SunTrust 2013 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.65

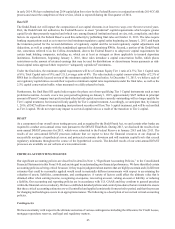

in early 2014. We have submitted our 2014 capital plan for review by the Federal Reserve in conjunction with the 2014 CCAR

process and await the completion of their review, which is expected during the first quarter of 2014.

Basel III

The Dodd-Frank Act will impact the composition of our capital elements in at least two ways over the next several years.

First, the Dodd-Frank Act authorizes the Federal Reserve to enact “prudential” capital requirements which require greater

capital levels than presently required and which vary among financial institutions based on size, risk, complexity, and other

factors. As expected, the Federal Reserve used this authority by publishing final rules on October 11, 2013. The rules require

banking organizations such as us to meet revised minimum regulatory capital ratios beginning on January 1, 2015, and begin

the transition period for the revised definitions of regulatory capital and the revised regulatory capital adjustments and

deductions, as well as comply with the standardized approach for determining RWAs. Second, a portion of the Dodd-Frank

Act, sometimes referred to as the Collins Amendment, directs the Federal Reserve to adopt new capital requirements for

certain bank holding companies, including us, which are at least as stringent as those applicable to insured depositary

institutions. Furthermore, beginning January 1, 2016, these rules introduce a capital conservation buffer, which places

restrictions on the amount of retained earnings that may be used for distributions or discretionary bonus payments as risk-

based capital ratios approach their respective “adequately capitalized” minimums.

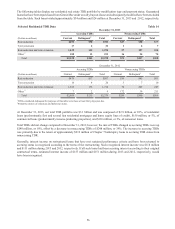

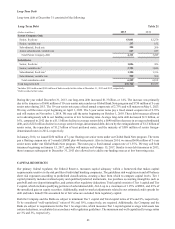

Under the final rules, the minimum capital requirements will be a Common Equity Tier 1 ratio of 4.5%; Tier 1 Capital ratio

of 6%; Total Capital ratio of 8%; and U.S. Leverage ratio of 4%. The rules include a capital conservation buffer of 2.5% of

RWA that is effectively layered on top of the minimum capital risk-based ratios. At December 31, 2013, we believe each of

our regulatory capital ratios exceeds their respective minimum capital ratio requirements under the final rules, as well as the

2.5% capital conservation buffer, when measured on a fully-phased-in basis.

Furthermore, the final Basel III capital rules require the phase out of non-qualifying Tier 1 Capital instruments such as trust

preferred securities. As such, over a two year period beginning on January 1, 2015, approximately $627 million in principal

amount of Parent Company trust preferred and other hybrid capital securities currently outstanding will no longer qualify for

Tier 1 capital treatment, but instead will only qualify for Tier 2 capital treatment. Accordingly, we anticipate that, by January

1, 2016, all $627 million of our outstanding trust preferred securities will lose Tier 1 capital treatment, and will be reclassified

as Tier 2 capital. We do not expect any impact to our total capital ratio as a result of the transition to Tier 2 capital.

DFAST

As a component of our overall stress testing process, and as required by the Dodd-Frank Act, we and certain other banks are

required to conduct semi-annual stress tests pursuant to the DFAST Final Rule. During 2013, we disclosed the results of our

semi-annual DFAST processes for 2013, which were submitted to the Federal Reserve in January 2013 and July 2013. The

results of our semi-annual DFAST processes indicate that we expect to have the financial resources at our disposal to

successfully navigate a hypothetical severe and protracted economic downturn and will maintain capital levels that exceed

regulatory minimums throughout the course of the hypothetical scenario. The detailed results of our semi-annual DFAST

processes are available on our website at www.suntrust.com.

CRITICAL ACCOUNTING POLICIES

Our significant accounting policies are described in detail in Note 1, “Significant Accounting Policies,” to the Consolidated

Financial Statements in this Form 10-K and are integral to understanding our financial performance. We have identified certain

accounting policies as being critical because (1) they require judgment about matters that are highly uncertain and (2) different

estimates that could be reasonably applied would result in materially different assessments with respect to ascertaining the

valuation of assets, liabilities, commitments, and contingencies. A variety of factors could affect the ultimate value that is

obtained either when earning income, recognizing an expense, recovering an asset, valuing an asset or liability, or reducing

a liability. Our accounting and reporting policies are in accordance with U.S. GAAP, and they conform to general practices

within the financial services industry. We have established detailed policies and control procedures that are intended to ensure

that these critical accounting estimates are well controlled and applied consistently from period to period, and that the process

for changing methodologies occurs in an appropriate manner. The following is a description of our current critical accounting

policies.

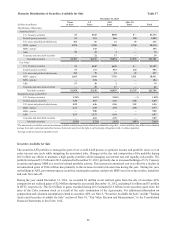

Contingencies

We face uncertainty with respect to the ultimate outcomes of various contingencies including the Allowance for Credit Losses,

mortgage repurchase reserves, and legal and regulatory matters.