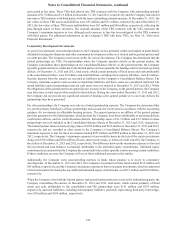

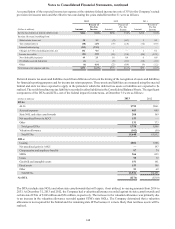

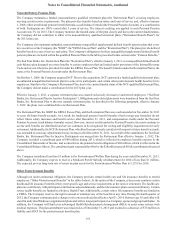

Long-term debt

Long-term debt at December 31 was as follows:

(Dollars in millions) 2013 2012 Interest Rates Maturities

Parent Company Only

Senior, fixed rate $3,001 $2,270 1.00% - 6.05% 2014 - 2028

Senior, variable rate 283 152 0.39 - 3.25 2015 - 2019

Subordinated, fixed rate 200 200 6.00 2026

Junior subordinated, variable rate 627 627 0.89 - 1.23 2027 - 2028

Total Parent Company debt (excluding intercompany

of $160 at December 31, 2013 and 2012) 4,111 3,249

Subsidiaries

Senior, fixed rate 11,006 426 0.00 - 9.65 2014 - 2053

Senior, variable rate 23,783 3,846 0.36 - 6.98 2015 - 2043

Subordinated, fixed rate 31,300 1,336 5.00 - 7.25 2015 - 2020

Subordinated, variable rate 500 500 0.53 - 0.55 2015

Total subsidiaries debt 6,589 6,108

Total long-term debt $10,700 $9,357

1 Includes leases and other obligations that do not have a stated interest rate.

2 Includes $256 million and $286 million of debt recorded at fair value at December 31, 2013 and 2012, respectively.

3 Debt recorded at fair value.

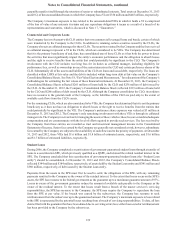

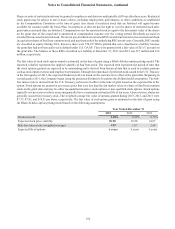

Maturities of long-term debt are: 2014 – $9 million; 2015 – $817 million; 2016 – $1.1 billion; 2017 – $4.7 billion; 2018 –

$1.6 billion; and thereafter – $2.4 billion. During 2013, the Company issued $600 million of 2.75% senior notes under the

Global Bank Note program that will mature in 2023 and $750 million of Parent Company 2.35% senior notes that will mature

in 2018. The Company may call these notes beginning one month prior to each issuance's maturity date. The Company had

no additional material issuances, repurchases, or extinguishments of long-term debt during the year.

Restrictive provisions of several long-term debt agreements prevent the Company from creating liens on, disposing of, or

issuing (except to related parties) voting stock of subsidiaries. Further, there are restrictions on mergers, consolidations, certain

leases, sales or transfers of assets, minimum shareholders’ equity, and maximum borrowings by the Company. At December 31,

2013, the Company was in compliance with all covenants and provisions of long-term debt agreements. As currently defined

by federal bank regulators, long-term debt of $627 million qualified as Tier 1 capital at both December 31, 2013 and 2012,

and long-term debt of $1.1 billion and $1.5 billion qualified as Tier 2 capital at December 31, 2013 and 2012, respectively.

At December 31, 2013, the Company had collateral pledged to the FHLB of Atlanta to support $12.3 billion of available

borrowing capacity with $3.0 billion of long-term debt and $4.0 billion of short-term debt outstanding at December 31, 2013.

The Company does not consolidate certain wholly-owned trusts which had been formed for the sole purpose of issuing trust

preferred securities. The proceeds from the trust preferred securities issuances were invested in junior subordinated debentures

of the Parent Company. The obligations of these debentures constitute a full and unconditional guarantee by the Parent Company

of the trust preferred securities.

