SunTrust 2013 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

149

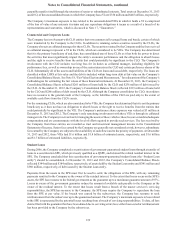

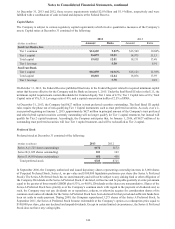

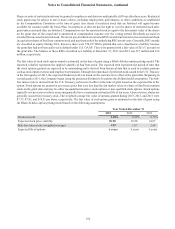

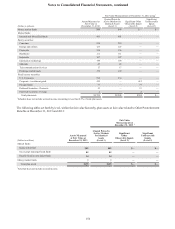

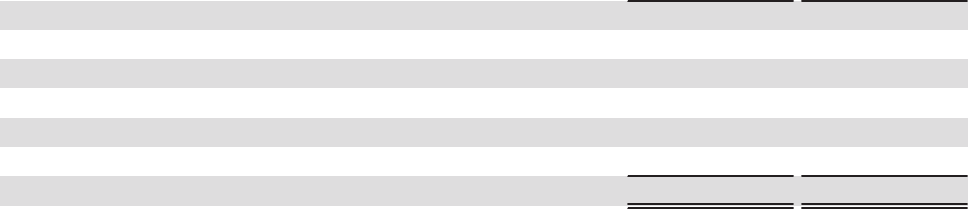

The following table provides a rollforward of the Company's federal and state UTBs, excluding interest and penalties, during

the years ended December 31:

(Dollars in millions) 2013 2012

Balance at January 1 $137 $133

Increases in UTBs related to prior years 41

Decreases in UTBs related to prior years (10)(2)

Increases in UTBs related to the current year 171 45

Decreases in UTBs related to settlements (2)(34)

Decreases in UTBs related to lapse of the applicable statutes of limitations (9)(6)

Balance at December 31 $291 $137

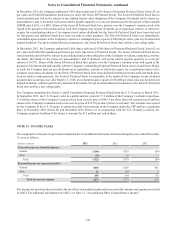

The amount of UTBs that, if recognized, would affect the Company's effective tax rate was $237 million at December 31,

2013. The remainder of the UTBs have offsetting amounts in other jurisdictions or would be offset by the recording of a

valuation allowance.

Interest related to UTBs is recorded as a component of the income tax provision. The Company had a liability of $17 million

and $18 million for interest related to its UTBs at December 31, 2013 and 2012, respectively. During the years ended December

31, 2013 and 2012, the Company recognized a benefit of approximately $1 million and $3 million, respectively, for interest

on the UTBs.

The Company files U.S. federal, state, and local income tax returns. The Company's federal income tax returns are no longer

subject to examination by the IRS for taxable years prior to 2010. With limited exceptions, the Company is no longer subject

to examination by state and local taxing authorities for taxable years prior to 2006. It is reasonably possible that the liability

for UTBs could decrease by as much as $75 million during the next 12 months due to completion of tax authority examinations,

receipt of a private letter ruling from the IRS, and the expiration of statutes of limitations.

NOTE 15 - EMPLOYEE BENEFIT PLANS

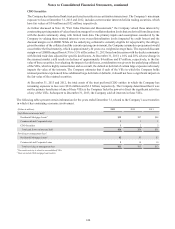

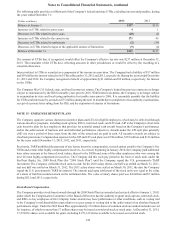

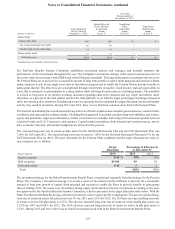

The Company sponsors various short-term incentive plans and LTIs for eligible employees, which may be delivered through

various incentive programs, including stock options, RSUs, restricted stock, and LTI cash. AIP is the Company's short-term

cash incentive plan for key employees that provides for potential annual cash awards based on the Company's performance

and/or the achievement of business unit and individual performance objectives. Awards under the LTI cash plan generally

cliff vest over a period of three years from the date of the award and are paid in cash. All incentive awards are subject to

clawback provisions. Compensation expense for the AIP and LTI cash plans was $150 million, $155 million, and $116 million

for the years ended December 31, 2013, 2012, and 2011, respectively.

Previously, TARP prohibited the payment of any bonus, incentive compensation, or stock option award to the Company's five

NEOs and certain other highly-compensated executives. As a result, beginning in January 2010, the Company paid additional

base salary amounts in the form of stock (salary shares) to the NEOs and some of the other employees who were among the

next 20 most highly-compensated executives. The Company did this each pay period in the form of stock units under the

SunTrust Banks, Inc. 2009 Stock Plan (the "2009 Stock Plan") until the Company repaid the U.S. government's TARP

investment. The Company settled the stock units in cash; for the 2010 salary shares, one half was settled on March 31, 2011,

and one half was settled on March 31, 2012. The 2011 salary shares were settled on March 30, 2011, the date the Company

repaid the U.S. government's TARP investment. The amount paid upon settlement of the stock units was equal to the value

of a share of SunTrust common stock on the settlement date. The value of salary shares paid was $4 million and $7 million

during 2012 and 2011, respectively.

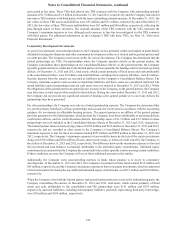

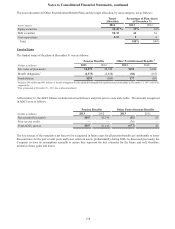

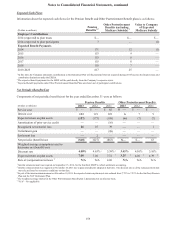

Stock-Based Compensation

The Company provides stock-based awards through the 2009 Stock Plan (as amended and restated effective January 1, 2011)

under which the Compensation Committee of the Board of Directors has the authority to grant stock options, restricted stock,

and RSUs to key employees of the Company. Some awards may have performance or other conditions, such as vesting tied

to the Company's total shareholder return relative to a peer group or vesting tied to the achievement of an absolute financial

performance target. Under the 2009 Stock Plan, approximately 21 million shares of common stock are authorized and reserved

for issuance, of which no more than 17 million shares may be issued as restricted stock or stock units. At December 31, 2013,

17,274,016 shares were available for grant, including 8,971,619 shares available to be issued as restricted stock.