SunTrust 2013 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

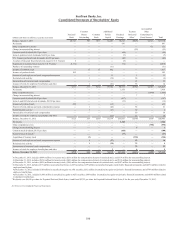

99

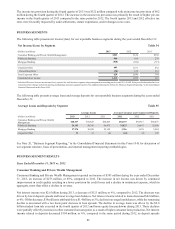

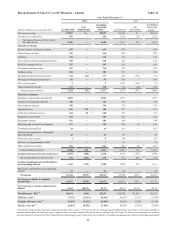

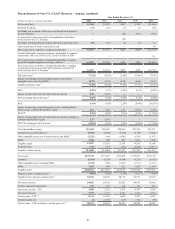

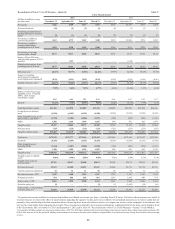

Reconcilement of Non-U.S. GAAP Measures – Quarterly Table 37

Three Months Ended

(Dollars in millions, except

per share data)

2013 2012

December 31 September 30 June 30 March 31 December 31 September 30 June 30 March 31

Net income $426 $189 $377 $352 $356 $1,077 $275 $250

Preferred dividends (10) (9) (9) (9) (4)(2)(3)(3)

Dividends and undistributed

earnings allocated to unvested

shares (3) (1) (3) (3) (2)(9)(2)(2)

Net income available to

common shareholders $413 $179 $365 $340 $350 $1,066 $270 $245

Net income available to

common shareholders,

excluding Form 8-K items1$413 $358 $365 $340 $350 $313 $270 $245

Net income per average

common share, diluted $0.77 $0.33 $0.68 $0.63 $0.65 $1.98 $0.50 $0.46

Impact of Form 8-K items

from the third quarters of 2013

and 2012 — 0.33 — — —(1.40)— —

Diluted net income per share,

excluding Form 8-K items 1$0.77 $0.66 $0.68 $0.63 $0.65 $0.58 $0.50 $0.46

Efficiency ratio 266.82% 90.77% 66.56% 64.46% 65.93% 44.90% 68.83% 69.50%

Impact of excluding

amortization of intangible

assets/impairment of goodwill (0.21) (0.31) (0.29) (0.29) (0.30)(0.43)(0.50)(0.48)

Tangible efficiency ratio 366.61% 90.46% 66.27% 64.17% 65.63% 44.47% 68.33% 69.02%

ROE 7.99% 3.49% 7.12% 6.77% 6.86% 20.84% 5.37% 4.94%

Impact of removing average

intangible assets, excluding

MSRs, from average

shareholders' equity

3.62 1.61 3.23 3.11 3.18 9.67 2.42 2.27

ROTCE 411.61% 5.10% 10.35% 9.88% 10.04% 30.51% 7.79% 7.21%

Total shareholders’ equity $21,422 $21,070 $21,007 $21,194 $20,985 $20,399 $20,568 $20,241

Goodwill, net of deferred

taxes 5(6,183) (6,189) (6,195) (6,200) (6,206)(6,210)(6,220)(6,180)

Other intangible assets, net of

deferred taxes, and MSRs 6(1,332) (1,285) (1,240) (1,071) (949)(888)(929)(1,142)

MSRs 1,300 1,248 1,199 1,025 899 831 865 1,070

Tangible equity 15,207 14,844 14,771 14,948 14,729 14,132 14,284 13,989

Preferred stock (725) (725) (725) (725) (725)(275)(275)(275)

Tangible common equity $14,482 $14,119 $14,046 $14,223 $14,004 $13,857 $14,009 $13,714

Total assets $175,335 $171,777 $171,546 $172,435 $173,442 $173,181 $178,257 $178,226

Goodwill (6,369) (6,369) (6,369) (6,369) (6,369)(6,369)(6,376)(6,344)

Other intangible assets

including MSRs (1,334) (1,287) (1,244) (1,076) (956)(896)(939)(1,155)

MSRs 1,300 1,248 1,199 1,025 899 831 865 1,070

Tangible assets $168,932 $165,369 $165,132 $166,015 $167,016 $166,747 $171,807 $171,797

Tangible equity to tangible

assets 79.00% 8.98% 8.95% 9.00% 8.82% 8.48% 8.31% 8.14%

Tangible book value per

common share 8$27.01 $26.27 $26.08 $26.33 $25.98 $25.72 $26.02 $25.49

Net interest income $1,213 $1,208 $1,211 $1,221 $1,246 $1,271 $1,274 $1,311

Taxable-equivalent adjustment 34 32 31 30 30 30 32 31

Net interest income - FTE 1,247 1,240 1,242 1,251 1,276 1,301 1,306 1,342

Noninterest income 814 680 858 863 1,015 2,542 940 876

Total revenue - FTE 92,061 1,920 2,100 2,114 2,291 3,843 2,246 2,218

Securities gains, net (1) — — (2) (1)(1,941)(14)(18)

Total revenue - FTE excluding

securities gains, net 9$2,060 $1,920 $2,100 $2,112 $2,290 $1,902 $2,232 $2,200

1 We present net income available to common shareholders and diluted net income per share, excluding Form 8-K items. We believe these measures are useful to

investors because it removes the effect of material items impacting the quarters' results and is more reflective of normalized operations as it reflects results that are

primarily client relationship and client transaction driven. Removing these items also allows investors to compare our results to other companies in the industry that

may not have had similar items impacting their results. These measures are utilized by us to measure performance. Additional detail on the items can be found in Form

8-Ks filed with the SEC on October 10, 2013 and September 6, 2012 and in Table 36, "Reconcilement of Non-U.S. GAAP Measures - Annual," in this MD&A.

2Computed by dividing noninterest expense by total revenue - FTE. The FTE basis adjusts for the tax-favored status of net interest income from certain loans and investments. We

believe this measure to be the preferred industry measurement of net interest income and it enhances comparability of net interest income arising from taxable and tax-exempt

sources.