SunTrust 2013 Annual Report Download - page 112

Download and view the complete annual report

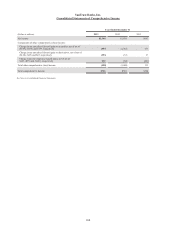

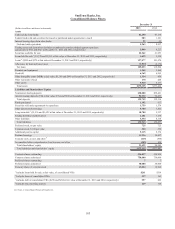

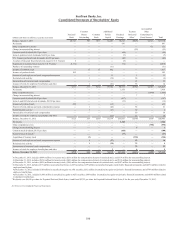

Please find page 112 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.96

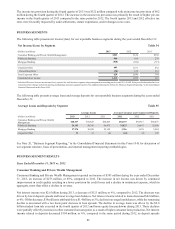

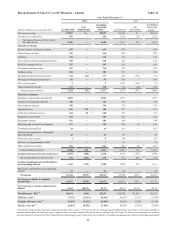

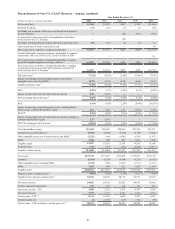

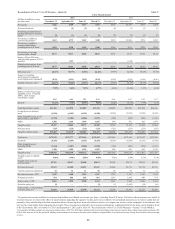

client relationship and client transaction driven. Removing these items also allows investors to compare our results to other companies in the industry that may not

have had similar items impacting their results. These measures are utilized by us to measure performance. Additional detail on the items can be found in Form 8-Ks

filed with the SEC on October 10, 2013 and September 6, 2012.

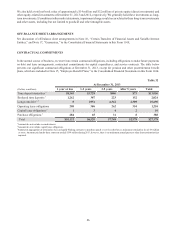

2 Reflects the pre-tax provision expense associated with the planned sale of $0.5 billion of nonperforming mortgage and CRE loans and impacts the Mortgage Banking

and Wholesale Banking segments.

3 Reflects the pre-tax impact of certain mortgage repurchase settlements with Fannie Mae and Freddie Mac and impacts the Mortgage Banking segment.

4 Reflects the pre-tax mortgage repurchase provision related to loans sold to GSEs prior to 2009 and impacts the Mortgage Banking segment.

5 Reflects the pre-tax gain associated with the early termination of agreements involving Coke shares and impacts the Corporate Other segment.

6 Reflects the pre-tax loss from moving $1.4 billion of student loans and $0.5 billion of Ginnie Mae loans to LHFS and impacts the Consumer Banking and Private

Wealth Management and Mortgage Banking segments.

7 Reflects the pre-tax impact from the settlement of certain legal and regulatory matters and primarily impacts the Mortgage Banking segment.

8 Reflects the pre-tax impact from the mortgage servicing advances allowance increase and impacts the Mortgage Banking segment.

9 Reflects the pre-tax impact from the charitable contribution of one million Coke shares and impacts the Corporate Other segment.

10 Reflects the pre-tax write-down associated with actively marketing $0.2 billion of affordable housing investments and impacts the Wholesale Banking segment.

11 Reflects the provision/(benefit) for income taxes impact on above items as well as certain tax items disclosed in the Form 8-Ks.

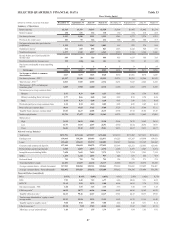

12 We present total revenue - FTE excluding Form 8-K items. Total Revenue is calculated as net interest income - FTE plus noninterest income. Net interest income is

presented on an FTE basis, which adjusts for the tax-favored status of net interest income from certain loans and investments. We believe this measure to be the preferred

industry measurement of net interest income, and it enhances comparability of net interest income arising from taxable and tax-exempt sources. We also believe that

revenue without the impacts of the Form 8-K items is more indicative of our performance because it isolates income that is primarily client relationship and client

transaction driven and is more indicative of normalized operations.

13 Computed by dividing noninterest expense by total revenue - FTE. The FTE basis adjusts for the tax-favored status of net interest income from certain loans and

investments. We believe this measure to be the preferred industry measurement of net interest income, and it enhances comparability of net interest income arising

from taxable and tax-exempt sources. We present the efficiency ratio excluding the impacts of the Form 8-K items because removing the impact of these items is more

indicative of normalized operations.

14 We present a tangible efficiency ratio, which excludes the amortization of intangible assets. We believe this measure is useful to investors because, by removing the

effect of these intangible asset costs (the level of which may vary from company to company), it allows investors to more easily compare our efficiency to other

companies in the industry. This measure is utilized by us to assess our efficiency and that of our lines of business. We also present the tangible efficiency ratio excluding

the impacts of the Form 8-K items because removing the impact of these items is more indicative of normalized operations.

15 We present the effective tax rate excluding the impacts of the Form 8-K items because removing the impact of these items is more indicative of normalized operations

and the effective rate for the periods' results excluding these items.