SunTrust 2013 Annual Report Download - page 187

Download and view the complete annual report

Please find page 187 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

171

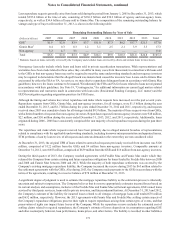

Loan repurchase requests generally arise from loans sold during the period from January 1, 2005 to December 31, 2013, which

totaled $295.6 billion at the time of sale, consisting of $230.9 billion and $30.3 billion of agency and non-agency loans,

respectively, as well as $34.4 billion of loans sold to Ginnie Mae. The composition of the remaining outstanding balance by

vintage and type of buyer at December 31, 2013, is shown in the following table:

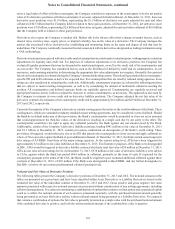

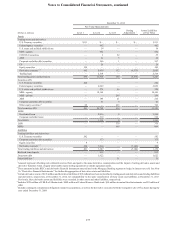

Remaining Outstanding Balance by Year of Sale

(Dollars in billions) 2005 2006 2007 2008 2009 2010 2011 2012 2013 Total

GSE1$1.9 $2.0 $3.9 $3.7 $11.0 $7.3 $8.2 $17.7 $21.3 $77.0

Ginnie Mae10.4 0.3 0.3 1.2 3.1 2.5 2.1 3.9 3.5 17.3

Non-agency 3.2 4.7 3.1 ——————11.0

Total $5.5 $7.0 $7.3 $4.9 $14.1 $9.8 $10.3 $21.6 $24.8 $105.3

1 Balances based on loans currently serviced by the Company and excludes loans serviced by others and certain loans in foreclosure.

Non-agency loan sales include whole loans and loans sold in private securitization transactions. While representations and

warranties have been made related to these sales, they can differ in many cases from those made in connection with loans sold

to the GSEs in that non-agency loans may not be required to meet the same underwriting standards and non-agency investors

may be required to demonstrate that the alleged breach was material and caused the investors' loss. Loans sold to Ginnie Mae

are insured by either the FHA or VA. As servicer, we may elect to repurchase delinquent loans in accordance with Ginnie Mae

guidelines; however, the loans continue to be insured. We indemnify the FHA and VA for losses related to loans not originated

in accordance with their guidelines. See Note 19, "Contingencies," for additional information on current legal matters related

to representations and warranties made in connection with loan sales (Residential Funding Company, LLC matter) and the

HUD Investigation regarding origination practices for FHA loans.

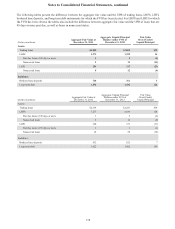

Although the timing and volume has varied, repurchase and make whole requests have increased over the past several years.

Repurchase requests from GSEs, Ginnie Mae, and non-agency investors, for all vintages, were $1.5 billion during the year

ended December 31, 2013, and $1.7 billion during the years ended December 31, 2012 and 2011, respectively, and requests

received since 2005 on a cumulative basis for all vintages totaled $8.5 billion. The majority of these requests were from GSEs,

with a limited number of requests from non-agency investors. Repurchase requests from non-agency investors were $18 million,

$22 million, and $50 million during the years ended December 31, 2013, 2012, and 2011, respectively. Additionally, loans

originated during 2006 - 2008 have consistently comprised the vast majority of total repurchase requests during the past three

years.

The repurchase and make whole requests received have been primarily due to alleged material breaches of representations

related to compliance with the applicable underwriting standards, including borrower misrepresentation and appraisal issues.

STM performs a loan by loan review of all requests and contests demands to the extent they are not considered valid.

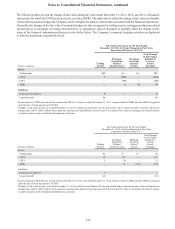

At December 31, 2013, the original UPB of loans related to unresolved requests previously received from investors was $126

million, comprised of $122 million from the GSEs and $4 million from non-agency investors. Comparable amounts at

December 31, 2012, were $655 million, comprised of $639 million from the GSEs and $16 million from non-agency investors.

During the third quarter of 2013, the Company reached agreements with Freddie Mac and Fannie Mae under which they

released the Company from certain existing and future repurchase obligations for loans funded by Freddie Mac between 2000

and 2008 and Fannie Mae between 2000 and 2012. While the majority of both repurchase settlements was covered by the

Company's existing mortgage repurchase liability, the Company increased the reserve during 2013 by $63 million related to

the settlement agreements with the GSEs. Also during 2013, the Company made payments to the GSEs in accordance with the

terms of the agreements, resulting in a reserve balance of $78 million at December 31, 2013.

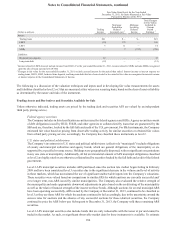

A significant degree of judgment is used to estimate the mortgage repurchase liability as the estimation process is inherently

uncertain and subject to imprecision. The Company believes that its reserve appropriately estimates incurred losses based on

its current analysis and assumptions, inclusive of the Freddie Mac and Fannie Mae settlement agreements, GSE owned loans

serviced by third party servicers, loans sold to private investors, and future indemnifications. At December 31, 2013 and 2012,

the Company's estimate of the liability for incurred losses related to all vintages of mortgage loans sold totaled $78 million

and $632 million, respectively. However, the 2013 agreements with Fannie Mae and Freddie Mac settling certain aspects of

the Company's repurchase obligations preserve their right to require repurchases arising from certain types of events, and that

preservation of rights can impact future losses of the Company. While the repurchase reserve includes the estimated cost of

settling claims related to required repurchases, the Company's estimate of losses depends on its assumptions regarding GSE

and other counterparty behavior, loan performance, home prices, and other factors. The liability is recorded in other liabilities