SunTrust 2013 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

153

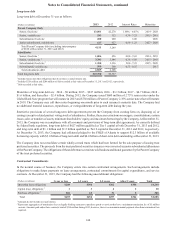

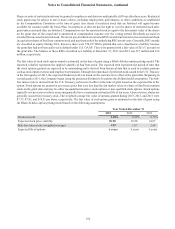

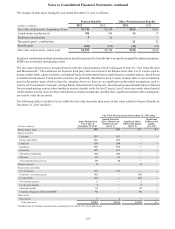

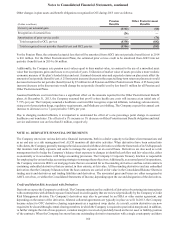

Noncontributory Pension Plans

The Company maintains a funded, noncontributory qualified retirement plan (the "Retirement Plan") covering employees

meeting certain service requirements. The plan provides benefits based on salary and years of service and, effective January

1, 2008, either a traditional pension benefit formula, a cash balance formula (the Personal Pension Account), or a combination

of both. Participants are 100% vested after 3 years of service. The interest crediting rate applied to each Personal Pension

Account was 3% for 2013. The Company monitors the funded status of the plan closely and due to the current funded status,

the Company did not contribute to either of its noncontributory qualified retirement plans ("Retirement Benefit Plans") for

the 2013 plan year.

The Company also maintains unfunded, noncontributory nonqualified supplemental defined benefit pension plans that cover

key executives of the Company (the "SERP", the "ERISA Excess Plan", and the "Restoration Plan"). The plans provide defined

benefits based on years of service and salary. The Company's obligations for these nonqualified supplemental defined benefit

pension plans are included within the qualified Pension Plans in the tables presented in this section under “Pension Benefits.”

The SunTrust Banks, Inc. Restoration Plan (the “Restoration Plan”), effective January 1, 2011, is a nonqualified defined benefit

cash balance plan designed to restore benefits to certain employees that are limited under provisions of the Internal Revenue

Code and are not otherwise provided for under the ERISA Excess Plan. The benefit formula under the Restoration Plan is the

same as the Personal Pension Account under the Retirement Plan.

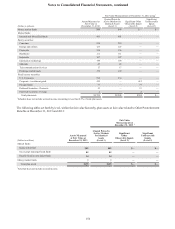

On October 1, 2004, the Company acquired NCF. Prior to the acquisition, NCF sponsored a funded qualified retirement plan,

an unfunded nonqualified retirement plan for some of its participants, and certain other postretirement health benefits for its

employees. Similar to the Company's Retirement Plan, due to the current funded status of the NCF qualified Retirement Plan,

the Company did not make a contribution for the 2013 plan year.

Effective January 1, 2011, a separate retirement plan was created exclusively for inactive and retired employees (“SunTrust

Banks, Inc. Retirement Plan for Inactive Participants”). Obligations and related plan assets were transferred from the SunTrust

Banks, Inc. Retirement Plan to the new separate retirement plan. As described in the following paragraph, effective January

1, 2012, the plans were combined into one Retirement Plan.

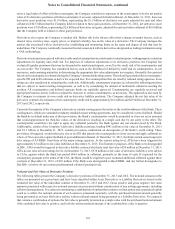

The Retirement Plan, the SERP, the ERISA Excess Plan, and the Restoration Plan were each amended on November 14, 2011

to cease all future benefit accruals. As a result, the traditional pension benefit formulas (final average pay formulas) do not

reflect future salary increases and benefit service after December 31, 2011, and compensation credits under the Personal

Pension Accounts (cash balance formula) ceased. However, interest credits under the Personal Pension Accounts continue to

accrue until benefits are distributed and service continues to be recognized for vesting and eligibility requirements for early

retirement. Additionally, the NCF Retirement Plan, which had been previously curtailed with respect to future benefit accruals,

was amended to cease any adjustments for pay increases after December 31, 2011. As a result of the curtailment, the SunTrust

Banks, Inc. Retirement Plan for Inactive Participants was merged into the Retirement Plan effective January 1, 2012. The

Company recorded a curtailment gain of $88 million during 2011, which is reflected in employee benefits expense in the

Consolidated Statements of Income, and a reduction to the pension benefit obligation of $96 million, which is reflected in the

Consolidated Balance Sheets. The curtailment gain was partially offset by the $28 million special 401(k) contribution discussed

above.

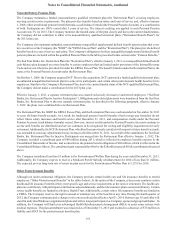

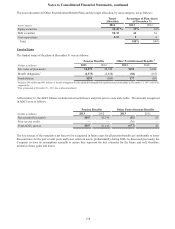

The Company contributed less than $1 million to the Postretirement Welfare Plan during the year ended December 31, 2013.

Additionally, the Company expects to receive a Medicare Part D Subsidy reimbursement for 2014 of less than $1 million.

The expected pre-tax long-term rate of return on plan assets for the Postretirement Welfare Plan is 5.25% for 2014.

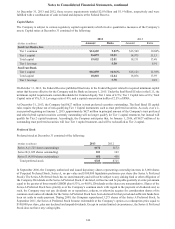

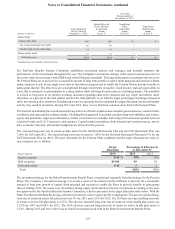

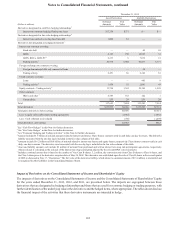

Other Postretirement Benefits

Although not under contractual obligation, the Company provides certain health care and life insurance benefits to retired

employees (“Other Postretirement Benefits” in the tables below). At the option of the Company, retirees may continue certain

health and life insurance benefits if they meet specific age and service requirements at the time of retirement. The health care

plans are contributory with participant contributions adjusted annually, and the life insurance plans are noncontributory. Certain

retiree health benefits are funded in a Retiree Health Trust. Additionally, certain retiree life insurance benefits are funded in

a VEBA. The Company reserves the right to amend or terminate any of the benefits at any time. During the fourth quarter of

2013, the Company communicated a change in its retiree medical plan effective April 1, 2014. Retirees age 65 and older will

enroll in individual Medicare supplemental plans and will no longer participate in a Company-sponsored group health plan. In

addition, the Company will fund a tax-advantaged Health Reimbursement Arrangement (HRA) to assist some retirees with

medical expenses. The plan amendment was measured as of December 31, 2013 and resulted in a decrease of $76 million in

liability and AOCI for the postretirement benefits plan.