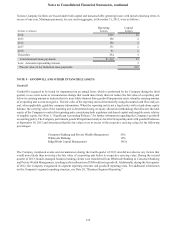

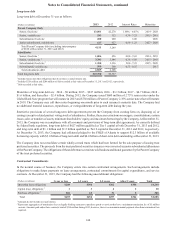

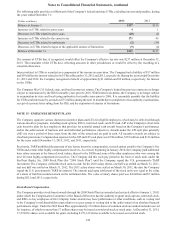

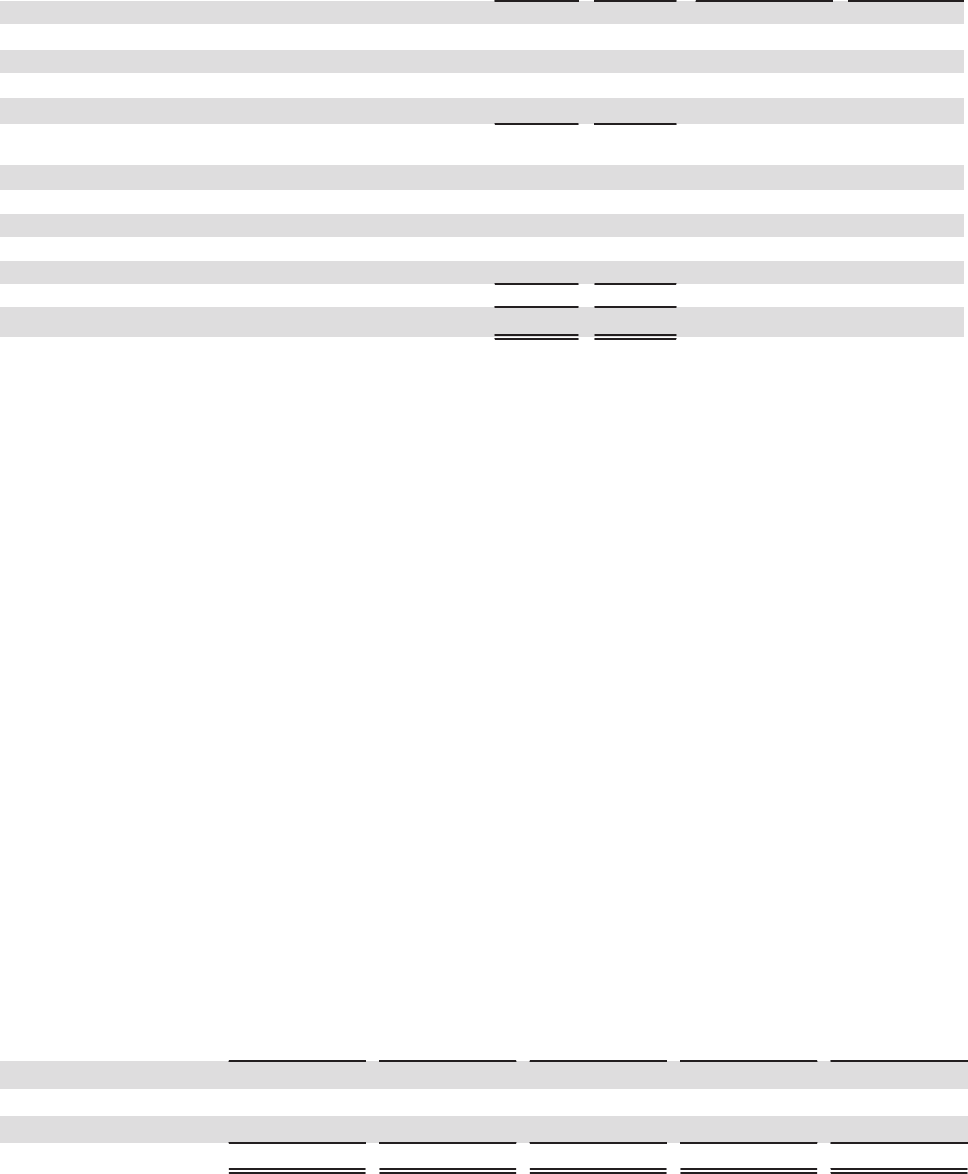

Contractual Commitments

In the normal course of business, the Company enters into certain contractual arrangements. Such arrangements include

obligations to make future payments on lease arrangements, contractual commitments for capital expenditures, and service

contracts. At December 31, 2013, the Company had the following unconditional obligations:

(Dollars in millions) 1 year or less 1-3 years 3-5 years After 5 years Total

Operating lease obligations $208 $386 $262 $354 $1,210

Capital lease obligations 1134210

Purchase obligations 2284 65 31 8 388

Total $493 $454 $297 $364 $1,608

1 Amounts do not include accrued interest.

2 Represents aggregation of termination fees on legally binding contracts to purchase goods or services that have a minimum termination fee of $5 million

or more. Amounts paid under these contracts totaled $194 million during 2013; however, there is no minimum annual payment other than termination fees

required.