SunTrust 2013 Annual Report Download - page 206

Download and view the complete annual report

Please find page 206 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

190

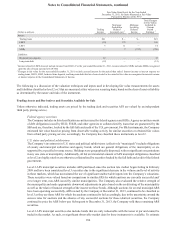

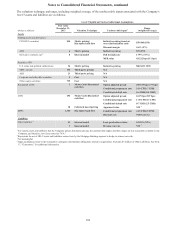

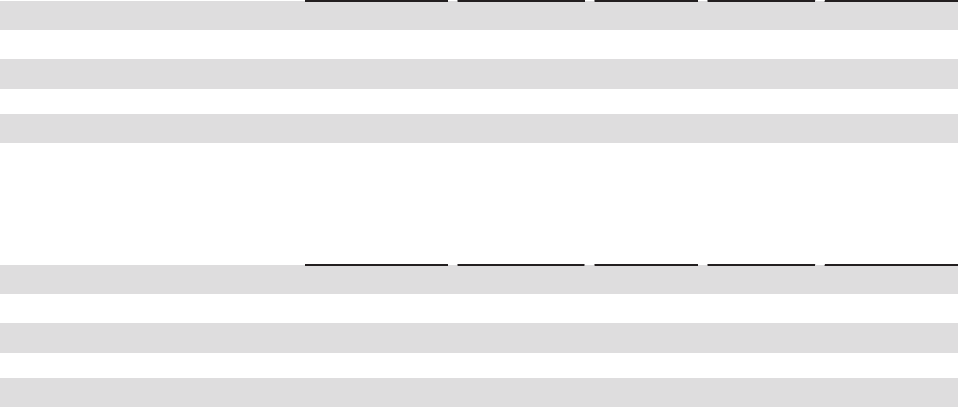

Non-recurring Fair Value Measurements

The following tables present those assets measured at fair value on a non-recurring basis at December 31, 2013 and 2012,

respectively, as well as loans for which impairment has been recognized during the years ended December 31, 2013 and 2012.

The changes in fair value when comparing balances at December 31, 2013 to those at December 31, 2012, generally result

from the application of LOCOM or through write-downs of individual assets. The table does not reflect the change in fair

value attributable to any related economic hedges the Company may have used to mitigate the interest rate risk associated

with LHFS and MSRs.

(Dollars in millions) December 31, 2013

Quoted Prices in

Active Markets

for Identical

Assets/Liabilities

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Losses for the

Year Ended

December 31,

2013

LHFS $278 $— $278 $— ($3)

LHFI 75 — — 75 —

OREO 49 — 1 48 (10)

Affordable Housing 7 — — 7 (3)

Other Assets 171 — 158 13 (61)

(Dollars in millions) December 31, 2012

Quoted Prices in

Active Markets

for Identical

Assets/Liabilities

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Losses for the

Year Ended

December 31,

2012

LHFS $65 $— $65 $— $—

LHFI 308 — — 308 (79)

OREO 264 — 205 59 (48)

Affordable Housing 82 — — 82 (96)

Other Assets 65 — 42 23 (13)

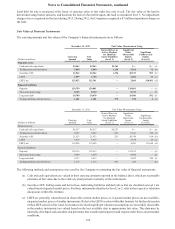

The following is a discussion of the valuation techniques and inputs used in developing fair value measurements for assets

classified as level 2 or 3 that are measured at fair value on a non-recurring basis, as determined by the nature and risks of the

instrument.

Loans Held for Sale

At December 31, 2013 and 2012, level 2 LHFS consisted primarily of agency and non-agency residential mortgages, which

were measured using observable collateral valuations, and corporate loans that are accounted for at LOCOM. These loans

were valued consistent with the methodology discussed in the Recurring Fair Value Measurement section of this footnote.

During 2013, the Company transferred $25 million of residential mortgage NPLs to LHFS, as the Company elected to actively

market these loans for sale. These loans were predominantly reported at amortized cost prior to transferring to LHFS; however,

a portion of the NPLs was carried at fair value. As a result of transferring the loans to LHFS, the Company recognized a $3

million charge-off to reflect the loans' estimated market value. These transferred NPL loans were sold at approximately their

carrying value during 2013. The Company also sold an additional $63 million of residential mortgage NPLs which had either

been transferred to LHFS in a prior period or repurchased into LHFS directly. These additional loans were sold at a gain of

approximately $12 million.

During 2012, the Company transferred $700 million of residential mortgage NPLs to LHFS, as the Company elected to actively

market these loans for sale. These loans were predominantly reported at amortized cost prior to transferring to LHFS; however,

a portion of the NPLs was carried at fair value. As a result of transferring the loans to LHFS, the Company recognized a $199

million charge-off to reflect the loans' estimated market value. Of these transferred loans, $486 million were sold at

approximately their carrying value during the year, $6 million remained in LHFS, $7 million were returned to LHFI as they

were no longer deemed marketable for sale, and $2 million were removed as a result of various loss mitigation events.

Loans Held for Investment

At December 31, 2013, LHFI consisted primarily of consumer and residential real estate loans discharged in Chapter 7

bankruptcy that had not been reaffirmed by the borrower, as well as nonperforming CRE loans for which specific reserves

have been recognized. As these loans have been classified as nonperforming, cash proceeds from the sale of the underlying

collateral is the expected source of repayment for a majority of these loans. Accordingly, the fair value of these loans is derived