SunTrust 2013 Annual Report Download - page 193

Download and view the complete annual report

Please find page 193 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

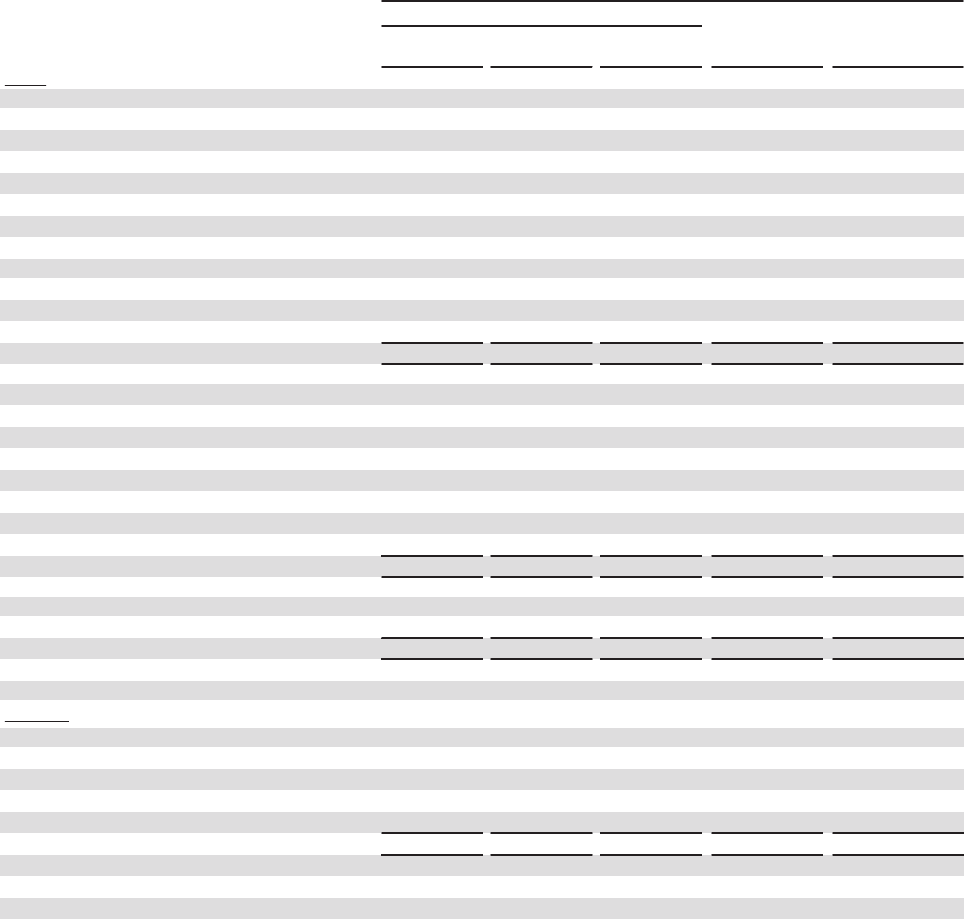

Notes to Consolidated Financial Statements, continued

177

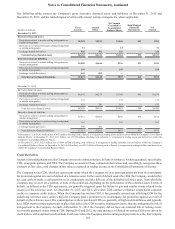

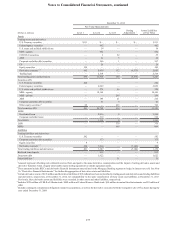

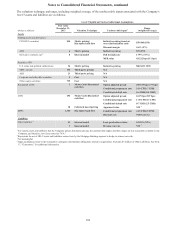

December 31, 2012

Fair Value Measurements

(Dollars in millions) Level 1 Level 2 Level 3

Netting

Adjustments 1Assets/Liabilities

at Fair Value

Assets

Trading assets and derivatives:

U.S. Treasury securities $111 $— $— $— $111

Federal agency securities — 462 — — 462

U.S. states and political subdivisions — 34 — — 34

MBS - agency — 432 — — 432

CDO/CLO securities — 3 52 — 55

ABS — 31 5 — 36

Corporate and other debt securities — 566 1 — 567

CP —28— — 28

Equity securities 100 — — — 100

Derivative contracts 2, 3 485 8,039 132 (6,573) 2,083

Trading loans — 2,319 — — 2,319

Total trading assets and derivatives 696 11,914 190 (6,573) 6,227

Securities AFS:

U.S. Treasury securities 222 — — — 222

Federal agency securities — 2,069 — — 2,069

U.S. states and political subdivisions — 274 46 — 320

MBS - agency — 18,169 — — 18,169

MBS - private — — 209 — 209

ABS — 195 21 — 216

Corporate and other debt securities — 41 5 — 46

Other equity securities 469 — 633 — 702

Total securities AFS 291 20,748 914 — 21,953

LHFS:

Residential loans — 2,916 8 — 2,924

Corporate and other loans — 319 — — 319

Total LHFS — 3,235 8 — 3,243

LHFI — — 379 — 379

MSRs — — 899 — 899

Liabilities

Trading liabilities and derivatives:

U.S. Treasury securities 582 — — — 582

Corporate and other debt securities — 173 — — 173

Equity securities 9 — — — 9

Derivative contracts 2, 3 300 7,214 — (7,102) 412

Total trading liabilities and derivatives 891 7,387 — (7,102) 1,176

Brokered time deposits — 832 — — 832

Long-term debt — 1,622 — — 1,622

Other liabilities 5——31 — 31

1 Amounts represent offsetting cash collateral received from and paid to the same derivative counterparties and the impact of netting derivative assets and

derivative liabilities when a legally enforceable master netting agreement or similar agreement exists.

2 These amounts include IRLCs and derivative financial instruments entered into by the Mortgage Banking segment to hedge its interest rate risk. See Note

16, "Derivative Financial Instruments," for further disaggregation of derivative assets and liabilities.

3 Certain derivative assets of $178 million and derivative liabilities of $15 million have been reclassified to trading assets and derivatives and trading liabilities

and derivatives, respectively, at December 31, 2012, for comparability to the same classification of these assets and liabilities at December 31, 2013.

Previously, these derivative assets and liabilities were recorded in other assets and other liabilities, respectively.

4 Includes $229 million of FHLB of Atlanta stock, $402 million of Federal Reserve Bank stock, $69 million in mutual fund investments, and $2 million of

other.

5 Includes contingent consideration obligations related to acquisitions, as well as the derivative associated with the Company's sale of Visa shares during the

year ended December 31, 2009.