SunTrust 2013 Annual Report Download - page 183

Download and view the complete annual report

Please find page 183 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

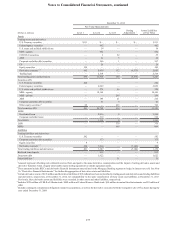

Notes to Consolidated Financial Statements, continued

167

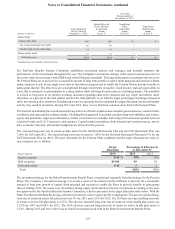

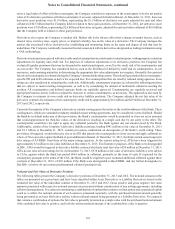

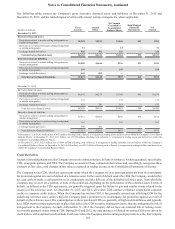

The following tables present the Company's gross derivative financial assets and liabilities at December 31, 2013 and

December 31, 2012, and the related impact of enforceable master netting arrangements, where applicable:

Net Amount

Presented in

Consolidated

Balance Sheets

(Dollars in millions)

Gross

Amount

Amount

Offset

Held/Pledged

Financial

Instruments

Net

Amount

December 31, 2013

Derivative financial assets:

Derivatives subject to master netting arrangement or

similar arrangement $5,285 $4,239 $1,046 $51 $995

Derivatives not subject to master netting arrangement

or similar arrangement 12 — 12 — 12

Exchange traded derivatives 828 502 326 — 326

Total derivative financial assets $6,125 $4,741 $1,384 1$51 $1,333

Derivative financial liabilities:

Derivatives subject to master netting arrangement or

similar arrangement $4,982 $4,646 $336 $13 $323

Derivatives not subject to master netting arrangement

or similar arrangement 189 — 189 — 189

Exchange traded derivatives 502 502 — — —

Total derivative financial liabilities $5,673 $5,148 $525 2$13 $512

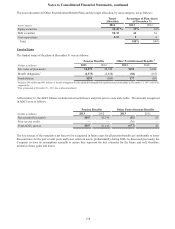

December 31, 2012

Derivative financial assets:

Derivatives subject to master netting arrangement or

similar arrangement $8,041 $6,273 $1,768 $94 $1,674

Derivatives not subject to master netting arrangement

or similar arrangement 132 — 132 — 132

Exchange traded derivatives 483 300 183 — 183

Total derivative financial assets $8,656 $6,573 $2,083 1$94 $1,989

Derivative financial liabilities:

Derivatives subject to master netting arrangement or

similar arrangement $7,051 $6,802 $249 $37 $212

Derivatives not subject to master netting arrangement

or similar arrangement 163 — 163 — 163

Exchange traded derivatives 300 300 — — —

Total derivative financial liabilities $7,514 $7,102 $412 2$37 $375

1 At December 31, 2013, $1.4 billion, net of $457 million offsetting cash collateral, is recognized in trading assets and derivatives within the Company's Consolidated

Balance Sheets. At December 31, 2012, $2.1 billion, net of $730 million offsetting cash collateral, is recognized in trading assets and derivatives within the

Company's Consolidated Balance Sheets.

2 At December 31, 2013, $525 million, net of $864 million offsetting cash collateral, is recognized in trading liabilities and derivatives within the Company's

Consolidated Balance Sheets. At December 31, 2012, $412 million, net of $1.3 billion offsetting cash collateral, is recognized in trading liabilities and derivatives

within the Company's Consolidated Balance Sheets.

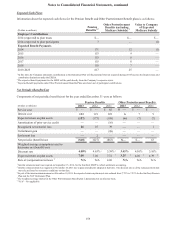

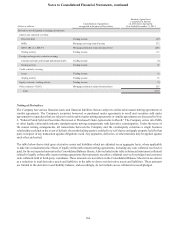

Credit Derivatives

As part of its trading businesses, the Company enters into contracts that are, in form or substance, written guarantees: specifically,

CDS, swap participations, and TRS. The Company accounts for these contracts as derivatives and, accordingly, recognizes these

contracts at fair value, with changes in fair value recognized in trading income in the Consolidated Statements of Income.

The Company writes CDS, which are agreements under which the Company receives premium payments from its counterparty

for protection against an event of default of a reference asset. In the event of default under the CDS, the Company would either

net cash settle or make a cash payment to its counterparty and take delivery of the defaulted reference asset, from which the

Company may recover all, a portion, or none of the credit loss, depending on the performance of the reference asset. Events of

default, as defined in the CDS agreements, are generally triggered upon the failure to pay and similar events related to the

issuer(s) of the reference asset. At December 31, 2013 and 2012, all written CDS contracts reference single name corporate

credits or corporate credit indices. When the Company has written CDS, it has generally entered into offsetting CDS for the

underlying reference asset, under which the Company paid a premium to its counterparty for protection against an event of

default on the reference asset. The counterparties to these purchased CDS are generally of high creditworthiness and typically

have ISDA master netting agreements in place that subject the CDS to master netting provisions, thereby, mitigating the risk of

non-payment to the Company. As such, at December 31, 2013 the Company did not have any material risk of making a non-

recoverable payment on any written CDS. During 2013 and 2012, the only instances of default on written CDS were driven by

credit indices with constituent credit default. In all cases where the Company made resulting cash payments to settle, the Company