SunTrust 2013 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.33

systems or infrastructure, or those of our third party vendors and other service providers, including as a result of cyber attacks,

could disrupt our businesses, result in the disclosure or misuse of confidential or proprietary information, damage our reputation,

increase our costs and cause losses; the soundness of other financial institutions could adversely affect us; we depend on the

accuracy and completeness of information about clients and counterparties; competition in the financial services industry is intense

and could result in losing business or margin declines; maintaining or increasing market share depends on market acceptance and

regulatory approval of new products and services; we might not pay dividends on our common stock; our ability to receive dividends

from our subsidiaries could affect our liquidity and ability to pay dividends; disruptions in our ability to access global capital

markets may adversely affect our capital resources and liquidity; any reduction in our credit rating could increase the cost of our

funding from the capital markets; we have in the past and may in the future pursue acquisitions, which could affect costs and from

which we may not be able to realize anticipated benefits; we are subject to certain litigation, and our expenses related to this

litigation may adversely affect our results; we may incur fines, penalties and other negative consequences from regulatory violations,

possibly even inadvertent or unintentional violations; we depend on the expertise of key personnel, and if these individuals leave

or change their roles without effective replacements, operations may suffer; we may not be able to hire or retain additional qualified

personnel and recruiting and compensation costs may increase as a result of turnover, both of which may increase costs and reduce

profitability and may adversely impact our ability to implement our business strategies; our accounting policies and processes are

critical to how we report our financial condition and results of operations, and require management to make estimates about matters

that are uncertain; changes in our accounting policies or in accounting standards could materially affect how we report our financial

results and condition; our stock price can be volatile; our disclosure controls and procedures may not prevent or detect all errors

or acts of fraud; our financial instruments carried at fair value expose us to certain market risks; our revenues derived from our

investment securities may be volatile and subject to a variety of risks; and we may enter into transactions with off-balance sheet

affiliates or our subsidiaries.

INTRODUCTION

We are a leading provider of financial services, particularly in the Southeastern and Mid-Atlantic U.S., and our headquarters is

located in Atlanta, Georgia. Our principal banking subsidiary, SunTrust Bank, offers a full line of financial services for consumers

and businesses both through its branches located primarily in Florida, Georgia, Maryland, North Carolina, South Carolina,

Tennessee, Virginia, and the District of Columbia, and through other national delivery channels. In certain businesses, we also

operate in select markets nationally. Within our geographic footprint, we operate three business segments: Consumer Banking and

Private Wealth Management, Wholesale Banking, and Mortgage Banking, with the remainder in Corporate Other. See Note 20,

"Business Segment Reporting," to the Consolidated Financial Statements in this Form 10-K for a description of our business

segments. In addition to deposit, credit, mortgage banking, and trust and investment services offered by the Bank, our other

subsidiaries provide asset management, securities brokerage, and capital market services.

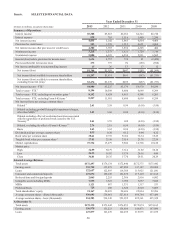

This MD&A is intended to assist readers in their analysis of the accompanying consolidated financial statements and supplemental

financial information. It should be read in conjunction with the Consolidated Financial Statements and Notes in Item 8 of this

Form 10-K. When we refer to “SunTrust,” “the Company,” “we,” “our,” and “us” in this narrative, we mean SunTrust Banks, Inc.

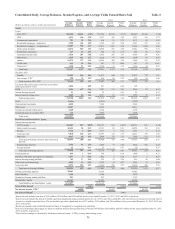

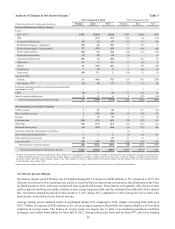

and subsidiaries (consolidated). In the MD&A, net interest income, net interest margin, total revenue, and efficiency ratios are

presented on an FTE basis. The FTE basis adjusts for the tax-favored status of net interest income from certain loans and investments.

We believe this measure to be the preferred industry measurement of net interest income and it enhances comparability of net

interest income arising from taxable and tax-exempt sources. Additionally, we present certain non-U.S. GAAP metrics to assist

investors in understanding management’s view of particular financial measures, as well as to align presentation of these financial

measures with peers in the industry who may also provide a similar presentation. Reconcilements for all non-U.S. GAAP measures

are provided in Tables 36 and 37.