SunTrust 2013 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

162

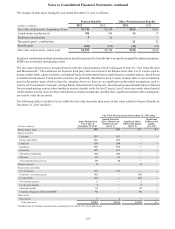

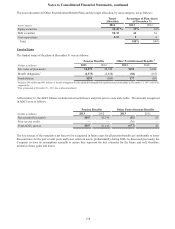

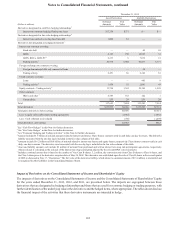

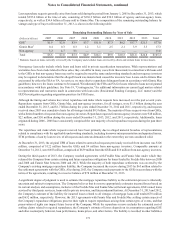

December 31, 2013

Asset Derivatives Liability Derivatives

(Dollars in millions)

Notional

Amounts

Fair

Val ue

Notional

Amounts

Fair

Val ue

Derivatives designated in cash flow hedging relationships 1

Interest rate contracts hedging floating rate loans $17,250 $471 $— $—

Derivatives designated in fair value hedging relationships 2

Interest rate contracts covering fixed rate debt 2,000 52 900 24

Derivatives not designated as hedging instruments 3

Interest rate contracts covering:

Fixed rate debt — — 60 7

MSRs 1,425 27 6,898 79

LHFS, IRLCs 44,561 30 1,317 5

Trading activity 570,615 2,917 65,299 2,742

Foreign exchange rate contracts covering trading activity 2,449 61 2,624 57

Credit contracts covering:

Loans — — 427 5

Trading activity 61,568 37 1,579 34

Equity contracts - Trading activity 519,595 2,504 24,712 2,702

Other contracts:

IRLCs and other 71,114 12 755 4

Commodities 241 14 228 14

Total 101,568 5,602 103,899 5,649

Total derivatives $120,818 $6,125 $104,799 $5,673

Total gross derivatives, before netting $6,125 $5,673

Less: Legally enforceable master netting agreements (4,284) (4,284)

Less: Cash collateral received/paid (457) (864)

Total derivatives, after netting $1,384 $525

1 See “Cash Flow Hedges” in this Note for further discussion.

2 See “Fair Value Hedges” in this Note for further discussion.

3 See “Economic Hedging and Trading Activities” in this Note for further discussion.

4 Amount includes $885 million of notional amounts related to interest rate futures. These futures contracts settle in cash daily, one day in arrears. The derivative

asset or liability associated with the one day lag is included in the fair value column of this table.

5 Amounts include $15.2 billion and $0.2 billion of notional related to interest rate futures and equity futures, respectively. These futures contracts settle in cash

daily, one day in arrears. The derivative assets/liabilities associated with the one day lag are included in the fair value column of this table.

6 Asset and liability amounts include $4 million and $5 million, respectively, of notional from purchased and written credit risk participation agreements,

respectively, whose notional is calculated as the notional of the derivative participated adjusted by the relevant RWA conversion factor.

7 Includes a notional amount that is based on the number of Visa Class B shares, 3.2 million, the conversion ratio from Class B shares to Class A shares, and

the Class A share price at the derivative inception date of May 28, 2009. This derivative was established upon the sale of Class B shares in the second quarter

of 2009 as discussed in Note 17, “Guarantees.” The fair value of the derivative liability, which relates to a notional amount of $55 million, is immaterial and

is recognized in other liabilities in the Consolidated Balance Sheets.